Bank failures bode ill. At least, that is how students of panics and depressions have generally seen it. Crisis is a whirlwind, emanating from the world of finance and spreading into the economy’s productive sectors. In other words, if a bank fails, run for it. And so historians, like most people, tend to think that bank insolvency is a particularly egregious instance of business failure: since banks link many different people and businesses they are especially likely to drag down many others when they themselves succumb to debt and become insolvent.

But what if bank failures were actually the least, rather than the most, problematic instances of bad credit? What if the demise of a bank were actually less troublesome to the economy than the failure of other kinds of businesses? I would like to pursue this admittedly provocative speculation in the context of the Panic of 1837, which, like many other panics, was characterized, and perhaps even triggered, by a chain of banking failures. I am not suggesting that bank failures are unproblematic. But a close examination of this problem can teach us some general lessons about how money was created and about the cultural resonance of credit in antebellum America.

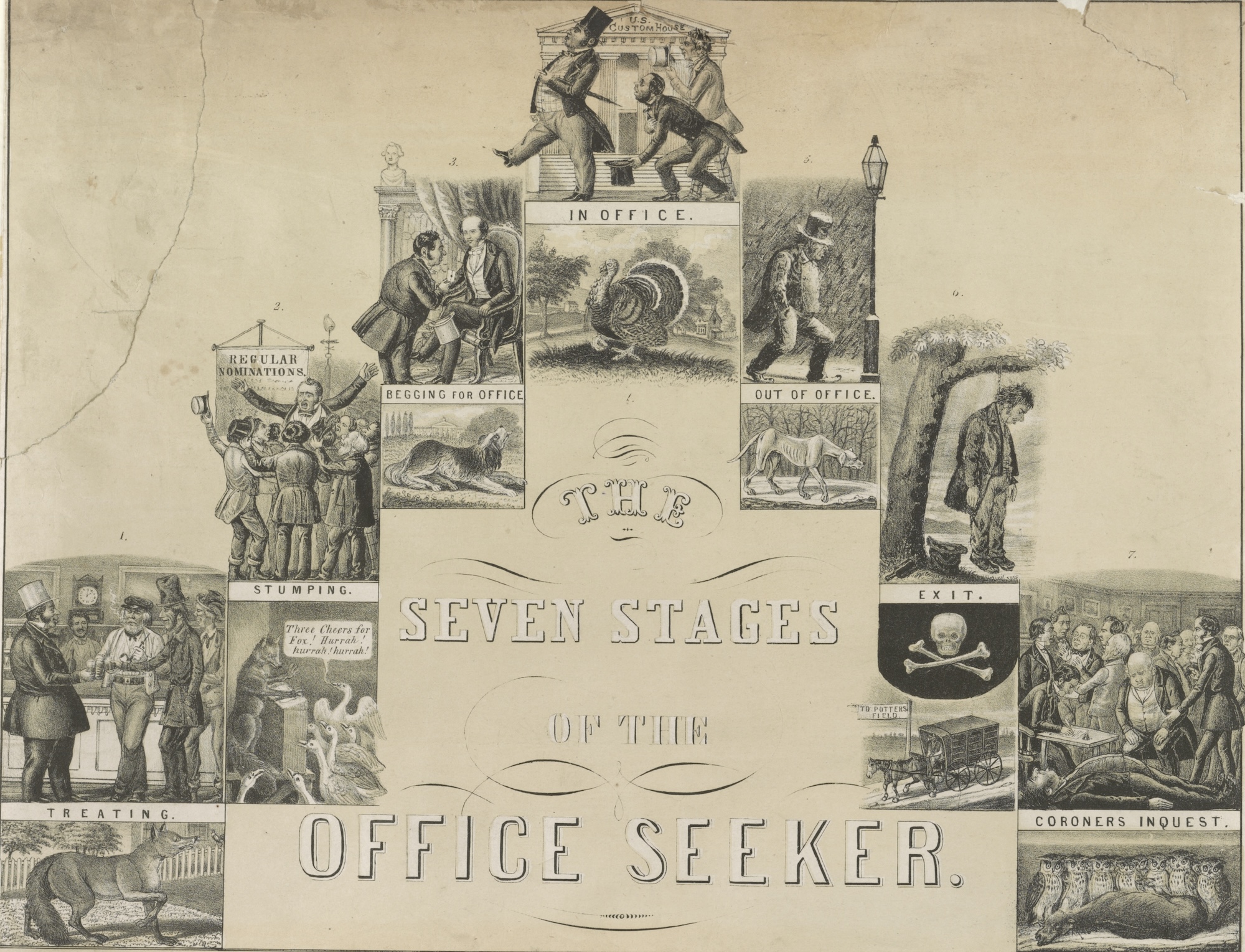

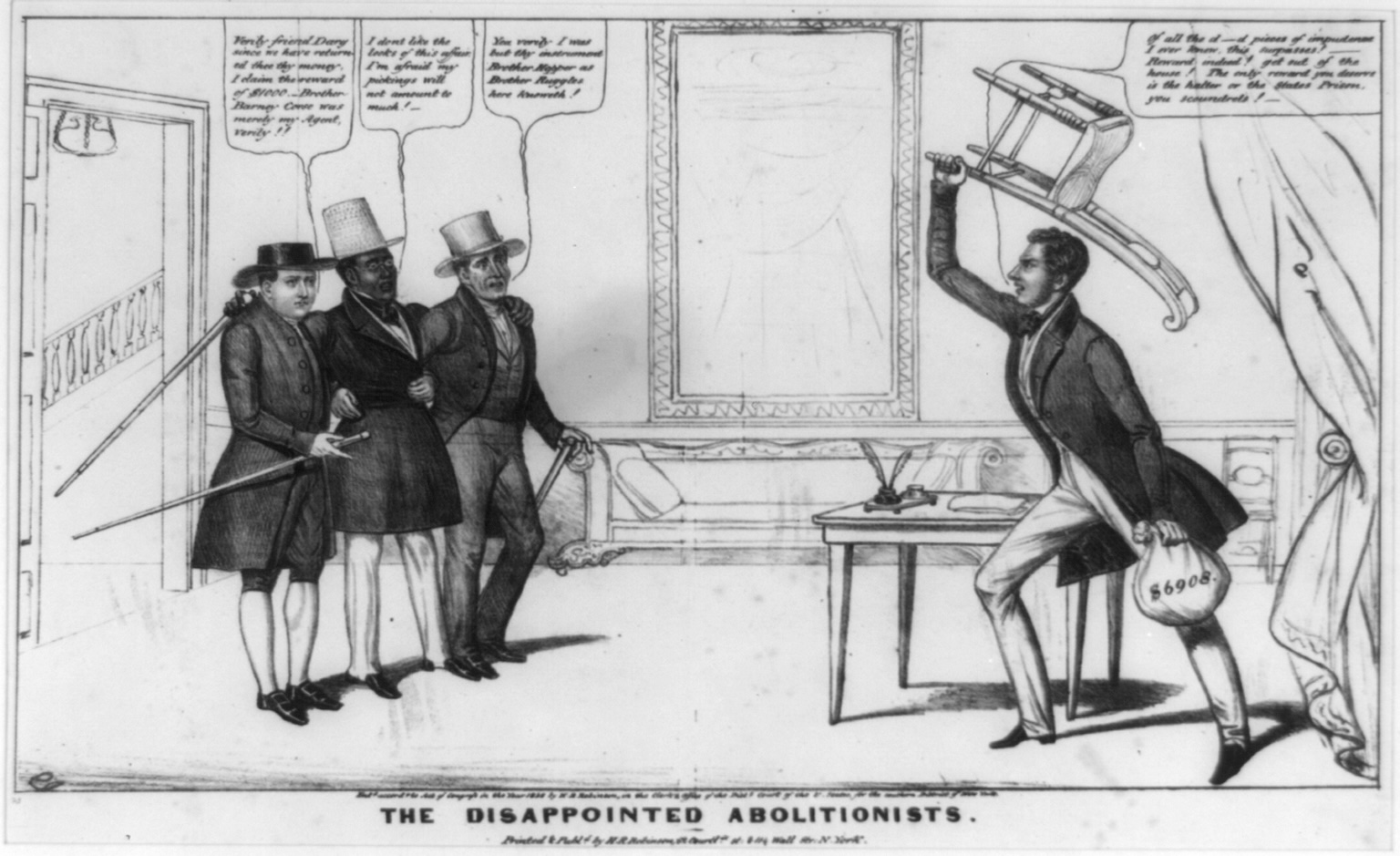

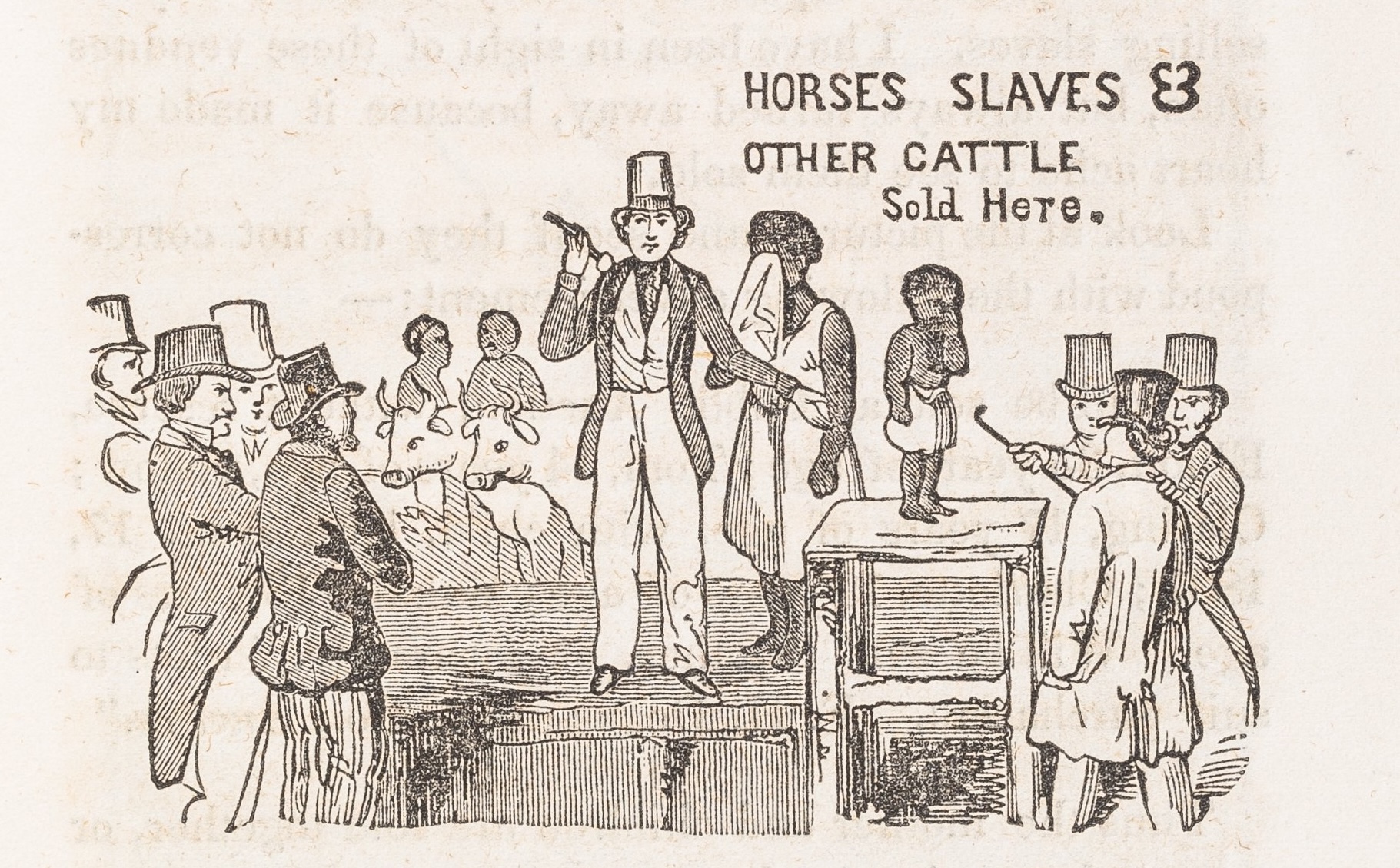

In the wake of the Panic of 1837 anti-bank sentiment in the United States reached a fever pitch. Indeed, anti-bank polemics were perhaps one of the few industries that flourished amidst the general gloom. Banks were assailed for manipulating credit to their advantage and at the same time for allowing credit to dry up just when it was needed most. They were blamed for extracting large profits, but also for being insufficiently capitalized and thus exposed to instability, and eventually to insolvency, as a result of imprudent decisions. Nor were the ills caused by banking limited to the financial, or even the economic, sphere: banks were also seen as corrupters of morals, law, and order.

Of course, such attacks were not born of the Panic, at least not of this panic. Similar charges against banks as ruining the character of the people animate William Gouge’s 1833 work, whose title tells much: The Curse of Paper Money and Banking, or a Short History of Banking in the United States, with an Account of its Ruinous Effects on Landowners, Farmers, Traders, and on All the Industrious Classes of the Community. Gouge compared banking and paper currency to feudalism, claiming that the former “divides the community into distinct classes, and impresses its stamp on morals and manners.” He thought that the creation of the paper system 140 years earlier had “affected the very structure of society, and, in a greater or less degree, the character of every member of the community. It may require one hundred and forty years more, fully to wear out its effects on manners and morals.” But these effects on character, while deep and most troubling, were not at the heart of Gouge’s diatribe. He focused, instead, on the “multitudes,” the “many thousands of families,” who had been ruined and “reduced to poverty by various Banking processes.”

Gouge’s critique, and with it the assumption that banks may drag hundreds or thousands down with them when they fail, was a persistent feature of antebellum popular writing (demonstrating a remarkable staying power right up to the present day as well). But by what agency do banks bring ruin to thousands? Through what mechanism do actual people suffer when a bank fails? To the modern ear, the very question sounds naïve, at best. Everyone, according to modern opinion, keeps their savings in the bank. Its failure would thus mean the disappearance of those savings. The modern solution to that problem, of course, is deposit insurance, which makes it safe for regular people to place savings with the bank, which the bank then invests, lending in support of productive economic activities. But we tend to forget that this is, for the most part, a modern solution for a modern problem. Antebellum banking in America was not, in fact, based on the numerous deposits of dispersed individuals. The primary asset to be found in today’s typical bank portfolio was insignificant in the early nineteenth century. This raises the question: if bank failure did not ruin people by destroying their savings, how did it affect them?

In order to answer this question, we need to expand our focus to the question of credit more generally and, in particular, bad credit. Let us imagine a typical credit relationship. Someone wishes to expand his business by purchasing a new machine. We can presume that credit will be forthcoming, either from the manufacturer or from the seller of the machine, who might agree to a deferred payment (perhaps in installments), or from a lender who will transfer the money to the businessman who will, in turn, pass it on to the seller. In either case, the income generated by the expanded production that results from using the machine is considered to be the source that will make repayment possible. It need not be an exclusive source, but its capability to generate returns is thought to be the rationale for giving credit. What has happened, from a social perspective, in this transaction? The borrower has realized a capacity for extending production in a way that was not possible without the credit. A writer on the “Principles of Credit” in Hunt’s Merchants’ Magazine in 1840 described this dynamic, noting that credit is “carried on upon a presumption that some positive benefit is to accrue, and some addition is about to be made to the resources of mankind. Whatever shape commercial credit may assume, it will always be found to rest upon some basis of value, real or supposed, at present existing, or to be created out of the application of labor. The object of loans is to realize a profit both to the lender and the borrower.” From an aggregate social perspective, the ensuing profit is just a sign of what has actually happened: an “addition … made to the resources of mankind.” Credit is the enabler of this particular addition.

Now let us turn to the unhappy case of bad credit. In this instance, the borrower uses the new machine to the same advantage, but for other reasons (say, uninsured healthcare expenses) he suffers a reversal of fortune and is unable to pay back the debt. The creditor is of course particularly unhappy. Aristotle thought that this situation—the half-completed exchange—presented the most urgent instance of intervention to assure justice. Not only had the creditor been damaged, but that damage was precisely the gain of the borrower. Each had moved from the initial status quo, but their movement was in opposite directions, resulting in a doubly wide gap that called out for remedy, for corrective justice. This is certainly the most common, intuitive response to a half-completed exchange, that is, to bad credit. But if we revisit the social perspective, we encounter a surprising result. Recall that the aggregate social perspective was interested in the addition to the resources of mankind. In the case of bad credit, as well, there is every reason to believe that such an addition was actually made. The problem is not that people did not act to use their capacities to increase production—that was the point of the credit, and that was also its result. The problem now is only one of distributing the addition, that is, the surplus derived from the increased production. The credit relationship determines a particular form of distribution which has now been upset. But since the distribution has no effect on the aggregate—on the “resources of mankind”—this only becomes a problem if we have some other reason to be concerned about the distribution, as opposed to the creation, of wealth or resources.

This dismissal of bad credit will not withstand generalization, however. For while a specific case of bad credit poses only distributive questions, the hint that bad credit is not an isolated incident but a widespread feature of interaction may hinder the advance of credit elsewhere. Returning to our “Principles” from Hunt’s we learn that “whatever the sum of capital may be, and the degree of credit which will necessarily attach to it in any community, they can never be made practically beneficial unless the general fidelity in the performance of engagements is fully complied with. This is the stimulus to all the active industry of modern society; for it creates the disposition to believe a promise of future labor equivalent to present capital, and hence promotes exchanges between the two.” It is only our trust in the principle and habit of fidelity to promises that allows people to engage in a credit system. “The disposition to perform promises is, then, as essential to the establishment of credit, as the ability. The two combine in every community to create that species of confidence which may be made the basis of action” (my emphasis).

There we have the key. What is credit but a species of confidence-inspiring action? And so, the problem with bad credit is not a particular failure to pay one’s debts. Instead, what is at issue is a type of game in which we encourage people to act without receiving any immediate gain, relying only on the solid expectation of future gain. The problem is that “credit may be most effectually destroyed, if the sense of the people can be demoralized,” which will bring them to disregard “all law, divine or human, but their own will.” If people lack confidence, if they believe that credit is too dangerous, they will stake nothing on the game, choosing to produce less than they would if they used credit.

With this general understanding of credit, then, let us return to the particular role of banks in the antebellum system of credit and production. Here again, the failure of any one particular bank—which happens when its liabilities prove to be cases of bad credit—seems much less problematic than our intuitive sense of the damage caused by bank failure. Credit was extended, borrowers engaged in production, and the resources of the community were increased. And what of the creditors? Again, recall that in antebellum banking the depositors who would be today’s paramount concern are not present in large numbers. Instead, there are two types of creditors, only one of which we are accustomed to thinking about today. First, there are the bank’s direct investors: its initial promoters (and in all probability, its directors) to the extent they contributed capital, together with stockholders if the bank “went public” at some point and sold stock on the open market. While this group technically classifies as a creditor of the bank, the bank’s successes were their successes, and so its failure is in great measure their failure. In other words, the distributive outcome has little or no meaning: the bank’s directors were in a sense their own creditors.

The second group of creditors comprises note holders. Antebellum banks issued notes that were payable in specie on demand. When a bank failed, note-holders could apply to the receiver of the bank for payment, but the bank’s assets typically did not cover even a small fraction of its liabilities. As a result, small note holders probably recovered only in rare instances. Happily, no one but those who had intimate business relations with a bank was likely to be left holding a large amount of the notes of any particular bank. And so, unlike today’s depositors whose holdings are highly concentrated in one bank, note-holders in antebellum America typically held notes from a wide array of banks, each for a small sum and for a relatively short duration. Or in modern parlance: the small note-holders were well diversified. They thus faced little risk from the demise of any particular bank.

One further twist should be borne in mind: banks, whether of the antebellum variety or those doing business today, are not simply intermediaries, despite a common belief. Banks do more than concentrate dispersed money and funnel it towards specific uses. Banks inhabit a fractional reserve system, which means that they can lend far more than they have on deposit. In fact, bank lending in a fractional reserve system creates money. Today, banks create money in the lending process because they can lend more (usually ten times more) than they must hold as reserves. Antebellum banks created money in a somewhat similar fashion, but they had a tool that today’s banks lack: they could issue their own notes, holding limited reserves in order to be able to redeem them in specie. The mechanics are different but the effects in terms of money creation are similar. The upshot here is that antebellum banks actually loaned considerably more money than they ever collected from investors or depositors. That means that for every dollar risked by a bank, there was much less than a dollar risked by a depositor. We have one more reason, then, to think that bank failures might be less of a cause for worry than other business failures. Because banks have the privilege of creating money, they actually spur the system of production beyond its existing capacity. Bank credit allows the production of something for nothing, or nearly so. More accurately, the equation is something for a nothing that will turn (everyone hopes) into a something later on. As our teacher in Hunt’s understood, credit allows people to treat the future as if it were already here.

We thus begin to see how the advantages of banking and the optimism regarding the minimal impact of any single bank failure might begin to unravel, and why the critics of banking were, at least in broad terms, barking up precisely the right tree. They understood or at least intuited three related problems about banking and the ways it might in fact ruin the lives of multitudes.

First, the critics saw that the power of banking to enhance productive capacity beyond the immediate ability to pay for it was potentially valuable, but almost certainly dangerous. Each act of advancing credit was an act of faith. But faith is like lying: it becomes easier with each additional step. In this sense, lending against fractional reserves, which was still something of a financial innovation, had a cascading effect, both on the way up and on the way down. The availability of credit, and especially the expansion of the sources of credit (that is, the appearance of new banks; or the expanded lending of existing banks once federal deposits were distributed throughout the country), helped create a bubble that would eventually burst. When on the rise, credit generates competitive pressures on surrounding banks to engage in similar acts. This dynamic has stayed with us regarding every form of financial innovation since the early nineteenth century. Confidence has its price.

Second, the critics understood that when the system came under stress, that is, when too many people demanded their money, banks would exacerbate rather than alleviate that pressure. This was because lending against fractional reserves meant that banks could not respond to actual stringency by opening their vaults. When faced with demands for cash, the banks would have to call in their loans; their customers, in turn, would have to call in any liabilities owed to them. In other words, just when the demand for money became most intense, the banks would become an active force on the demand side rather than being able to act as a source of supply. Banks would not encounter this problem if they simply acted as intermediaries. It was their money-creating function which made banks a big part of the problem rather than a means of resolving the problem when pressure for money arose. What’s more, the system of lending money that did not actually exist until the loan was made insured that more and more economic actors had their fortunes integrated. Pressure on one point in a chain of loans could easily be transferred to many other points in many other chains through the channel of a bank.

Third, critics understood that the kind of confidence required for banking created a precarious web. When confidence in one bank was shaken, confidence in surrounding banks was nearly sure to founder as well. Once creditors got edgy, there was nothing standing in the way of the downward cascade described above. And because banks owed one another, and all businesses owed banks, a crisis of confidence would (almost) never be limited to one bank. This is how the ripple effects of a banking crisis would spread directly to the production sector: banks would call in loans, and businesses strapped for cash would have to cut expenditures, fire workers, and eventually close. The banks were instrumental in propping up more businesses than could ever have existed without the banks’ support. At the same time, the banks were a central reason for why so many businesses came under pressure all at once in what Irving Fisher would eventually call the debt-deflation problem. When productive businesses close, people lose their jobs. To the extent that bad bank credit contributes to general decline, all the various observers concerned about bank failure are completely right to worry.

Perhaps the best way to understand the attacks on banking is not by focusing on the concern for the pecuniary safety of the average citizen. For Gouge and others like him, the soul rather than the body of the people was at stake. When the advocates of banking could write that “credit is a moral property as well as an economical instrument,” and that the habits of credit should “extend their influence over general conduct in all the relations of life,” critics bristled. This was not because they doubted whether there was a moral imperative to pay one’s debts. Rather, they were shocked to see the idea of bank credit, based as it was on getting something for nothing, vying for the moral high ground. Credit of this sort was a speculation. Allowing it to flourish was one thing; granting it not only legitimacy, but moral status was horrific. If people were taught to consider their relationship with their banker as analogous to their obligations toward family, community, and state, the multitudes would indeed have come to ruin.

Further reading

For competing interpretations of the role of banking in precipitating the Panic of 1837, see Bray Hammond, Banks and Politics in America, from the Revolution to the Civil War (Princeton, 1957) and Peter Temin, The Jacksonian Economy (New York, 1969). A new evaluation of the evidence appears in Jane Knodell, “Rethinking the Jacksonian Economy: The Impact of the 1832 Bank Veto on Commercial Banking,” The Journal of Economic History 66, no. 3 (2006): 541-74. On the history of banking in the United States, see Howard Bodenhorn, State Banking in Early America: A New Economic History (New York, 2003) and Naomi Lamoreaux, Insider Lending: Banks, Personal Connections, and Economic Development in Industrial New England (New York, 1994). On the economics and culture of failure, see Edward Balleisen, Navigating Failure: Bankruptcy and Commercial Society in Antebellum America (Chapel Hill, 2001). For an account of one particularly spectacular banking failure, see Jane Kamensky, The Exchange Artist (New York, 2008).

This article originally appeared in issue 10.3 (April, 2010).

Roy Kreitner is the author of Calculating Promises: The Emergence of Modern American Contract Doctrine (2007). He teaches in the faculty of law at Tel Aviv University and is currently the Lillian Gollay Knafel Fellow at the Radcliffe Institute for Advanced Study, Harvard University, and an American Council of Learned Societies Fellow.

!["The Golden Age Or How To Restore Pubic [i.e. Public] Credit," lithograph (U.S., between 1832 and 1837?). Courtesy of the Political Cartoon Collection, American Antiquarian Society, Worcester, Massachusetts. Click image to enlarge in a new window.](https://commonplace.online/wp-content/uploads/2016/06/1-5-300x215.jpg)