Capital in the Eighteenth Century

Participating in this roundtable on Thomas Piketty’s Capital in the Twenty-first Century feels a little like coming to the public meeting after all the starred speakers have spoken and the bulk of the audience has moved on. As we know, for a while this book, for very recognizable reasons, drew commentary from economists, political scientists, sociologists and even from that endangered breed, politicians who read. Marxists were peeved by its opportunistic title, and even more so when Piketty announced that he had no time to read Marx, and while they celebrated his demolition of the long-cherished superstitions of free-market fundamentalists, they argued that Piketty refused to draw what they thought of as the obvious conclusions warranted by his study of the destabilizing growth of inequality. For David Harvey, and indeed even for a liberal historian like Thomas Frank, Piketty had produced a critique of the consolidation of capital and the emergence of plutocracy, but had steered away from a critique of capitalism as historical and socio-political process. Conversely, the Financial Times was so appalled by Piketty’s demonstration that tax laws had favored the rich that they attacked his data sets. This turned out to be a strategic error as it allowed Piketty—whose scrupulous collection of historical data has been praised across the board—to show exactly why the Financial Times was simply defending oligarchs and the one-percenters in spite of the evidence of their political and moral illegitimacy.

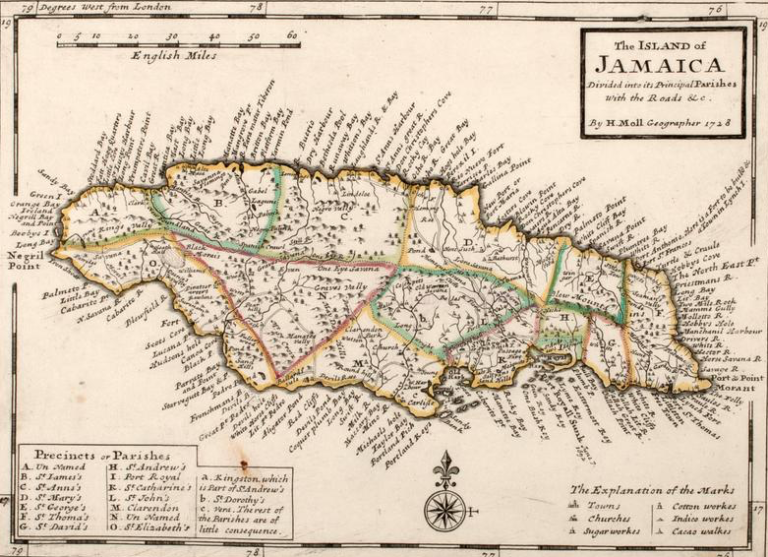

What then might I, as a student of eighteenth-century cultures of colonialism and nation-formation, add to this conversation? Piketty’s Capital, after all, attends to capital formation and inequality largely in the nineteenth and twentieth centuries, so it almost seems unfair to ask why the book does not consider the crucial role of colonial systems of expropriation and primitive accumulation in the making of Europe and Britain in the seventeenth and eighteenth centuries. Piketty actually has an answer for this historical objection: he states that “Foreign possessions first became important in the period 1750-1800, as we know, for instance, from Sir Thomas’s investments in the West Indies in Jane Austen’s Mansfield Park. But the share of foreign assets remained modest: when Jane Austen wrote her novel in 1812, they represented, as far as we can tell from the available sources, barely 10 percent of Britain’s national income, or one-thirtieth the value of agricultural land” (120). As statistician, Piketty is interested in aggregates, which means that ten percent of national income is not enough to demand more systematic attention than is enabled by his occasional literary references. Ten percent is not negligible in any context, but in the years ranging from 1750-1800, as the economist Nuala Zahedieh shows, the growth rate of colonial trade was disproportionately high, and its impact on social and cultural formations particularly visible. (Zahedieh also points to the dynamic changes that colonial commerce generated, including major innovations in institutional systems ranging from shipbuilding to law to financial accounting.) If Piketty had turned to literary writing before Austen, as I will, he would have found a world teeming with the world-creating energies of overseas trade that Zahedieh, and other economic historians, take very seriously.

Piketty does note that for both Balzac and Austen, people could live with a minimum of elegance only when their income was about thirty times the average income of the day, which was thirty pounds per annum. This “material and psychological threshold” (411) corresponded “to the average income of the top 0.5 percent of the inheritance hierarchy (about 100,000 individuals out of an adult population of 20 million in France in 1820-1830, or 50,000 out of a population of 10 million British adults in 1800-1810) ” (619, n. 36). Piketty understands the eighteenth century to be largely inflation free, so he can state that in both Austen’s and Balzac’s worlds, “land (like government bonds) yields roughly 5 percent of the capital invested” (53). He highlights this figure because its consistency over almost a century suggests to him that capital investments were “quiet” rather than “risky,” even though he emphasizes the fact that “Capital is never quiet: it is always risk-oriented and entrepreneurial, at least in its inception, yet it always tends to transform itself into rents as it accumulate in large enough amounts—that is its vocation, its logical destination” (115-16).

So Piketty sees the eighteenth century as an era of quiet capital, invested in land or bonds at home; how then should we understand the instance that Daniel Defoe, that astute observer of economic energies, offers in Robinson Crusoe? In that text, the young Crusoe, who was born in 1632, ventures into the Atlantic world against the advice of his father, and when he returns from his first voyage to Guinea, brings back gold dust worth “300 l” which represents a 750 percent return on his initial investment of forty pounds. Toward the close of the novel, Crusoe has become the English landowner he has always fancied himself—he has £5,000 in capital and a guaranteed annual income of £1,000 from his plantation in the Brasils. The novel ends by promising us “further adventures” as Crusoe sails away to resume his status as settler-owner of his island plantation colony.

In an earlier instance of “risky” capital investment, we learn that Drake’s successful privateering aboard the Golden Hind allowed his investors a profit of 4,700 percent. One of them, the then impecunious Elizabeth I, made enough to retire the national debt and to invest £42,000 in the Levant Company; John Maynard Keynes believes this booty “may fairly be considered the fountain and origin of British Foreign Investment.” We can multiply such instances of highly successful risky investments across the seventeenth and eighteenth centuries, not all of which find mention in literary texts. But many did, and those successes contributed to contested, but ideologically crucial, conversations about the economic urgency of overseas privateering and plunder, as well as control over oceanic trade routes, entrepôt and territories elsewhere. At one point in Alexander Exquemelin’s The Buccaneers of America (translated into English in 1684), he tells us that after their raids on Spanish Atlantic coast towns, each of Françoise l’Olonnais’ buccaneers earned £230, which, as Piketty’s numbers remind us, was eight times the average annual income in England. That they drank or gambled it away in short order is another matter! In Defoe’s The Life, Adventures and Piracies of the Famous Captain Singleton (1720), Bob Singleton makes a great deal of money during his buccaneering and wandering overseas and in Africa, and, since he also learns astute business practices, figures out methods of transferring £11,000 and more in the form of tradable goods into England so that he and his beloved Quaker William can settle into anonymity in a village outside London. Toward the end of the century, in Samuel Foote’s comedy The Nabob (1772), Sir Matthew Mite, newly enriched in India, offers to settle upon his future father-in-law the equivalent in Indian rupees of £60,000 and thus to restore him to his estate. This sum of money is vast enough to remind Foote’s audience why Englishmen who made their fortunes overseas were to be envied and resented. These last two instances do not feature what Piketty terms “quiet” capital, but they do illustrate just how money made overseas works hard to transform itself into the English landownership that will make it appear so.

Jane Austen’s genius lay in part in her novelistic capacity to denominate as timelessly, effortlessly English the landscapes, estates and interiors that had been remade for over a century by imports and by wealth generated in overseas trade and plantations. This is the quiet comfort Piketty finds in her world: if you simply mention the money each character is worth, you have no need to note the chinoiserie that they eat out of (or even evacuate themselves in); nor do you have to think about the origins of all that they consume, from sugar to tobacco, or of the cotton or silk they wear; nor do you have to think about the role played by continual warfare, the slave and bullion trades, or indeed class exploitation at home, in enabling comfortable lives. Nor do you have to remember William Cobbett’s acerbic comment on those whose investments initiated agrarian capitalism: “The war and paper-system has brought in nabobs, negro-drivers, generals, admirals, governors, commissaries, contractors, pensioners, sinecurists, commissioners, loan-jobbers, lottery-dealers, bankers, stock-jobbers; not to mention the long and black list in gowns and three-tiled wigs.”

Raymond Williams remarks that the unsettlement and remaking of socio-economic relations in the countryside was rendered less conspicuous by the fact that the new investors were often the younger sons of the “‘resident native gentry’ who had gone out to these new ways of wealth, and were now coming back.” For Williams, Austen’s “achievement of a unity of tone, of a settled and remarkably confident way of seeing and judging,” brings calm to what actually is a “chronicle of confusion and change.” In her novels “money from the trading houses, from the colonial plantations” comes into view only once it is realized in orderly estates (“it has to be converted into these signs of order to be recognized at all”). That is the Austen who beguiles Piketty. On the other hand, those of us who read in the non-Austen literary history of the eighteenth century, in the literary texts that celebrate and bemoan the making of “Great Britain,” discover a different scenario of exciting, risky capital, one that presumes that there is no growth without bloodshed and violence, where capitalism births its future in its furious coupling with colonialism. That, to riff on Piketty’s title, and to conclude, is the dynamic, world-forging history of capital in the eighteenth century.

Further Reading

David Harvey’s “Afterthoughts on Piketty’s Capital” is available online (accessed on November 14, 2015). Thomas Frank’s commentary appeared in Salon magazine (accessed on November 14, 2015). The Financial Times investigation of the “series of errors” in Piketty’s data was reported by Chris Giles (accessed on November 14, 2015), and Piketty’s rebuttal appeared in the Huffington Post (accessed on November 14, 2015). Nuala Zahedieh’s arguments are available in her The Capital and the Colonies: London and the Atlantic Economy, 1660–1700 (Cambridge, 2010). J. M. Keynes’s remarks are from A Treatise of Money vol. 1 (London, 1930): 156-57. William Cobbett published his essays on rural society between 1822 and 1826; they were collected as the two-volume Rural Rides in 1830. Raymond Williams’s bracing, sensitive commentary on Austen’s achievement is to be found in The Country and the City (Oxford, 1973): 108-19.

This article originally appeared in issue 16.3 (Summer, 2016).

Suvir Kaul is A. M. Rosenthal Professor of English at the University of Pennsylvania. He is the author of Eighteenth-Century British Literature and Postcolonial Studies (2009); Poems of Nation, Anthems of Empire: English Verse in the Long Eighteenth Century (2000); and Of Gardens and Graves: Essays on Kashmir; Poems in Translation (2015). He teaches and writes on eighteenth-century British literature and culture, South Asian writing in English, and on critical theory, including postcolonial studies.