Since French economist Thomas Piketty’s 2013 book on economics, economic history, and political economy appeared in English translation, it has made waves among American readers. In 2014, it spent nearly three months on the New York Times best-seller list and three weeks in first place. It was a media sensation. Worldwide, Capital in the Twenty-First Century has sold more than 1.5 million copies in 39 languages. Nobelist in economics and New York Times columnist Paul Krugman judged it the most important economics book of the decade.

Other timely studies have drawn similar conclusions about enduring and indeed increasing inequality of income distribution in the West. Piketty himself and with co-authors had already published preliminary findings. Yet these appealed primarily to specialists such as professional economists, sociologists, and historians. Strikingly, too, at nearly 700 pages, Capital appears better positioned to scare away readers than to attract them. Instead, the book has reached across the globe, and its author is now a widely recognized public figure.

So why Piketty? What accounts for the exceptional success of Capital? Many reviewers have noted that the book was well timed to resonate with American political debates that followed the 2008 financial crisis. Yet it is not merely a question of timeliness, nor of furnishing data to prove a central argument. Piketty’s study in economics is also an artifact of French culture that reflects France’s Enlightenment heritage and present-day norms. Surprisingly, across the vast response from journalists, the public, and specialists alike, the treatise’s cultural foundations have received hardly any analysis. Yet the author’s pedagogical and demystifying stance, humanistic and universalizing attitude, and approachable language are essential elements that shape the book’s presentation. These elements furnish a key to understanding its popularity among American readers.

More than most recent volumes authored by specialists, Capital sets out methodically to make economics understandable to the lay person and to emphasize inseparable links among economic, political, and social spheres. Having begun his career at an American university, Piketty critiques what he calls the “childish passion” of the discipline of economics, especially as practiced in this country, for “mathematics and for purely theoretical and often highly ideological speculation.” He comes down hard on what he terms the pretensions of economics to “scientific legitimacy” and the discipline’s tendency to disregard historical research, input from other social sciences, and fundamental questions about human society (32-33).

With such statements, Piketty draws attention to the mystique surrounding economics, encapsulated in the notion that it is far too complex for the non-specialist to understand. For his part, by rendering economic ideas, methods, and data accessible to readers, Piketty demystifies the very discipline. As a specialist, Piketty is himself a priest in the economic temple. Yet he has stated in a 2015 interview with historian Kenneth Mouré that “I want to reach normal people.” With Capital, he has stepped out of the inner sanctum, rejected the halo of the sacred, and mixed with the laity. To be sure, he is not alone in doing so. Paul Krugman, among others, regularly writes for non-specialist audiences about economics in its connections to politics and society. What is remarkable is Piketty’s persistent focus on data—tools of the quantitative economist—which he highlights even as he addresses general readers.

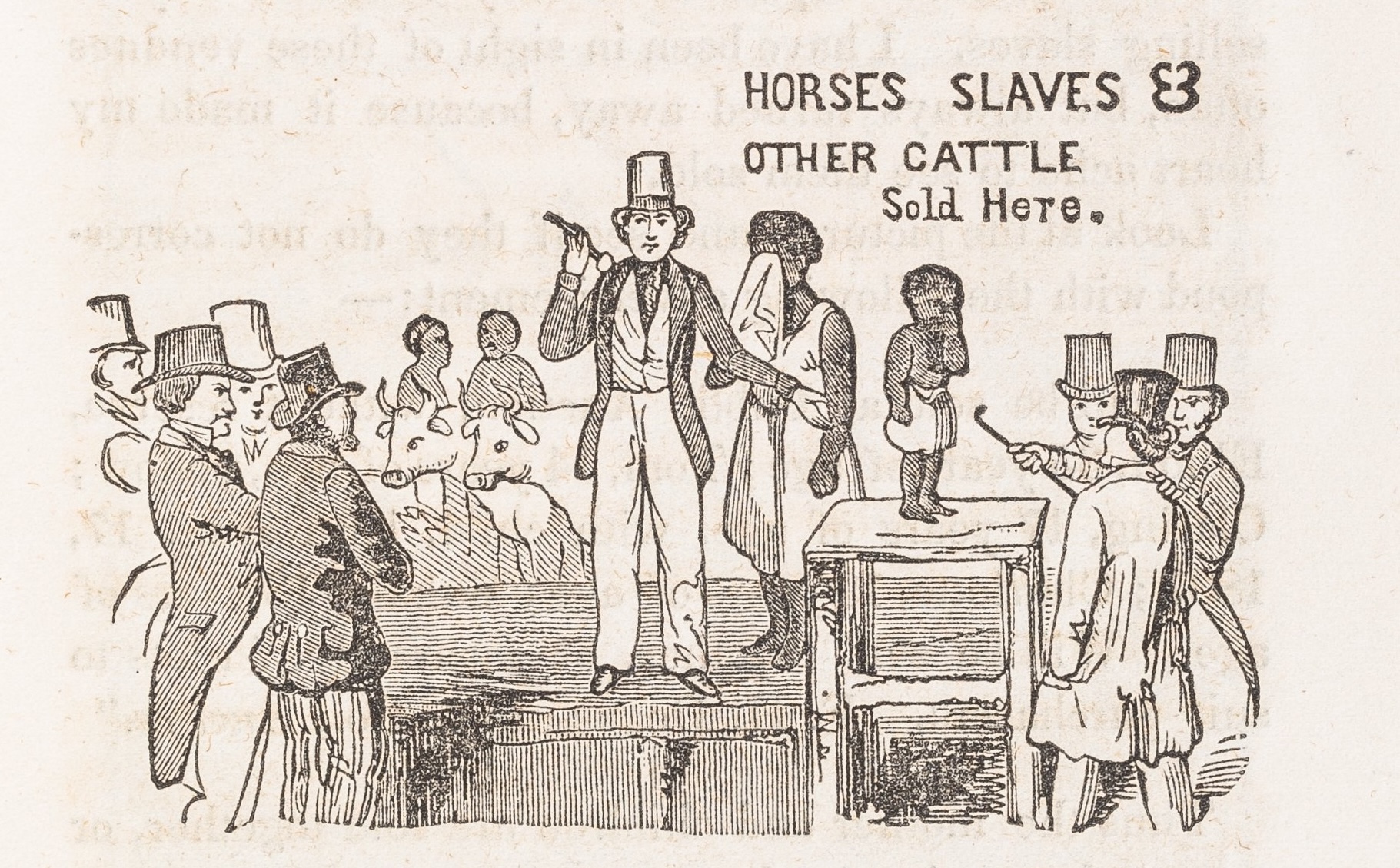

The data that he draws upon notably include lengthy runs from tax records from several countries, with some extending back nearly 250 years. From these emerge comparative sketches of the economic progress over time of several rich countries, including the United States and France. Stating that the data—much of it generated collaboratively—constitute the primordial contribution of his work, Piketty uses it to illustrate two consequential points. The first point is that over the long term in the wealthy countries under study, capital has accumulated at a greater rate than wealth from income has grown. As a result, the largest capital holders have accumulated wealth most quickly. This has held true of aristocratic and bourgeois elites in pre-Revolutionary France, wealthy Belle Époque French at the turn of the twentieth century, and the 1 percent in America today. Those who have already, get more, faster. The rich get richer. The poor, poorer, as popular culture has long had it.

The second essential point is that economies and markets are not natural phenomena, but rather human creations. Their workings reflect policies and laws, as well as myriad decisions that individuals make, both in private and in institutional and public contexts. As he argues, the data show that the current structures and processes function “mechanically” to accumulate capital and privilege in the hands of a few, to the social, political, and economic detriment of the many. Contrary to the notion advanced by Adam Smith in The Theory of Moral Sentiments (1759) and whose effects Smith described in The Wealth of Nations (1776), for Piketty, no “invisible hand” exists “naturally” to distribute wealth and effect economic equilibrium (9). Rather, Piketty’s data and arguments notably undermine the dogma dear to many Americans that an unfettered market rationally distributes wealth and develops democracy. His study underlines the sober—though not innovative—conclusion that the purportedly natural relationship between democracy and free-market economics is a mirage. It is a fictive alibi that obscures the destruction of American ideals of opportunity and equality. Tearing away the blinding veil of the national economic mythology, Piketty illuminates by means of data the gross workings of the system of concentration of private and corporate wealth by reinforcement of extant privilege.

The historical irony implied here is striking. In present-day America, the market economy fosters the unequal distribution of wealth and attendant privilege. Economic structures are deepening socio-economic distinctions and separating people into castes. Modern America—now a plutocracy—recalls other oligarchies, including the absolutist, monarchic state in eighteenth-century France. To recognize the nature of current conditions is therefore to face up to a historical responsibility and an ethical choice of grandiose proportion. Despite an overall increase in global wealth, in America, wealth inequality is notoriously great, and it is continuing to increase quickly, with consequent erosion of democratic customs and social justice. The current tendencies contradict political and social ideals of democracy, justice, equality, and opportunity. Is this state of affairs acceptable? This is the question that Piketty’s book ultimately sets before readers.

Because Piketty’s conclusions are far from original, they beg the question of his book’s hungry reception by American readers. What is unusual is the way that Piketty’s book works exceptionally hard to empower readers through knowledge and to set them onto a more equal footing with the specialist author and, by extension, with other economics experts. He admonishes readers that “all citizens should take a serious interest in money, its measurement, the facts surrounding it, and its history” and intones that “[r]efusing to deal with the numbers rarely serves the interests of the least well off” (577). Since we all participate in the economic and political system that Piketty addresses, it behooves us to understand it. What is remarkable is the way that Piketty—in the manner of his Enlightenment forbears—gives readers tools to actively learn and patiently incites them along the path to discovery.

To this reader, the relatively demotic style, exemplary sharing of information, and exhortatory stance loudly echo strategies that many an eighteenth-century French writer used to share critical knowledge—including knowledge about learning itself—with readers. Jean-Jacques Rousseau’s fictionalized treatise on teaching and learning Emile, or On Education (1762) laid down by example an influential theory of independent learning. Reading the novel, we see how the character of the knowledgeable tutor craftily leads his pupil to make discoveries and evaluate them on his own. In the collaborative multi-volume Encyclopedia that Denis Diderot and Jean Le Rond d’Alembert published over nearly 15 years (1751-65) during the mid-eighteenth century, the system of satirical and thought-provoking cross-referencing was designed to send readers from one article to the next, and in this way to encourage them to draw subversive conclusions based on the linkages among articles.

Similarly, Capital is laid out to encourage active learning on the part of readers. Within the text, the economist-author unpacks essential formulas and graphs, which he explains, lesson by lesson, to the reader. He indicates, furthermore, that his data are available for consultation. In fact, he has placed the data online, where they may be freely examined, along with, in the World Wealth and Income Database that he created with economists Facundo Alvaredo, Tony Atkinson, Emmanuel Saez, and Gabriel Zucman, expanded and also new sets covering additional nations. In a word, Piketty democratically shares his tool kit and techniques with the reader, to whom he further extends, as it were, the invitation to tinker as she sees fit.

Considered as an instrument of enlightenment for today, Piketty’s narrative, it appears, is meeting a need on the part of American readers to become better informed about economic matters, including achieving a deeper understanding of their social, cultural, and political dimensions. The explicit aim of the book is to “assist” readers to see dynamics at play in the economy and outline the choices that they will face in the future. This is a modest claim, but it certainly resonates with the book’s lucid, pedagogical exposition. Piketty states that his data and his own interpretations of it are mere “technicalities” and has repeated similar claims in interviews. That is, he has insisted that economic details are of contingent and provisional interest, only useful insofar as they can draw attention to and remediate injustice. To set things in perspective, he observes that, by contrast, climate change is a topic of truly pressing concern.

If this is so, we might ask why Piketty occupies so many pages with exposition of economic data, concepts, formulas, and history, and so few with direct discussion of social and political equality and environmental sustainability, beyond throwaway references? Why wrangle—at such length—big data, statistics, and mathematical formulas only to downplay, in the end, their importance relative to ultimate topics that are not even analyzed in detail?

Viewed from a different angle, the gesture is strategic. If Piketty’s ploy to draw readers evokes 250-year-old pedagogical ideals and communicative practices, he must deliver the immersion lesson in economics, but stop short of elaborate prescription. He must leave readers to draw their own conclusions and choose what to do with their new knowledge. The proceeding assumes that the reader is capable of learning about the important subject and worthy to judge its use. A fair number of individuals have stepped forward to meet Piketty’s challenge, through reading.

Beyond assuming intelligence and agency, Piketty appears to envision readers as possessing additional traits of a potentially disruptive nature to the current economic and political order. In contrast to much economic discourse and to common usage in media settings, the author does not refer to human persons as consumers, but rather as “citizens” and simply as “people.” He disdains the word “global” in favor of the planet Earth itself, referring to “planetary finance” and especially “planetary” concerns about human-induced climate change. These terms reflect lived circumstances, necessities, and ideals. While the “citizen” may be able to act at the level of the nation, her concerns, updated for current conditions of the transnational, finance-based economy, are now planetary.

In effect, the planetary agglomeration of citizens must be concerned about the same problem of rising inequality and wealth concentration. The vocabulary emphasizes the transcendent, universal nature of the predicament and the necessity for informed political participation by each person as citizen of a polity and of the human race. Against the paradigm of exploitation and division, a vision of relative equality and reciprocity comes into view, recalling typically French ideals of cosmopolitanism and appeals to a shared, if abstract, humanity. In point of fact, as Piketty reiterates, to more fairly distribute wealth, promote social mobility, and reshape the plutocracy back into a democracy, we must differently manage the market and economy. Since we have made the economy, we can also remodel it for the future, by changing policies, laws, expectations, and behaviors.

In a short period, Piketty has reached a broad audience who are now engaging in conversations about economics, reframed in terms of political economy. This is an important step—indeed, the necessary first step—to modify the current economic culture.

Further Reading

Critiques of economic discourse and practice appear in Donald N. McCloskey, The Rhetoric of Economics (Madison, Wis., 1985) and Gavin Wright, “Economic History as a Cure for Economics” in Schools of Thought: Twenty-Five Years of Interpretive Social Science (Princeton, N.J., 2001): 41-51.

From literary studies, Hans Robert Jauss discusses the interplay of reader expectations and responses in Toward an Aesthetic of Reception (Minneapolis, 1982).

Historian Arno Mayer drew conclusions about income distribution that pre-figure Piketty’s in The Persistence of the Old Regime: Europe to the Great War (New York, 1981; New York, 2010), while Pierre Rosanvallon similarly addresses related issues of social and economic inequality in The Society of Equals (Paris, 2011; Cambridge, Mass., 2013).

An essential earlier publication from Thomas Piketty co-authored with Emmanuel Saez is “Income Inequality in the United States, 1913-1998,” The Quarterly Journal of Economics 118:1 (February 2003): 1-39.

For French and American attitudes toward politics, economics, and culture, Alexis de Tocqueville’s Democracy in America (Paris, 1835/1840; New York, 2004) is indispensable.

Richard F. Kuisel’s Capitalism and the State in Modern France: Renovation and Economic Management in the Twentieth Century (New York, 1981) and The French Way: How the French Embraced and Rejected American Values and Power (Princeton, N.J., 2012) illuminate the specificity of modern French political economy and culture.

From sociology, Michèle Lamont’s Money, Morals, and Manners: The Culture of the French and American Middle Class (Chicago, 1992) compares views of money and economics in France and America.

This article originally appeared in issue 16.3 (Summer, 2016).

Julia Abramson is a professor of French and Francophone Studies at the University of Oklahoma and the author of Learning from Lying: Paradoxes of the Literary Mystification (2005) and Food Culture in France (2007). A recent Gustave Gimon Research Fellow in the History of French Political Economy at Stanford University and recipient of a research grant from the Hagley Center for the History of Business, Technology, and Society, she is writing a new book about finance and culture.