The Rise of Usury in Early New England

Commerce, bills of exchange, and the morality of money

In 1637, a recent immigrant to Massachusetts Bay named Dennis Geere dictated his will in the presence of the colony’s governor John Winthrop. Geere apportioned most of his modest estate among his family and then launched into a remarkable act of contrition. “The Lord our God of his great goodness, since my coming into New England, hath discovered to me all usury to be unlawful,” he confessed. To make restitution, Geere charged his executors, who included Pastor John Wilson, to restore “all such moneys” that he had received in England “by way of usury, whether it were 6 or 8 per cent.” The details were important. English law allowed up to 8 percent interest on such loans, but the penitent Geere meant to do the law one better. He wished to “manifest” his “distaste against every evil way.” Geere had practiced usury without compunction in “old England,” as he put it. He had learned his “duty” in New England. Winthrop and Wilson had taught him that usury was sin, and he meant to repent of it as a testimony to his newfound life in Massachusetts.

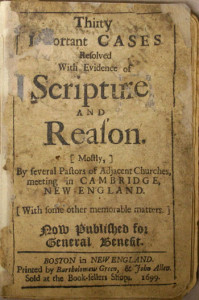

In 1699, the third-generation Boston pastor Cotton Mather informed New Englanders that the Puritan ministers of the Boston area no longer regarded usury as sinful. Meeting as the Cambridge Synod, they had determined that usury, or “an Advance on any thing lent by contract” (the import of the reference to contract is explained below) was legitimated by the “Divine Law” of the Old Testament, given “countenance” in the New Testament, “Justified” by economic “Necessity and Utility,” mandated by the ethical principle of equity, required by the philosophical meaning of money itself, and congruent with the moral “Law of Charity.” Only Catholics soaked in canon law and papal superstition, Mather wrote for the other ministers, maintained the old prohibitions against usury. Mather and his colleagues, in contrast, imagined some forms of usury as means of sociability, prosperity, and promoting the common good.

Geere’s will and Mather’s account of the 1699 Cambridge Synod suggest three reflections on usury. First, the practice signified deep moral and spiritual dilemmas for early New Englanders—enough to occupy the devotional focus of a commoner making his will and of an assembly of divines addressing widespread social dilemmas some sixty years later. Usury, indeed, was one of the great moral subjects for early modern Englishmen (and for French and Dutch writers as well). From the mid-sixteenth through the seventeenth century, few topics aroused such extensive debate. Economic counselors to the English crown, propagandists for overseas-trading companies, humanist essayists, municipal officials, writers of devotional tracts, preachers, authors of formal theologies: everyone wrote about usury.

In today’s economic conversation, the globalization of the market would be a similar sort of issue. The term globalization is everywhere (pun only slightly intended); few opinions on economic life, the market, or social relationships in general omit some account of it. The analogy, moreover, involves more than ubiquity. Globalization is so complex and involves so many different definitions that one cannot simply say that globalization as a whole is good or bad. Just as the issue of globalization defies summary judgments, so too did usury. Geere’s repentance and Mather’s legitimizations, then, should not be read as a straightforward and simple dichotomy. Seventeenth-century Americans confronted usury with different definitions, justified some forms of it while rejecting others, changed opinions, and expressed as much ambivalence, if not confusion, as they did moral certainty.

Second, American Protestants (in this case, New England Puritans) of Geere’s generation may have practiced usury, but they associated it with vice and iniquity. The common interpretation might take Mather’s defense of usury as the essential Protestant mentality. So, the story often goes, Catholics inhabited an Aristotelian moral universe where money functioned as a mere sign of value—a marker for worth that resided in tangible goods and estates. As a mere medium for exchange, it by necessity could not increase in value. (Just as a ruler measures things properly only if its units of length remain constant: an inch must always be—well, an inch long.) The use (Latin usura, from which we get “usury”) of money as a means of profit in and of itself—to make money merely from lending money—was a misuse because it changed what ought to have been a constant sign. Catholic teaching on usury, last encoded in a 1745 papal edict and never officially rescinded, therefore decreed usury to be unconditionally and universally wrong.

Early Protestants, especially John Calvin, according to this common interpretation, broke the Catholic framework. They observed that the value of money in fact changed through time, whatever the medieval schoolmen taught. In the expanding commercial milieu of Protestant urban centers, price inflation rendered a pound worth so much grain one year and less the next. The creditor who loaned one pound in 1555 and received a pound in return in 1557 might in fact lose value. Some increase on money merely kept pace with price inflation.

More importantly, the opportunity for long-distance exchange transformed money into a means of production. Merchants invested in trading ventures rather than in agriculture or manufactures and deserved a return on it. So, writers such as Calvin distinguished between a legitimate increase on credit and egregious or uncharitable returns on loans, especially to poor debtors. Internal moral motive, in this case, marked the line between good and bad loan practices. Calvinists called the latter usury in the sense of necessarily vicious (they referred to Old Testament prohibitions against nesek, translated as “biting usury”). The Reformers, by this reading, had deconstructed medieval objections to usury and opened the way for modern commercial uses of credit.

This Protestant-as-opposed-to-Catholic reading of usury misleads. Many Catholic moralists anticipated the supposedly Calvinist argument long before Calvin; the papacy validated Italian “charity banks” that charged interest on loans to Venetian merchants and used the profits for charitable purposes. Moreover, influential early modern Calvinists, including Calvin and many Puritans through the 1630s in England and New England, often viewed usury with suspicion. They urged severe restrictions on loan practices through the mid-seventeenth century and wielded church discipline against violators. True enough, they allowed small rates of interest that kept pace with inflation. They also permitted commercial investment for profit, as long as the creditor bore the risk of investment. That is, if a merchant paid for one-quarter of the costs of an overseas trading venture, then he deserved one-quarter of the profits as long as he also risked the possibility of loss through storm, accident, or piracy. This allowance, however, did not preclude prohibitions against contracts that guaranteed profits to creditors; such contracts, their critics argued, took unfair advantage of debtors who alone bore risks but shared rewards. Puritans such as William Perkins, William Ames, and John Cotton, along with lesser lights, would have taken Mather’s “an Advance on any thing lent by contract” as usurious and immoral.

Geere’s will reflects a widespread assumption among his generation that usury was nearly always wrong despite the fact that most European states, including England, legalized interest rates from 6 to 8 percent on domestic loans and 10 percent on overseas credit. Social commentators and moralists in London, such as the humanist jurist Thomas Wilson, the economic writer Gerard de Malynes, most Anglican theologians, and Puritan preachers decried the various schemes by which creditors made profits without active production and labor, as though the mere elapse of time enhanced the value of their money. They complained that usury (outside a proper recompense for inflation and the risks of investing in commercial ventures) appeared to corrupt nearly every economic transaction in the new economy.

Loan brokers charged the legal rate on interest and then piled on spurious fees such as insurance and the cost for scriveners (notaries). Grain merchants loaned money to cash-poor farmers for a specified amount of produce and deferred collection until a grain shortage raised prices far beyond their levels at the time of the original contract. Landlords raised rents for those taking room on credit. Shopkeepers inflated prices for goods sold on book credit. Financiers accepted mortgages for collateral and received rents from the mortgaged land on top of repayment for the original loan. Merchants devised especially crafty means to profit from credit: undervaluing the worth of foreign currency, charging fees for delayed payments, shifting the amount or valuation of goods and notes passing through their hands.

By the 1620s, usury had become, for its critics, a synecdoche for nearly every form of avaricious dealing, especially market-induced misbehavior. However much humanist and religious moralists accepted small amounts of interest and commercial investment as legitimate, they especially condemned the financier who made a living solely from lending money. The Dutch Reformed Church went so far as to mandate excommunication for the sin of being a banker, or Lombard. “Usurer!” was the worst of name-calling.

Finally, the difference between Geere and Mather indicates that New England Protestants changed their understanding of usury over the course of the seventeenth century. During the great expansion of overseas commerce from the 1650s through the 1680s, social commentators in England and America began to reconsider the boundaries between licit and improper loan practices. In effect, innovations in the use of credit outpaced the old moral reservations and mandated a more liberal attitude toward what the critics previously called usury.

The imperial market system depended on complicated—some economic historians employ the term “abstract”—instruments of credit at nearly every transfer in an ever-expanding series of exchanges. In the absence of a steady supply of specie, merchants in London and Boston wrote and received bills of exchange: signed notes (something like IOUs) that promised payment in goods or cash by a set date, included interest, and prescribed penalties for late payment. In 1678 a modest merchant from Braintree, Samuel Tompson, learned to use bills of exchange from one of the numerous secretary’s and merchant’s manuals circulating around Massachusetts at the time, Edward Cocker’s Magnum in Parvo, Or the Pen’s Perfection (London, 1675). Taking notes on Cocker, Tompson recorded the proper form for a bill and included an implicit fee for the credit as well as an explicit penalty for late payment.

“Be it known to all men by these presents that I ________ do owe and am indebted unto _______ the sum of ________ currant money of England to be paid unto the said ________ [or] his Heirs . . . to the which payment will and truely to be made I do bind my self . . . in the penalty or sum of ________ of like money, firmly by these presents. In witness whereof I have hereunto set my hand and seal [dated and signed].”

Recipients of bills of exchange often transferred them to other creditors, indebting its original signer to someone whom he had never known. In such cases, it was practically impossible to follow the customary religious mandate to refrain from taking interest from a poor debtor or to monitor one’s motives so that debtors were not used as means of profit. One may have never met one’s debtor. Bills of exchange in effect made usury a commonplace without an explicit reference to high interest rates on personal loans.

Shopkeepers, farmers, fishermen, peddlers, and artisans all used bills of exchange in this manner. When they did so, they engaged in a practice that previously had been called usury but that passed in their day as a necessary means of business. In the complex nexus of the expanding market, effective exchange required rapid, impersonal, and legally accountable measures to transfer credit and assure some penalty for delayed payment. In the economic environment of seventeenth-century Massachusetts, with its erratic supply of money and the ease with which currency moved to England, commerce depended on the value of bills of exchange and other paper instruments such as mortgages and bonds.

This system placed immense pressure on creditors, usually merchants, to bring debtors into court. The number of debt cases in the Massachusetts Superior Court of Judicature, which often involved unpaid bills, soared during the 1670s and 1680s, and the number of debt cases also rose markedly in the county courts. The Suffolk County Court became the most frequently used forum for economic adjudication in the Boston area, spending most of its docket on contested bills of exchange and disagreements over contracts, bonds, and rents. Comparable figures emerge from the records of the Essex and Middlesex County courts in a slightly later period.

The widespread circulation of bills of exchange eroded many previously held rationales for anti-usury sentiment. Many moralists in New England nonetheless protested the spread of usury throughout the 1670s. Increase Mather (Cotton Mather’s father) of Boston’s Second Church and Urian Oakes of Cambridge portrayed the toleration of usury as communal calamity. Magistrates may have accepted the practice and even enforced it by their judgments in civil courts, but it was sin nonetheless. Mather and Oakes counted usury among the several causes for the relentless judgments of God against New England: bad weather, Indian wars, intrusive royal agents, and depressed trade. Yet, as much as these traditionalists knew that usury was wrong, they increasingly found themselves at a loss to analyze the specific meaning of usury amidst multilayered and indirect exchanges, the unavoidable treatment of credit as a commodity, new accounting measures, fiscal rationalizations for interest, and complex debt litigation.

While critics of usury found it increasingly difficult to specify the proper use of credit, a new genre of social commentary published in London from the 1660s through the 1690s legitimated free-floating interest rates and rising loan fees as an economic necessity and national mandate. Advisors to Parliament and advocates for England’s overseas-trading companies gradually assembled a body of literature that derived economic principles from technical analyses of market exchange and the overall, long-term production of wealth. Sometimes misclassified under the rubric “mercantilist,” these economic writers included Sir Josiah Child, Thomas Mun, Edward Misselden, and Sir William Petty. They addressed the nation’s economic problems—shortage of coin, depression in the cloth trade, scarcity of goods, unemployment, and rising poverty—with proposals to enhance exports and the overall exchange of goods. They sometimes offered contradictory advice on interest rates, but they all rested their arguments on fiscal analyses, trade statistics and other empirical data, mathematical reasoning, and comparisons with Dutch and French competitors.

In their advice to the English government, these proto-economists excluded customary moral and religious objections to usury. They rejected earlier commentators who assumed that prices should be stable, that specie had an unchanging value, and that usury corrupted credit transactions. Money, they argued, had no absolute intrinsic value; it only had exchange value, its worth on the market in terms of consumable goods. The practical effect of monetary policy and innovative credit schemes eclipsed abstract arguments about the nature of money. Higher interest rates in fact encouraged investment in overseas ventures and speeded commerce. Analysts such as Petty suggested that the sooner English policy makers learned that lesson, the sooner they would encourage English merchants to adapt to rather than resist currency fluctuations, compete in the exchange of credit, and allow their prices in commodities (including money) to rise to the greatest profit level. The payoff enhanced England’s balance of trade. The merchant and financier who understood the market and maximized returns from it served the public good. Here was England’s first thoroughgoing legitimization of usury, appearing in a flood of economic pamphlets at the close of the seventeenth century. Popular Anglican theologians and devotional writers from the period, such as Richard Allestree, submitted to such logic: if usury was good for England, then they would be the last to condemn it.

By the time that Cotton Mather’s report from the Cambridge Synod appeared, the technicalities of credit exchange and the cost of deferred payments on bills had rendered anachronistic the customary arguments against usury. After 1690, colonial governments began to issue paper money, called bills of credit, backed by tax revenues; but overseas merchants, inland traders, and urban consumers continued to use bills of exchange. Cotton Mather and his colleagues understood bills of exchange to function like money and argued, with England’s economists, that money ought to produce a profit in itself because it was not a mere instrument of exchange. As Mather put it, it was a commodity: “Money is as really Improvable a thing as any other; and it rather more than, less productive [sic]” so that “there can be no reasonable pretence that should bind me to lend my Money for nothing, rather than any other Commodity whatsoever: nor can a Contract in this case be more blameable, than in any other.”

This is not to say that the merchants, magistrates, and ministers of Massachusetts (and Massachusetts took the lead for the other New England colonies in such measures) had thrown open the doors to any and all credit practices. English law and widespread social consensus decreed some limits (just as the colonies continued to legislate occasional wage and price ceilings on essential goods through the eighteenth century). In the 1660s, the General Court of Massachusetts rescinded colony-wide regulations on credit and empowered county courts to proceed against what they determined were egregious interest rates or fees. It appears, however, that judgments on such matters varied between regions. Boston merchants and financiers, who issued most of the bills of exchange circulating in New England, charged up to 25 percent interest when London credit brokers gave them unfavorable exchange rates (that is, deflated the worth of New England bills relative to the London pound). Rural debtors often complained, to little effect.

Yet deep sensibilities about the commonweal, care for the poor, and the moral purpose of credit remained in place in New England, even after the anti-usury arguments disintegrated. Colonial governments, in some cases, still legislated upper limits on usury, and county courts made judgments in favor of plaintiffs who charged their creditors with avaricious practices. Most of these cases, however, involved personal loans between neighbors or acquaintances and particularly loans given to those in dire and immediate need. They did not address the impersonal transactions represented in bills of exchange, banking contracts, or commercial ventures. This should not surprise us. Even today, over half the state governments in the United States have statutory maximums on interest: 7 percent in Michigan, 20 percent in Massachusetts, and 45 percent in Colorado. These statutes are chiefly symbolic (except for loan-sharking). Current lending laws provide exceptions for banks, small lending companies, and loans for real estate and automobiles. Several states also release credit-card companies from statutory limits. (This, I suspect, explains why so many credit cards are issued in South Dakota.) In any case, our remaining anti-usury laws memorialize ancient sentiments about usury, long since deconstructed.

Further Reading:

Dennis Geere’s will can be found in “Genealogical Gleanings in New England,” The New England Historical and Genealogical Register 37 (1883); Cotton Mather’s work was published as [Cotton Mather,] Thirty Important Cases Resolved with Evidence of Scripture and Reason (Boston, 1699); Tompson’s notes on Cocker are in his notebook at the American Antiquarian Society. For the standard argument about usury and Calvinism, see Benjamin N. Nelson, The Idea of Usury: From Tribal Brotherhood to Universal Otherhood (Princeton, 1949). For the importance of credit and the decline of anti-usury sentiment throughout the Anglo-American commercial world in the seventeenth century, see Craig Muldrew, The Economy of Obligation: The Culture of Credit and Social Relations in Early Modern England (New York, 1998) and Norman Jones, God and the Moneylenders: Usury and Law in Early Modern England (Oxford, 1989). For the economic thinkers, see Joyce Oldham Appleby, Economic Thought and Ideology in Seventeenth-Century England (Princeton, 1978).

This article originally appeared in issue 6.3 (April, 2006).

Mark Valeri, the E. T. Thompson Professor of Church History at Union Theological Seminary in Virginia, is currently writing a book on religious thought, merchants, and the rise of market exchange in early Massachusetts.