When Money Was Different

A look backward

Visitors to the United States often complain, “Your money all looks alike.” Ones look like fives or tens or twenties, with the same color combinations—black for the faces and muddy green for the backs. Thoughtful Americans might agree with their guests: our currency does look very much alike, with the same limited, and deadly, choice of portraits and views. And it’s been that way forever, right?

Wrong.

There was a time when America’s paper money reveled in the offbeat, the inconsistent, the colorful. There was a time when it came from thousands of places rather than one, when local scenes and notables predominated, and when Americans were accustomed to receiving threes, fours, sevens, and nines along with fives and tens. There was a time when American currency was interesting, was actually intended to communicate with its audience and not simply to serve as an aid to commerce. This money dominated most of the American nineteenth century.

From the colonial period through the end of the Civil War, Americans were more dependent on paper money than any other people in the West. There was an excellent reason for this reliance: they had little choice. Like other transplanted Europeans, the early immigrants to English America spent much time and energy in the search for precious metals. Unlike many others, they were unsuccessful in their quest. It would not be until the middle third of the nineteenth century that two factors (the discovery of gold and silver in the 1840s and the modernization of the minting process) would create the possibility of enough “hard money” for everyone. And by that time, a robust, alternative tradition had grown to maturity, one based on paper and not on metal.

The paper era started out in Massachusetts, where colonial authorities hit upon the idea of issuing paper certificates to purchase the supplies and pay the troops the Bay Colony was expected to contribute to the first of an interminable series of English wars against the French in Canada. This was in 1690: the notes were printed from engraved copper plates (probably the work of silversmith Jeremiah Dummer), the troops were paid, the supplies, purchased. The Crown pledged to pay Massachusetts for its trouble, in specie, at war’s end.

That pledge was crucial; the certificates were as good as gold because everyone knew that “real” money stood or would eventually stand behind them, insuring their redemption. But then someone in the local government hit upon a clever, and epochal, idea: since everyone knew that the paper was good, why not leave it in circulation instead of retiring and destroying it once the English specie had arrived? The current monetary situation wasdesperate. It was done, and when the other colonies saw that the wrath of God did not descend on Boston, they got into the game themselves. By 1750, a paper tradition had been firmly established.

The medium posed problems, of course. It was subject to counterfeiting, and there was always the temptation to issue more of it than could be readily redeemed. But if paper threatened, it also attracted: it enabled generations of Americans to build roads, start workshops and factories, expand farms, grow cities and towns. In a very real sense, our early economy was built on thin air, on promises to pay, on optimism, on lack of viable alternatives, and by sheer will. And the miracle is that the whole thing worked.

One can divide our early paper’s story into two chapters. The first, lasting from 1690 to the early 1780s, featured notes from public sources—colonies and succeeding states; a new insurgent authority, the Continental Congress; and occasional cities or towns. The period from the early 1780s to the mid-1860s relied on currency from private issuers—mostly banks but also factories, canals and railroads, and, on occasion, some more unusual participants, including a hotel in Dixon, Illinois, and an orphan’s institute in Fulton, Ohio. There was a good reason for the shift from public to private money: the War for Independence had been fought with “official” currency issued by the national and state governments, and it had become virtually worthless by the end of the conflict. When a group of lawyers, politicians, and businessmen on the eastern seaboard wrote and pushed through a new federal Constitution, the last thing they wanted was more public paper. They prohibited the states from creating more currency, and they were cleverly silent on whether the new national government could do so. They realized that an emergency might someday arise, an emergency so dire that national paper would be required (and one did: we call it the Civil War). But as far as humanly possible, the United States would be a “hard money” nation, where coinage was king.

Then reality intruded. The United States was as short of specie as ever. But the economy was strong and getting stronger. If it were to reach its full potential, the money supply would have to be increased, and quickly. Paper was the only viable solution. But the public powers had effectively put themselves out of the running. What was left?

Banks were left. The Constitution was silent on the matter of note-issuing private banks, presumably because its framers had never anticipated their necessity. But barring a miracle, these were exactly the sorts of institutions that would have to carry matters forward. And so they did: a handful of note-circulating banks opened their doors in the 1780s and 1790s, a few more in the first decade of the nineteenth century, many more after the War of 1812, and an avalanche between the 1820s and the early 1860s. It has been estimated that around eight thousand banks and other institutions issued paper money of their own.

Of course, there were a number of risks involved. How did you know whether a bank was solvent or even extant? Who rode herd on the bankers? What did their notes look like? How were their notes supposed to look? At bottom, there were two interrelated problems. They had cropped up well before 1800, and they would have to be solved at once, were the promise of paper to reach its full potential. First, notes must be made far more difficult to counterfeit than they currently were. Second, new methods of production must be found and married to improved security. The goal would be paper money with an absolute consistency of design, identical notes that could be produced in any quantity desired. If experiments to safeguard and mass-produce paper currency had been carried to their logical conclusion back in 1800, we might have had money looking very much like our money today: the same portrait here, the same curlicue there, etc. But they were not carried to their logical conclusion—at least, not yet. What happened and how it happened make a fascinating tale.

The key player was a genius from Newburyport, Massachusetts, named Jacob Perkins. Perkins was a sometime inventor and dedicated self-promoter, very skilled in working with metals. Shortly before 1800, he began tinkering with the concept of printing currency from steel plates rather than copper ones. Steel would outwear copper by a factor of six, but it was proportionally harder to engrave.

Perkins made two contributions to the engraving and printing conundrum. He devised a method for softening and hardening steel at will: a design could be engraved in soft steel, hardened, and then used to print anything, including money. But just like the unsung Boston genius of 1690, Perkins carried things a logical and absolutely crucial step farther. He devised a transfer press, wherein designs could be replicated an infinite number of times.

He began with a design engraved on a soft piece of steel. Harden that piece, clamp it in a press, and force a soft steel cylinder over the flat plate often enough and you’d eventually pick up the original design, in relief. Harden the cylinder and force it repeatedly over a flat piece of soft steel and you’d have your original design back again. Add various touches, harden the plate, and you’d have a steel printing plate, ready for work. And you could make an infinite number of plates in this fashion, each identical to all the others.

Jacob Perkins had invented a technology so elegant, and so perfect, that security printers would rely on it for the better part of two centuries.

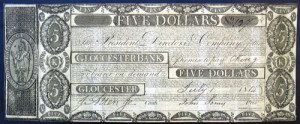

The inventor had perfected things a year or two prior to 1805. He then built a large printery in Newburyport and waited for orders to flood in. A substantial trickle repaid his efforts, but matters did not quite go as he assumed they would. Figure 1 shows a typical Perkins product, an 1814 five-dollar bill for the Gloucester Bank. Note the complexity of design. All of the work for the face and for the back (unlike many other printers, Perkins favored biface notes) could effectively be done by means of large plates with holes allowing for “customization” (the denomination, the name of the bank, and the place of issue). These notes were extremely difficult to counterfeit—so much so that the state of Massachusetts mandated that every bank in the state (which then included Maine) apply to Jacob Perkins for their paper money. But if his products were difficult to forge, they were even more difficult to love; they look downright homely now, and they must have given a similar impression two centuries ago.

So bankers were of mixed minds. While they appreciated what the inventor had accomplished, they were looking for variety. And a growing group of printers was soon meeting the challenge. In essence, Murray, Draper, Fairman, and Company (the Philadelphia firm where Perkins worked for a few years after winding up his own printshop) and all who followed would give the bankers what they wanted—individualized money—while using Perkins’s methods to achieve it.

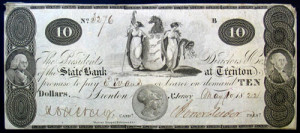

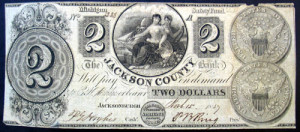

Over the next half century, America’s currency grew increasingly ornate, as engravers and producers grew more confident. It may be of interest to look briefly at a progression of “typical” obsolete notes. Our first example dates from 1822, a ten-dollar bill issued by the State Bank at Trenton, New Jersey (fig. 2). Murray, Draper, Fairman, and Company printed the note, employing Perkins’s methodology to do so. Vignettes on notes from this period are fairly simple and small: the transfer press still lacked the force necessary for more ambitious work. Our next piece dates from the late 1830s, and it shows how far the technology had evolved in a few short years (fig. 3). The work is larger now, although the bill still has a “cut-and-paste” look to it. Inspiring allegories were the order of the day. This note was issued by the Jackson County Bank, which closed its doors almost as soon as it had opened them, victim of the hard economic times then current.

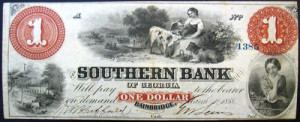

Almost all of this early currency was uniface, and all of it was printed in a single color, black. By the 1840s, cautious experiments were beginning with the application of a second color, sometimes called a “protector,” intended to safeguard against counterfeiting and alteration. A note from the Monmouth Bank was also intended to commemorate a Revolutionary War battle and the man at the helm, George Washington (fig. 4). The decade of the 1850s saw an expansion of the use of the second color and a new confidence and quality of engraving. A note from the Southern Bank of Georgia is a typical product from this decade (fig. 5). The trend continued through the early 1860s, and the second tint now became an integral part of the design, as on a dollar bill from Baltimore, Maryland (fig. 6). Back printing was also being reintroduced here and there. America’s private currency was beginning to resemble the first of the federal currency that would soon supplant it.

Almost from the beginning, issuers demanded and engravers supplied pictorial elements, portraits and vignettes, for America’s private currency. The artwork was there to foil forgers: counterfeiting was always a problem, in part because the bankers and others had not followed Jacob Perkins’s idea of absolute conformity of design and in part because of widespread illiteracy and lack of acquaintance with fiscal objects. But there were other reasons to favor portraits, stories, and scenes on your money. Beauty on your bank notes might make your products more popular with the public than those of your competitors—an admittedly minor factor but one which must be taken into account in places with many currency issuers. There was a final reason for the connection between the pictorial and the paper. Bankers and others came to see their currency as a way of telling Americans about themselves—about their country and its unique destiny, its past, its prosperity, and its strengths. Through the seven decades of the obsolete note, issuers would have almost unlimited chances to recount the American story.

By the 1830s, paper money usually presented more than one portrait or vignette. By 1850, the common arrangement was three or four images—a large central scene, plus a smaller scene or portrait on either end, and, perhaps, a tiny image at center bottom. During the years between 1830 and the early 1860s, at any given time there were several hundred currency issuers. Each was responsible for, say, half a dozen denominations, which almost always differed from each other in terms of their visual content (so that a lower denomination couldn’t be raised to a higher one by someone gifted with a pen). The designs of the notes tended to be changed every few years to ward off counterfeiting. While popular images were used by many banks because their recycling saved time and expense for everyone, there were still many hundreds, probably thousands, of images that were “one-offs,” expressions of a particular point of view at a particular time and place. These images reminded me of prehistoric insects forever frozen in amber, and I finally wrote an electronic book about them, Pictures from a Distant Country.

The most fascinating thing I found about these old notes was the progression they displayed—not only an evolution in printing expertise but a progression in how people and objects were portrayed, from simple, black-and-white, either/or depictions in the beginning to far more nuanced images towards the end.

And the end finally came. A great war, the Civil War, found North and South needing more paper money than the banks could ever provide. Like it or not, the national government got back into the currency business, from which it has never departed. And the road to monetary conformity lay open.

This article originally appeared in issue 6.3 (April, 2006).

R. G. Doty is Senior Curator of Numismatics at the Smithsonian. He is the author of eight books and the editor of two more, and he has also written about two hundred and fifty articles, radio scripts, etc., all dealing with various aspects of numismatics from ancient times to the present.