Free Silver and the Constitution of Man

The money debate and immigration at the turn of the century

In 1889, Harvard economist Francis A. Walker described the “social effects of paper money” that ranged from bad taste—”wanton bravery of apparel and equipage”—to dangerous consumer desires, which undermined the father’s authority. Paper money, Walker observed, led to the “the creation of a countless host of artificial necessities in the family beyond the power of the husband and Father to supply without a resort to questionable devices or reckless speculations.” Not only driven to recklessness, these fathers adopted “humiliating imitations of foreign habits of living.” Paper money undermined “that fit and natural leadership of taste and fashion which is the best protection society can have against sordid material aims.” And it elicited “manners at once gross and effeminate,” which led to “democracy without equality or fraternity, and exclusiveness without pride or character.”

Paper money threatened patriarchy; it drove otherwise respectable men to immoral or dangerous speculations. Paper bills produced both “effeminacy” and coarseness, encouraging foreign habits. How did paper money manage this cultural crime spree? Not by raising prices—in this passage Walker never mentions higher prices. Instead, by removing society from a basis in “real values,” paper money overturned natural laws and natural social hierarchies. It decentered the self.

Walker was probably America’s leading labor economist in the 1890s. He was also supervisor of the census. The two roles may seem only indirectly linked, but in Walker’s case, they were not. Like most of his peers, he imagined steady global progress marching directly towards the United States of America and its “fit and natural leadership of taste and opinion.” To reinforce that notion, he founded his economics, his sense of social hierarchy, and his view of money in natural law. “Money,” Walker declared in 1895, “is a product of evolution, a result of the ages.” In political economy as in society, in the markets and cultural capitals of the world, “the better [gold] has gradually crowded the worse out of existence.” Like other “hard money” economists, Walker championed gold as the natural money of the superior races. As supervisor of the census, he also called eastern- and southern-European workers racially inferior and argued vehemently that American society had no place for them. For Walker, bad blood and bad money were of a piece: both displaced the superior products of superior races. Walker’s assumptions about both bad blood and bad money reduced the complex, constant renegotiations of value and identity in the marketplace to simplistic, comforting essentials, a “bottom line” of nonnegotiable truths supposedly written by nature. This reduction made the dazzling, unsettling economic and social world of the gilded age more comprehensible and less disturbing.

Rapid transformations in the techniques of credit and exchange had made it hard to be certain about money. Was it gold? silver? Was it a paper promise to pay or a legal compulsion? a socially convenient medium of exchange or a material with intrinsic properties governed by natural law? The United States in 1896 had “probably the most heterogeneous system of money of any of the civilized countries,” wrote the deputy assistant to the treasurer. Gold and silver coins circulated along with “greenback” United States notes, treasury notes of 1890, and gold and silver certificates, “and it is due solely to the unbounded faith of the people in the unlimited credit of the nation that all these kinds [of money] have for so many years circulated side by side.” But that faith was neither unlimited nor unbounded—each kind of money occupied a different position in the raging debate over hard or soft money that had dominated American politics since Reconstruction. The currency’s heterogeneity in 1896 mirrored the nation’s ethnic, racial, and economic diversity: the anxiety about both that characterized the 1890s makes the connection between money and the sense of self unmistakeable.

The federal government had resorted to legal tender “greenbacks” to pay for the Civil War—fiat money that derived its value from the fact that law compelled acceptance. Greenbacks quickly depreciated relative to gold; but a general prosperity followed the war, and many voters attributed that prosperity and even the Northern victory to the greenback economy’s easy credit and mild inflation. Indignant gold men denounced greenbacks as bad faith, and the prosperity as false: gold formed the only proper basis for a modern economy. Gold bugs fought incessantly with greenbackers from 1865 through the 1870s. Attempts to contract the currency, to “redeem” the greenbacks, alternated with measures designed to preserve and even expand their circulation. Complicating the issue, after 1873, those arguing for a bimetallic, silver and gold monetary standard adopted the greenbackers’ inflationary rhetoric—making silver also a “real money” commodity would increase the amount of money in circulation and raise prices. But silverites shared the gold bugs’ faith in intrinsic value and natural law—silver, they argued, also enjoyed a timeless and universal “intrinsic value.” A series of awkward compromises followed, until the election of 1896 and the Gold Standard Act the year after.

The intrinsic-value claims associated with silver and gold bear a close resemblance to the era’s essentialist notions of identity—that is, its theories of racial character. Both use often identical metaphors and both establish their claims on the authority of what they regarded as natural law. In the work of those political economists who argued most strenuously for specie money and who also opposed immigration, essentialist ideas about gold and silver and about identity come together, and it was this conjunction of “specie” and “species” that gave gold standard arguments their popular force.

Arguments for both gold and silver depended heavily on fantasies of intrinsic, natural value. “Who or what gave these metals . . . their peculiar qualities for serving as coined money?” asked A Currency Primer of 1896. “Men did not,” came the answer. “Law did not. Government could not. It was done by Nature.” “Nature has decreed of what materials our money should be, and has even indicated the proportions of money to be made of each metal”—that is, the ratio of gold to silver—”and nature is more potent than legislation.” Relatively unstudied by historians, the nineteenth-century specie fetish presents an extraordinary wealth, as it were, of preposterous claims about essential value. Arguments for gold and silver described those metals’ intrinsic physical properties using Darwinist language. Economist David A. Wells insisted, for example, that “in civilized nations, natural selection has determined the use of gold as a standard.” An 1897 textbook on the money problem argued for gold on the grounds that “the ultimate value of real money rests on the market value of itself.” In other words, its value is its value, which is itself, its intrinsic properties.

Such essentialist accounts of gold’s magical properties filled this void of meaning by relating gold’s use to evolutionary development. William Trenholm, director of the U.S. Rubber Company and comptroller of the currency under President Grover Cleveland, argued in The People’s Money that “there must be a natural law . . . which tends always to establish as a standard of value the material of highest intrinsic value available at the time” and that “it is obvious that, in fixing upon silver and gold to be the standards of value, modern nations have simply followed a natural law.” Trenholm used the language of the social Darwinist Herbert Spencer and Darwin himself to argue for gold. The fantasy of stability in gold and the fantasy of stability in race have the same root origin or cause: fear of market negotiability. Both fantasies seemed to give existing hierarchies the status of natural law.

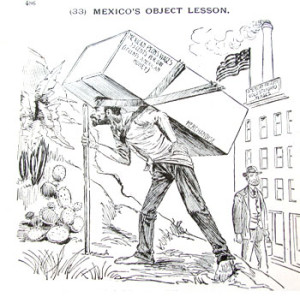

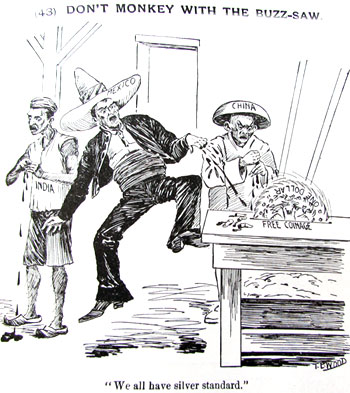

Primitive peoples thus used base materials. “Iron once served the Lacedæmonians as money,” Walker claimed, “but it would be an impossible money today for any but a nation of savages.” Over time, humble materials gave way to more valuable metals. “The history of money and the history of the civilization of the human race are intertwined,” argued A Currency Primer. “Gold is the standard of civilization and Christianity,” insisted another gold bug. “As Mexico adheres to the implements of which the farmers of the United States discarded fifty years ago, so does it adhere to a standard of value [silver] which this country . . . discarded in 1834.” “The brass ‘cash’ of China,” A Financial Catechism announced, “indicate[s] that the people are in an extreme state of degradation; the silver dollar of Mexico represents a higher condition of the people; the gold coin . . . of the United States . . . represents the highest condition.” Like monotheism, suggested Trenholm, “gold mono-mettalism is the unavoidable destiny of this country.”

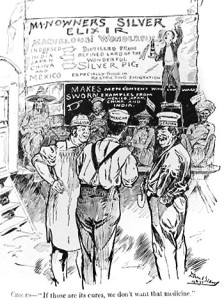

Late-nineteenth-century political economists unmistakably associated gold as money with civilization, advancement, and racial superiority—not coincidentally the ideological cornerstones of American empire. The gold standard became the mark of the imperializing civilization; the silver currencies of “pagan Asiatics,” that of the justly imperialized. “Turn your eyes to the countries having the silver standard alone—Mexico, South America, Asia—and those having the gold standard,” an American gold bug wrote, “and there is no room for argument. The latter countries are prosperous, intelligent, and progressive; the former embarrassed, poor, and ignorant.” A gold-bug tract of 1892 argued similarly that “fair tests of the state of civilization in any country” included “the kind of money it uses”: only the poorer nations of the world used silver. “Congress cannot cause us to be born again, and into the Hindu, Chinese, Japanese or even into the Mexican or South American silver-handling type,” it concluded. “Silver has served a useful purpose as a standard,” another tract argued, “but it has yielded to the survival of the fittest.” These authors connected gold to an interracial economic struggle, linking America’s racial “value” to gold’s intrinsic superiority.

Gold-standard arguments reflected a more generalized concern about and fascination with the insubstantiality of character, race, and value in labor. Mass production changed the meaning of individual labor and work itself. It made workers machine-like and interchangeable, depriving them of their traditional identity as artisans. But it also made identity more negotiable—immigrants might “assimilate” and become American; their “racial” difference was negotiable. Facing intense competition, lowered wages, and deskilling in the 1890s, many workers found refuge in nativism and racial typologies that posed essential, nonnegotiable differences between Anglo-Saxon, “Latin” [Italian], Semitic, Slavic, black, and Asian workers. In this view black Americans were simply not “union material,” and as Samuel Gompers later put it, “The Caucasians . . . are not going to let their standard of living be destroyed by negroes, Chinamen, Japs or any others.” In the 1890s, native white workers responded strongly to racially based economic arguments about the low character of imported workers. Alarmed by the census of 1890, which revealed a massive increase in immigration from eastern and southern Europe, Walker warned that new immigrants would beat down wages. “They have none of the inherited instincts and tendencies” compatible with self-government. “They are,” he claimed, “beaten men from beaten races, representing the worst failures in the struggle for existence.” Walker blamed their poor wages on their poor genetic stock, their willingness to settle. Poor nations try to escape poverty by issuing paper money, he argued in Money, Trade and Industry. And they do this “in defiance of the laws of its distribution,” which demonstrated that the poverty of their people stemmed from “vices of industrial character” or, simply put, bad racial character.

Economist William Z. Ripley similarly contrasted the “urban activity” of the acquisitive, mercantile “Teuton” to the “reactionary passivity” of the “Alpine” and especially of the “Alpine Celt.” As historian Lawrence Glickman and others have argued, native workers feared immigrants as poor consumers, people with few needs who needed only small wages. Undistracted by consumption, unambitious, they simply hoarded with what novelist Frank Norris in McTeague called the “instinct” of “peasant blood”—”saving for the sake of saving, hoarding without knowing why.”

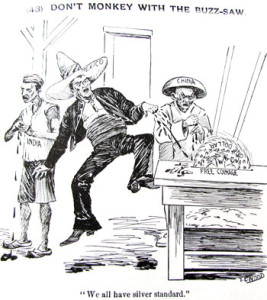

Arguments for gold aimed at the working class often linked gold to both a high standard of living and the intrinsic superiority of the Anglo-Saxon race. “Take a look at the company before you sit down at the feast,” an anti-silver tract warned workingmen. Who had silverites invited? “Half civilized, half clad peoples, who are weak and ignorant, who have little or no commerce; where bullfights abound and schools do not; where human labor is in sharp competition with the meek and lowly jackass; where the breech-clout is preferred to a full suit.” A “sound money” cartoon published and distributed free to newspapers in 1896 depicted three workingmen labeled “English,” “American,” and “German” standing in front of a barker’s wagon. The barker sells “Minowners silver elixir: Indorsed by India, Japan, China and Mexico [sic].” The barker’s sign describes the elixir as “especially good in restricting emigration.” Gaunt, poorly clad stereotypes of Mexican, Chinese, Japanese, and Indian workers sit beneath the sign looking lean, hungry, and sinister. “If those are its cures,” says the caption, “we don’t want that medicine.” The cartoon linked a high standard of living to the gold standard; it also linked both to the essential racial difference between northern-European whites and peoples of color.

Political economists imagined race relations as problems of exchange. Herbert Spenser saw poorer races perpetuating their inferiority by biologically exchanging and reproducing bad traits, bad genes driving out the good. Walker similarly looked at the 1890 census and saw immigrants overwhelming native stock as they strained resources and drove down wages. They “lacked the enterprising spirit” and so would swamp the economy. The time had come, Walker argued, when “the nation’s birthright shall no longer be recklessly squandered” through open door immigration. Without action, the Anglo-Saxon “birthright,” which included a high standard of living, would vanish, squandered like easy paper money, as lazy immigrants accepted less and drove good character out of the market.

The influence of these arguments was evident by 1903, when workers on the Panama Canal had been segregated by task and by pay into two groups: white workers, known as “gold” workers, who took their pay in gold, and black workers, or “silver workers,” who were paid with silver coins. Economics and racism worked together to produce the basic categories for organizing labor. “What prevents Congress from legislating the value of a dollar?” asked the gold-bug “financial catechism” of 1895. Is it the Constitution? “Not the Constitution of the United States,” came the answer, “but the constitution of man.”

Money, we could say, is a shorthand sign for what difference means. We symbolize the difference between skilled and unskilled workers by paying skilled workers more; we use a shorthand symbol, the price, to say what the difference between “standard” and “deluxe” means. But if money seems unstable, so might the system of making sense of difference. Walker, quoted at the start of this essay, saw paper money as the source of unstable character. Gold drew his interest because it offered, in a time of increasing economic dynamism and ethnic diversity, to stabilize the meaning of difference; it offered a “gold standard” through which immigrants and the racially different might be put in their place. His nativist anxiety masqueraded (as similar sentiments of free marketeers do today) as fantasies of natural market law.

Further Reading:

Pamphlets, tracts, articles, and books on the money question rained down like autumn leaves in the 1890s. Francis A. Walker’s sentiments appear in Money in its Relations to Trade and Industry (New York, 1889) and Money and Banking (Boston, 1902 [reprint of 1895 ed.]). The single best evidence on the gold-bug position may be the periodical Sound Currency, published in the mid-1890s and quoted extensively here. On its extraordinary reach and effectiveness see James Livingston, Origins of the Federal Reserve System: Money, Class and Corporate Capitalism (Ithaca, N.Y., 1986). Among recent books that deal with immigration and economics, Mathew Frye Jacobson, Barbarian Virtues (New York, 2001) and Katrina Irving, Immigrant Mothers (Bloomington, Ill., 2000) are most pertinent. The author established some of these arguments in O’Malley, “Specie and Species: Race and the Money Question in the Nineteenth Century,” in American Historical Review 99 (Spring 1994): 369-395; Gretchen Ritter’s Goldbugs and Greenbacks: The Antimonopoly Tradition and the Politics of Finance, 1865-1896 (Cambridge, Mass., 1999) looks at race and money arguments in similar ways. For theoretical background on money as a symbol, see John Joseph Goux, Symbolic Economies (Ithaca, N.Y., 1990), David Graeber, Toward an Anthropological Theory of Value (London, 2001), Marc Shell, Money, Language and Thought (Baltimore, Md., 1991) and Art and Money (Chicago, 1995), and Viviana Zelizer, The Social Meaning of Money (Princeton, 1997).

This article originally appeared in issue 6.3 (April, 2006).

Michael O’Malley is associate professor of history and art history at George Mason University. He is studying the money question in American history, as well as studying the history of recorded sound.