When Johnny Comes Marching Home…from the Bank

War and finances in America, from the U.S.-Mexican War to the present

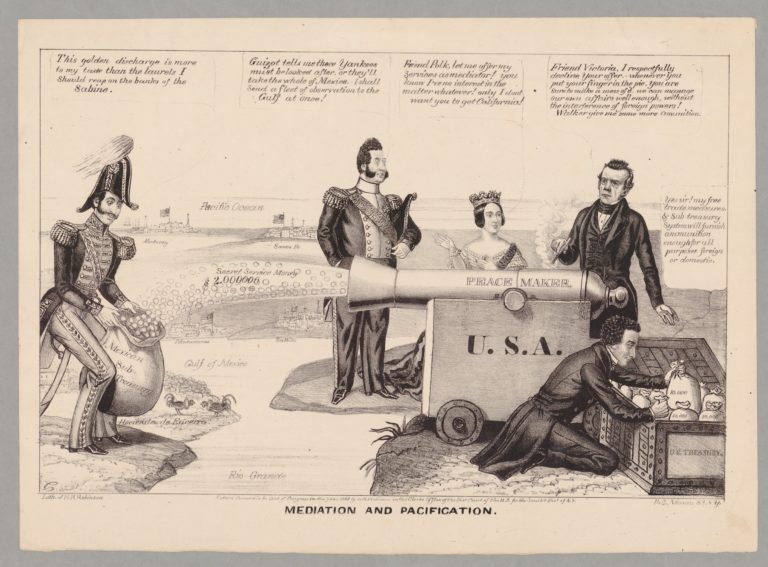

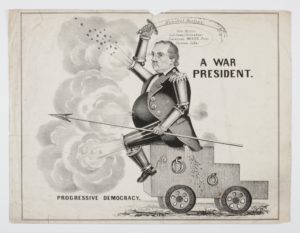

The American republic seeks “peace with…all the world. To enlarge its limits is to extend the dominions of peace over additional territories and increasing millions. The world has nothing to fear from military ambition in our Government.” Spoken not by a member of the present administration but by James K. Polk in his inaugural address, these words nonetheless bear an eerie resemblance to the rhetoric of recent years. Today the United States presents itself as a nation at peace with all the world, yet like no other nation it pursues war across the globe. When Polk made his remarks in 1846, however, he was speaking about the annexation of Texas, not about American intervention in another country. Yet within mere months he would order the invasion of the nation’s southern neighbor. From the Mexican perspective the U.S.-Mexican War of 1846-1848 has always seemed an unjust war of conquest. On the American side judgements have been more mixed. But regardless of the moral dimension of the invasion, the Mexican War is of interest for what it says about the long-term rise of the American republic from colonial dependence to world domination.

When Polk was elected president, what is now the mainland United States was divided between five sovereign states. Three were republics: the United States, Mexico, and Texas. Two were monarchies: Great Britain and Russia. In addition to Europeans and their descendants, many stateless Indian nations also resided on this territory. Within three short years, the American republic had acquired title to almost all of its present day North American possessions, a process completed by the Gadsden Purchase in 1853 and the acquisition of Alaska in 1867. In a process where sovereign states disappeared (Texas), contracted (Mexico), or gave up their colonial possessions (Russia), and stateless peoples were dispossessed and killed off (Native Americans), the United States picked up the spoils.

There is a romantic notion that this American expansion was achieved by settlers unaided by government—the rugged frontiersmen of the mythic West. In reality, however, the United States expanded through state action: annexation in the case of Texas; diplomatic settlement with Britain in the case of Oregon; war with Mexico in the case of California and the Southwest; purchase from Russia in the case of Alaska. Against the Indian nations, the full range of state tools was employed: war, diplomacy, and land purchases, which together amounted to a policy of ethnic cleansing. In the competition with states and stateless peoples in North America, the United States won because it could bring to bear a stronger and more efficient state. Although this American state acted in many different ways, underlying them all was the ability to raise money to finance government action. From Ancient Greece to our own times, money has been the supreme sinew of power.

The significance of sound public finances to a nation’s history is vividly demonstrated in the different destinies of Mexico and the United States in the nineteenth century. At first sight the outcome of the competition between the two nations over the Southwest and California may seem a foregone conclusion. After all, the American republic was both richer and more populous than its southern neighbor. But population and wealth matter little to a state’s strength if the government cannot mobilize and translate such social resources into military power. This is not as easy as it may sound and failures are common in the records of history. Natural circumstances did not make Mexico a poor nation. Before independence, New Spain had not only been a prosperous colony but had also generated a substantial tax revenue. On average, annual tax collections amounted to some fourteen million dollars in the late 1780s. This can be compared to the four to six million dollars that the federal government north of the border raised annually in the mid 1790s. Even after independence, Mexico’s tax collections were far from insignificant. As late as the period 1840 to 1844, Mexico’s tax revenue was only marginally smaller than that of the American central government.

The problem was that despite substantial tax collections, the Mexican government ran large and growing deficits for every year between 1826 and 1844. Tax reforms were tried, but the government lacked the political muscle to implement them over the long term. When deficits could not be met by raising taxes, the government turned to the loan market, first in London and then domestically. Within merely three years, payment on the London loans was suspended and this effectively cut off Mexico’s access to foreign credit and forced the government to turn to domestic lenders. Gradually the Mexican treasury fell into the hands of groups of creditors who provided the government with short-term loans at often usurious interest. To secure these loans the government often had to transfer control over government assets such as customs collections, mines, the mint, and government monopolies, a practice that further depleted the treasury. The government tried to make ends meet by cutting or withholding the salaries of government employees and reducing payments to the army. Such policies were highly unpopular among affected groups. Above all they bred discontent in the army and made officers and soldiers willing instruments of coups. Thus, weak government generated weak finances, which in turn further weakened the government. When the American invaders poured over the Rio Bravo del Norte, the Mexican government was thus in no condition to repel them.

The United States in contrast stood strong in 1846, possessing the fiscal and financial institutions as well as the experience necessary to raise money to meet extraordinary expenses such as war. To the Americans, funding the war with Mexico proved to be easy. As in the present-day conflict in Iraq, the administration avoided raising taxes to pay for the war. While Polk and his treasury secretary Robert J. Walker may not have agreed with Republican Tom DeLay that “nothing is more important in the face of war than cutting taxes,” they did engage in ambitious reforms to reduce the fiscal burden in the face of war. Rather than risk alienating the citizenry by levying taxes to pay for a controversial war, the administration borrowed more than eighty million dollars, about three times the annual tax revenue. These loans were secured mostly on American financial markets, which by the 1840s had become very advanced, and to a lesser extent in London and on the European continent. For the first time, the government made use of the services of investment banking firms to further facilitate borrowing. Meanwhile, on the other side of the border the Mexican government continued to mismanage its finances. Mexico began the war by suspending payments on the nation’s public debt. Although this action reduced expenses it also made sure that no voluntary loans would be forthcoming. Instead, the war effort, such as it was, was financed with forced loans and army requisitions. At every step, the Mexican government relied on coercion rather than voluntary action when raising money.

The war with the United States was only one instance in a series of crises when Mexico’s sovereignty was undermined as the result of the government’s weakness. Often enough these crises could be directly attributed to the troubled nature of Mexico’s public finances. At other times, lack of money triggered or exacerbated political crises. Spanish troops sent to reconquer Mexico were repulsed in 1829. In 1838, French forces occupied Veracruz to secure compensation for damages to French-owned property. Five years after the U.S.-Mexican War ended, the United States bought territory that now is part of southern Arizona. In 1857, a civil war began and bonds emitted by the losing side found their way into the hands of French creditors. When the new post-war Mexican government refused to honor this debt, Britain, France, and Spain decided to intervene militarily. In 1861 their troops landed in Veracruz. Britain and Spain soon disassociated themselves from this venture when they realized that Napoleon III had more ambitious plans for Mexico than debt collection. Hardly more than a decade after the American army had left, Mexico was again conquered by a foreign power.

Whereas the period between independence in 1821 and the establishment of the Porfiriato in 1877 was one of political turmoil and territorial disintegration for Mexico, the antebellum era was an age of expansion for the United States. Mexico’s distress highlights the significance of the successful fiscal and financial reforms undertaken by the federal government in the United States after the adoption of the Constitution. After troubled beginnings, the fledgling American republic very rapidly copied British methods of public finance, just as Britain had copied “Dutch finance” after the Glorious Revolution. The mastermind behind the reform of American finances was the nation’s first secretary of the treasury, Alexander Hamilton. Under Hamilton’s direction, Congress federalized much of the debt the states had run up during the War of Independence, merged it with the federal debt, and converted the entire public debt into long-term interest-bearing bonds. Congress also reformed the tax system so that the federal government could draw a stable income from customs duties, thereby allowing it to service the public debt to perfection. By making good on its debts, the value of government debt—represented by the price of government bonds—rose and public credit was restored. Hamilton was of course one of the more controversial figures of the early republic and historians have sometimes reduced his financial program to a blatant attempt to enrich the members of his own (adopted) class. But such an interpretation misses Hamilton’s crucial achievement. When he retired from the Treasury in 1795, the United States had both a productive and stable tax system and the ability to borrow large sums of money on the open credit market.

The creation of a stable and productive fiscal regime and the transformation of post-war financial chaos into an ordered public debt may never become the stuff of heroic narrative, but these achievements were nonetheless of immense significance for the nation’s future. Between the adoption of the Constitution and the outbreak of the Civil War, the federal government financed a number of institutions and ventures that helped the nation grow in wealth, size, and power. It maintained a small army in the West that acted as a border constabulary, pacifying Indian nations and policing the frontiers. Special envoys treated with the Indians to secure title to their land in return for compensation in money or kind. Land offices surveyed and sold public lands throughout the West. By means of its diplomatic corps and its navy, the federal government extended its reach far beyond the nation’s borders. The consular departments, with representatives in every major port worldwide, looked out for the interests of American merchantmen and sailors. Although the navy was small it was used successfully against weak opponents, such as the Barbary powers, or stateless actors, such as pirates. The major duty of the navy was to promote American commerce by protecting merchant vessels, whalers, overseas citizens, and their property; by opening markets through diplomatic and commercial agreements; and sometimes by the threat and use of force. Already by 1840 the United States maintained permanent squadrons in the Mediterranean, the Pacific, the West Indies, the South Atlantic, and East Asia. The navy also promoted commerce by collecting important information on seas and river basins, on tides, currents, and winds, and on whaling areas and potential new markets for American manufactured goods.

But the most spectacular uses of the government’s financial capacity were the funding of war and territorial purchase. The Mexican War was far from the only time this power was put to use. Given their aversion to taxes, debts, and big government in general, it is ironic that it was the Jeffersonians who made the most use of Hamilton’s fiscal reforms. Hamilton’s ingenious restoration of public credit made it possible for Jefferson to purchase Louisiana from France in 1804. It also allowed Madison to embark on a “second war of independence” against Britain in 1812. Loans paid for land the government acquired from Spain in 1819 and for the territory and claims of Texas after its annexation by the United States. Loans and taxes paid not only for the invasion of Mexico in 1846 but also for the compensation for territory surrendered by Mexico in 1848 and again in 1853. Despite the enormous debt run up during the Civil War, the federal government found the means to buy Alaska in 1867. And there could have been more. Much as he fretted over the debt created by the war against Mexico, President James K. Polk had his eyes on Yucatan and never hesitated when he saw the chance to buy Cuba from Spain for the princely sum of one hundred million dollars.

The ability to promote the national interest and to maintain the territorial integrity of a nation depends on the government’s capacity for action. That Mexico lost half its territory in the decades after independence must be ascribed chiefly to the difficulties it experienced in trying to establish efficient and legitimate governmental institutions, not least a stable and productive fiscal system and sound practices of debt management. That the United States doubled its territory at Mexico’s expense was a result of the nation’s success in creating a strong government based on strong public finances. The consequences for the Mexican republic of its failure to create an efficient central state apparatus were profound. In all but name the new nation was reduced to colonial status. Unable to maintain its sovereignty and territorial integrity the Mexican nation lacked the means to govern its own fate—the very meaning of republicanism. In contrast, the significance to the United States of its success in creating a strong and stable government was that it avoided the fate of Mexico, becoming instead a truly independent republic. For better or worse, a strong government also made it possible for the American republic to join Europe’s empires in dominating the less fortunate nations of the world.

Further Reading:

Readers who wish to explore the relationship between public finance and political power can start in no better place than John Brewer’s The Sinews of Power: War, Money and the English State, 1688-1783 (London, 1989). An extensive treatment of the funding of the Mexican War is found in James W. Cummings’s excellent University of Oklahoma dissertation from 2003, to be published this fall as Towards Modern Public Finance: The American War with Mexico, 1846-1848 (London, forthcoming). The troubled finances of Mexico are the topic of Barbara A. Tenenbaum, The Politics of Penury: Debts and Taxes in Mexico, 1821-1856 (Albuquerque, N.Mex., 1986). Hamilton’s reforms of American public finances are analyzed in Max M. Edling and Mark D. Kaplanoff, “Alexander Hamilton’s Fiscal Reform: Transforming the Structure of Taxation in the Early Republic,” The William and Mary Quarterly, 3d ser., 61:4 (October 2004): 713-44, and in Max M. Edling, “‘So immense a power in the affairs of war’: Alexander Hamilton and the Restoration of Public Credit,” The William and Mary Quarterly, 3d ser., 64:2 (April, 2007): 287-326.

This article originally appeared in issue 9.1 (October, 2008).

Max M. Edling holds a research fellowship from the Swedish Research Council and is a member of the history department at Uppsala University. He is the author of A Revolution in Favor of Government: Origins of the U.S. Constitution and the Making of the American State (2003).