Capitalist knowledge in nineteenth-century America

Of all the numerous claims made on behalf of bookkeeping in the nineteenth century its importance as an ideology was never noticed. In fact, it was adamantly ignored. The exploding number of those charged with posting accounts, and with teaching others how to do so, all preferred to emphasize bookkeeping’s rigorous, scientific character, together with its consequent ability to uncover the truth buried within a mass of disinterested figures. Frederick Beck made a representative claim in his Young Accountant’s Guide, first published in 1831: “Mercantile Book-keeping is the art of recording and stating accounts in such manner, that the true state of each and all the accounts, and the merchant’s situation, may at any time be easily, speedily, and distinctly comprehended and known.” In other words, accounts, which would obstinately refuse to add up if anyone tried to make them tell anything but the whole story, were perceived as an island of disinterested neutrality in the era’s tidal wave of profit seeking. They were, so to speak, an ontological check on what everyone agreed to be the national free-for-all in pursuit of riches.

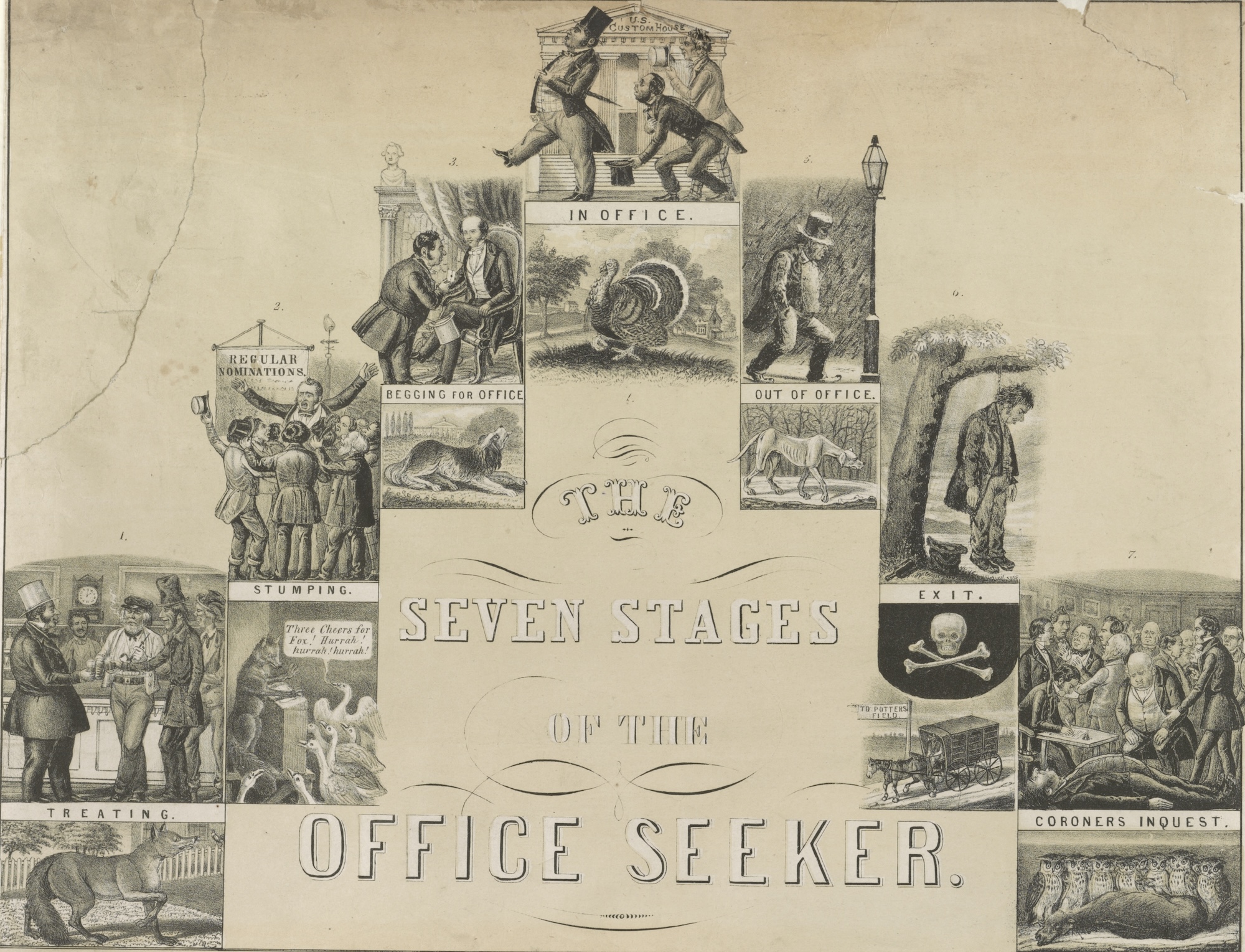

In fact, locating incontestable truth within the very heart of business avarice had considerable ideological value in the age of capital. Christopher Columbus Marsh, an author of accounting manuals and bookkeeping promotional literature, explained in 1835 that the science of bookkeeping was distinct from the art of trading. “You may be an excellent business man, and no book-keeper at all; or, an accomplished book-keeper and possess few requisites indispensable in the character of a merchant.” The latter, as everyone knew, was bound “by a thousand threads” to “every change in the market.” It was little wonder, then, that the merchant was invariably so anxious, animated, depressed, and disappointed, for those threads “may be severed in an hour by a wave on the ocean of political opinions, policy, or local interests.” Bookkeeping, on the other hand, was immune to such shocks for it was dependent on nothing but itself. It recognized no other policies or interests, and certainly no political opinions. As a result, the bookkeeper “eats and sleeps as usual,” in contrast to the merchant. In fact, the widespread public interest in bookkeeping during the early decades of industrial revolution meant that everyone slept a little better.

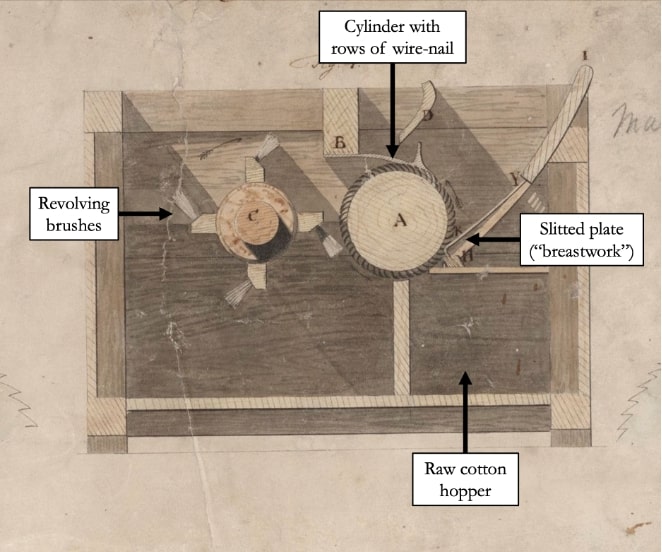

Why was this so? Because keeping accounts became as important to the social life of a market society as it was to proper business administration. Nineteenth-century capitalists were frantic system builders, not because of any innate personality trait or some vague ethical imperative handed down by the Protestant Reformation, but because they had destroyed the existing foundations of social order in their rise to power. Such “creative destruction” gave birth to a post-agrarian conundrum, which defined the liberal age: how could stability be founded on the ever-shifting value of exchange—that is, on the fluid relations governing merchandise, consignments, stocks, shipments, moveables, bills receivable, bills payable, drafts, remittances, commissions, insurance, and interest payments? These were all bookkeepers’ categories, of course, and they became the basis of a balanced picture of the whole economy, “easily, speedily, and distinctly comprehended and known,” as Frederick Beck claimed. Bookkeeping, in other words, proved that the constantly varying signs of value—whether Mr. Holmes’s broadcloth, Mr. Brown’s hardware, Mr. Lloyd’s miscellaneous merchandise, or Mr. Jones’s bill payable at thirty days’ sight—could serve as the foundation of equilibrium and that the perpetual movement of commodities was actually the key to stability. In a dialectic suited to such revolutionary times, the problem thus became its own solution. Once the source of instability, monetized trade and the individual ambition that drove it now emerged as the foundation of certainty, if not, in fact, of truth: that is, of the “bottom line.”

This is why a technology invented in the fourteenth century achieved unprecedented popularity in the nineteenth. By the 1830s bookkeeping was a subject of common-school curricula, of scores of competing instructional methods, of public lectures on the fast-growing Lyceum circuit, of morning and evening classes in Mercantile Libraries and in the country’s numerous new “commercial academies,” and even of parlor entertainments that filled leisure hours. For instance, Henry Patterson, a young business clerk recently arrived to New York City from Suckasunny, New Jersey, attended a double-entry study group every Tuesday evening, which counted among its regular participants “Mr. and Mrs. Crane, Ann Maria, Turner, and Edgar.”

“No gentleman’s education is complete without it,” Frederick Beck exclaimed, and the hyperbole was not without basis. Benjamin Franklin Foster likewise declared in his Origin and Practice of Book-keeping (1852) that the science teaches “those things which the [young] will need to practice when they come to be men.” Foster, who was referred to as a “counting-house oracle” by the Educational Times, was the author, in addition to the Origin and Practice of Book-keeping, of The Counting-House Assistant, A Concise Treatise on Book-keeping, The Clerk’s Guide, Hints to Young Tradesmen, Foster’s School Book-Keeping, Commercial Book-keeping, The Merchant’s Manual, Double Entry Elucidated,and The Origin and Practice of Book-keeping, among other related works. Foster also offered courses in bookkeeping at his Commercial Institute on Broadway in New York City, as did C. C. Marsh, and Brown and Pond, and a Mr. Renville, and Mr. Dolbear, and Mr. Paines. All were pedagogical entrepreneurs seeking to build an enterprise out of the close relationship between the expanding market and the democratic spread of business ambition. Thus, C. C. Marsh could claim with a perfectly straight face that “book-keeping is so extensively required, that it becomes difficult to say who may not stand in need of the knowledge embraced under its name.”

![]()

The knowledge itself—namely, the system used to organize accounts—was singular. That is, none of the competing manuals or courses of study offered a different technology but only a purportedly better method for learning “the theory and practice of the art.” At the same time, these sundry teaching methods all shared a common pedagogical principle, asserting that the student needed to grasp the business logic of accounts rather than simply learn by rote the rules for listing debits on one side of the ledger and credits on the other.

Thomas Jones explained in his Analysis of Bookkeeping as a Branch of General Education in 1842 that “when [the pupil] understands the theory [my emphasis] of debit and credit, . . . [then] he makes his journal entries without any necessity of help from his teacher, he knows what must be done in order to get at his result, and he perfectly understands how each step bears upon it.” Likewise, James Bennett in his American System of Practical Bookkeeping wrote that “in order to make a correct Journal entry, it is first necessary perfectly to comprehend the business transaction on which it is founded.” And so, Samuel Crittenden’s Elementary Treatise on Bookkeeping promoted the day-book, which contained the initial record of each transaction, to the center of its course of study, challenging the student to then “depend upon his own mental resources” in deciding whether to list the transaction in the cash book, the bill book, the journal, the invoice book, the sales book, the accounts current, the book of commissions, the expense book, copy book, letter book, ships’ accounts, receipt book, bank book, check book, or memoranda book.

The aim was for “the learner [to] exercise his judgment” and so become “a responsible and free agent.” Such responsible use of freedom was not just a desideratum of business, of course, but an essential trait of political life in the republic, which turned bookkeeping into something of a civics lesson. Further, with principles as demonstrable and universal “as those of Euclid,” the bookkeeper became part of an accounting profession with a standard skills set bound to no particular industry or individual. C. C. Marsh explained, “A person may keep correctly the accounts of the house in which he was brought up, but as the business may be quite different in any other house, change his situation, and he who was capable will be incapable . . . Not so with the individual who is master of the science, he is at home in the accounts of any business.” And so, for instance, graduates of Comer’s Commercial Academy in Boston were qualified for any employment “from Maine to California.” Like all important industrial technologies, bookkeeping knowledge became interchangeable, which meant that a fluid labor market in bookkeepers could develop, essential for an economy undergoing revolutionary growth that now required legions of clerks to administer all the new exchanges.

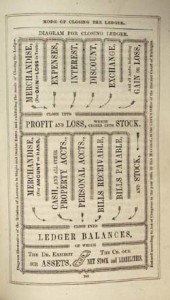

In the double-entry system of accounts that everyone was learning, each transaction is recorded twice in the books—each transaction, that is, actually consists of two exchanges. If something is debited, something else needs to be credited. If I sell J. J. Astor ten thousand pipe cleaners for one hundred dollars, then I record a credit in my books for the outgoing cleaners and a debit for the incoming cash. This symmetry is what promised an “equilibrium of results” and is what made the books a neutral ground, always balancing a record of what goes out with one of what comes in. If we were, theoretically, to line up all the accounts being kept by double entry, we would have a complete picture of the economy—of the great chain of exchange—since someone’s debits would always appear as someone else’s credits, and vice versa. In fact, if the market—which no longer manifested itself in any specific time or place—had a tangible existence in industrial society, it was here in the bookkeeper’s ledger. This was where all parties met. And this was where flesh and blood commodities became abstract equivalents, making the movement of capital synonymous with the economy (while disqualifying other activities as no longer economic at all, such as the efforts of the village cobbler who “doesn’t even keep accounts”).

![]()

Thomas Jones, whose system for teaching double entry had recently garnered the endorsement of New York’s American Institute, explained in an early number of Hunt’s Merchant’s Magazine that bookkeeping is a “problem of arrangement.” In other words, comprehension of the business transaction that was now required of everyone was a taxonomic exercise of knowing where to list each transaction within the matrix of accounts. “Each class of items has therefore its proper place assigned, and to know these places, and the object of each collection, is to know the plan.”

How, exactly, were these “proper places” assigned? And how was the “plan” itself created? An instructive example is to be found in a controversy that erupted in the merchant banking firm of Brown Brothers in the 1850s. The controversy concerned the proper manner for recording bad debts in the company’s books. Debts had been listed as a company asset because they were money owed to the firm. As such, they had benefited the senior partners, whose income was derived from those assets. But because some debts were bad debts and thus would probably never actually be collected, the partners were effectively receiving payments “which [have] not been fully earned.” This meant that they were pocketing money that would never exist, a practice that discriminated against those not included in the firm’s profit sharing and that injured the firm’s solvency in general.

The practice provoked protest within Brown Brothers, which led to the creation of a “suspense account” for listing such questionable debts. The suspense account was to be written off against the senior partners’ personal capital accounts, thus reducing their income in accordance with the amount of bad debt. However, the amount written off was less than the entire sum of bad debt. Part of the debt was left on the books as a full asset, thus showing up in the firm’s balance sheet as profit and consequently lining the partners’ pockets.

This compromise between rival personal interests at Brown Brothers became the company’s effective financial reality. Of course, it had nothing to do with “material reality,” neither with the legal status of the debt as outstanding nor with the practical recognition of the debt as worthless. But “material reality” was a non sequitur anyway since no firm could sell all its paper, debts, and assets on a given date each year in order to determine their true market value. What, then, constituted true value? On what did the balancing act between creditors, debtors, goods, receipts, and cash rest? Actually, it rested on none other than the firm’s own definition of balance. For regardless of how interested or even arbitrary these specific categories may be, they satisfied scientific accounting criteria as long as they strictly and systematically adhered to internal laws and logic. The invention of a new entity called a “suspense account” for certain debts thus proved to be a most practical solution even though it exposed the “science of accounts” as an entirely artificial phenomenon. Of course, there was no actual contradiction here since such artificialities were highly suited to an increasingly plastic, fungible world. The solution was practical, furthermore, because the categories that effectively guided the business’s activities were invented by the business in the first place. Brown Brothers functioned on the basis of its balance sheet, which rested on categories the firm had made up. These, in turn, gave it considerable power to act in the economy. Such tautologies, it turned out, were double-entry bookkeeping’s strength—proof that accounting’s perfect Euclidian logic required no referent outside of itself to be true.

The accounting paradigm thus proved to be not only descriptive but prescriptive. That is, the “proper place” for recording transactions was not just that which best reflected market activity but that which best managed market activity and, in managing it, largely created and even defined it. Bookkeeping showed that that system was stronger than reality, or that that system—in this case, a system translating qualitative differences into common financial values—was reality. Accounting not only revealed how the essence of goods lay in their exchangeability but demonstrated just how naturally commodifiable everything was.

Anthropologists and sociologists have correctly argued that this view of value as a single, impersonal, rational instrument of civilization is a naked ideologization, if not a fetish, and that money actually assumes a great variety of forms and uses, even in capitalist societies. But the more important historical task is to understand how money did, after all, become colorless (in Simmel’s famous aphorism) and acquire a universal status—how it came to function as an absolute standard, applicable to all equivalences, and, as such, was seemingly free of any political commitments. This contributed to the creation of an environment of calculative norms by which an economic science was detached from the caprice of avarice and seemingly grounded in objective material logic itself. It naturally followed that capitalists would claim common sense as their own.

![]()

And so, ideology might be too modest a description for the political work carried out by accounting. Epistemology might be more to the point. Businesses might fail, resulting in bankruptcies that traumatize personal lives and disorder society, but at the level of paradigm, double entry can explain them—and often predict them—making such apparent failings of the market an entirely normal economic event. (Indeed, bankruptcies were presented as the result of a failure to maintain proper accounts.)

Bookkeeping thus proved capable of naturalizing and then taming the market, an essential contribution to the rise of industrial capitalism. What’s more, by organizing the mass of individual acquisitions (and personal acquisitiveness) into a single matrix encompassing all of the economy’s agents, by turning the short-term, self-interested activities of our atomized lives into the stuff of a broad, secular social and scientific order, bookkeeping helped to synthesize the potentially destabilizing dualities at the heart of the liberal paradigm: freedom and order, fluidity and stasis, individuality and universality. It is little wonder, then, that of all the competing forms of knowledge jockeying for position in an age yet to be crowned the age of capital, bookkeeping proved to be one of the most powerful of all.

Further Reading:

There is a vast critical literature on accounting with a strong base in post-structuralism, the sociology of knowledge, and business history. Unfortunately, this scholarship has made little impression on social, labor, and cultural histories of industrial revolution in the United States, no doubt because of the general tendency to downplay capitalism’s domination of American life in the nineteenth century. For those otherwise inclined, the best place to start is in the tables of contents of the following journals: Critical Perspectives on Accounting; Accounting, Organizations, and Society; Accounting, Business & Financial History; The Accountant; Accounting Review; and Abacus.

This article originally appeared in issue 6.3 (April, 2006).

Michael Zakim is the author of Ready-Made Democracy: A History of Men’s Dress in the American Republic, 1760-1860 (Chicago, 2003). The present essay takes up where Ready-Made Democracy left off in exploring the cultural and political meanings of capitalist revolution in America. Zakim teaches history at Tel Aviv University.