On May 23, 1811, James S. Ewing of Philadelphia wrote to lawyer and New Jersey official Jonathan Rhea of Trenton, asking the latter to sell his property there. The Philadelphian, a former medical student, druggist and grocer turned distiller, had defaulted on one of his debts and was bankrupt. He was nevertheless intent on repaying as much of his debt as he could. “I shall give up everything,” he explained despondently, “and am without any plan or means of subsisting my little family. I have rendered my misfortunes doubly distressing, by having brought very heavy losses on my friends, through too sanguine expectations of ability to repay, until I have no reasonable claim to anything further from them.” And while these same friends, which included his brother Samuel, had insisted that Ewing keep his furniture rather than release it to the creditors, he maintained that this “should in no way be an obstacle to the general arrangement, if any one objects on account of it.” He would willingly release his table, chairs, and beds, though of little value, if Rhea thought it was proper.

Bankruptcy was a common occurrence in 1811. Jefferson’s government could do little to protect U.S. trade from the effects of the clash between the two superpowers of the era, France and England. But Ewing’s letter reveals more than just a temporary economic downturn, showing that his actual problem stemmed from the fact that he could not make any more “claims” on his friends. A few months earlier, in December 1810, the prominent Boston trader Henry Lee had reported to a correspondent that “the greatest want of money prevails among those who are among our richest men, who have such good credit that they have calculated upon getting what money they wanted, as indeed they may in common times, but credit avails nothing now, nothing will produce money.” For both Ewing and Lee, then, access to money was a function of a larger set of mutual obligations, of “good credit” and “claims.” Hard times ensued when these sources dried up.

To understand why and how this happened, we need to explore the complex interplay between cash and credit common at the time, one that extended far beyond the calculation of balances in black or red ink. Dealings in both cash and credit entailed a whole set of social, cultural, and even political relationships, similar to the shifting interpersonal dynamics described by Marcel Mauss in his famous 1924 essay, “The Gift.” When managing the vacillating dynamics of business in the eighteenth and early nineteenth centuries, traders—whatever their social status or gender (for there were numerous women in business as well, not all positioned at the bottom of the pecking order, either)—had to constantly take calculated risks for which account books offered very imperfect guidance, at best.

Both Ewing and Lee knew very well that credit was the highest priority, dwarfing cash in value and comprising numerous non-monetary assets that were central to all trading activities, including the constant need for quality control, access to markets, and accumulation of privileged information. An entire set of relationships was thus built up between traders in which cash transactions played a relatively marginal role. At the same time however, hard cash was essential to the workings of the system, and its shortage could send everything crashing down at a moment’s notice. No amount of foresight and precaution could ever insulate traders from such catastrophic failure, for it was built into the very heart of their trading operations. As such, credit in all its forms—personal as well as financial—was at once the main tool and the main threat in the cash-poor commercial life of the eighteenth and early nineteenth centuries. No profits could be made without it, and yet its use could turn the biggest profits into no less significantly crippling losses .

To understand why credit was more important than cash in the activities of any eighteenth-century trader, we have to recapture what it was to buy and sell goods at the time. First, imagine never being sure of exactly what one was buying. Some products, mostly luxury items, were controlled by state inspectors who enforced a standard of quality often linked to some legal privilege, as in the case of the famed Manufactures royales set up under Louis XIV in France. But most goods did not benefit from any kind of state supervision or certification of their production process, and even when they did, such inspections were powerless to stem the tide of counterfeit and smuggled goods. A piece of cloth with all the markings and seals of the Manufacture royale of the town of Mazamet, in southwestern France, could just as well be a cheap imitation made by counterfeiters in nearby villages and then combined with higher-quality products by unscrupulous wholesalers. The quality of imported goods, furthermore, was supposed to be assessed by customs officers, but they were wholly unequal to the task. In England itself, an estimated three-quarters of the tea drunk by the third quarter of the eighteenth century came via French, Swedish and Dutch smugglers; and the strict enforcement of tariff duties was such an unusual occurrence that when the British government tried to achieve it in its North American colonies, the resulting outrage led to the Boston Tea Party and eventually to a revolutionary insurrection.

Even when the products were not imitations, the absence of both state-enforced norms as well as consistent, uniform standards of production meant that any given good could differ slightly in size, shape, quality and raw material even within a well-defined general category. Customs officers, when assessing the value of the goods before taxing them, sought to establish scales of quality that would adequately capture the bewildering array and diversity they faced. The result was almost comically complex: by 1772, New York custom officials were using 45 separate categories, each containing a separate measure of quality, merely to tax English-made woolen cloth arriving in the colonies. Less cumbersomely, merchants fell back on general terms that were often based on the original region of production (“cambrics” or “osnabrucks” for instance), and made practical judgements concerning each good they bought or sold. But this was hardly any easier. Did a certain barrel contain superfine flour, as claimed by its New York importer? Or was it a mix of inferior grades? Were these silk scarves really from Lyons, or from a subcontractor in nearby Saint-Etienne who used pilfered silk, pirated patterns and inferior laborers? Any trader could know a few products well enough after a lifetime of practice to effectively judge their quality, but no one could hope to master the whole range of goods being sold in most stores at the time.

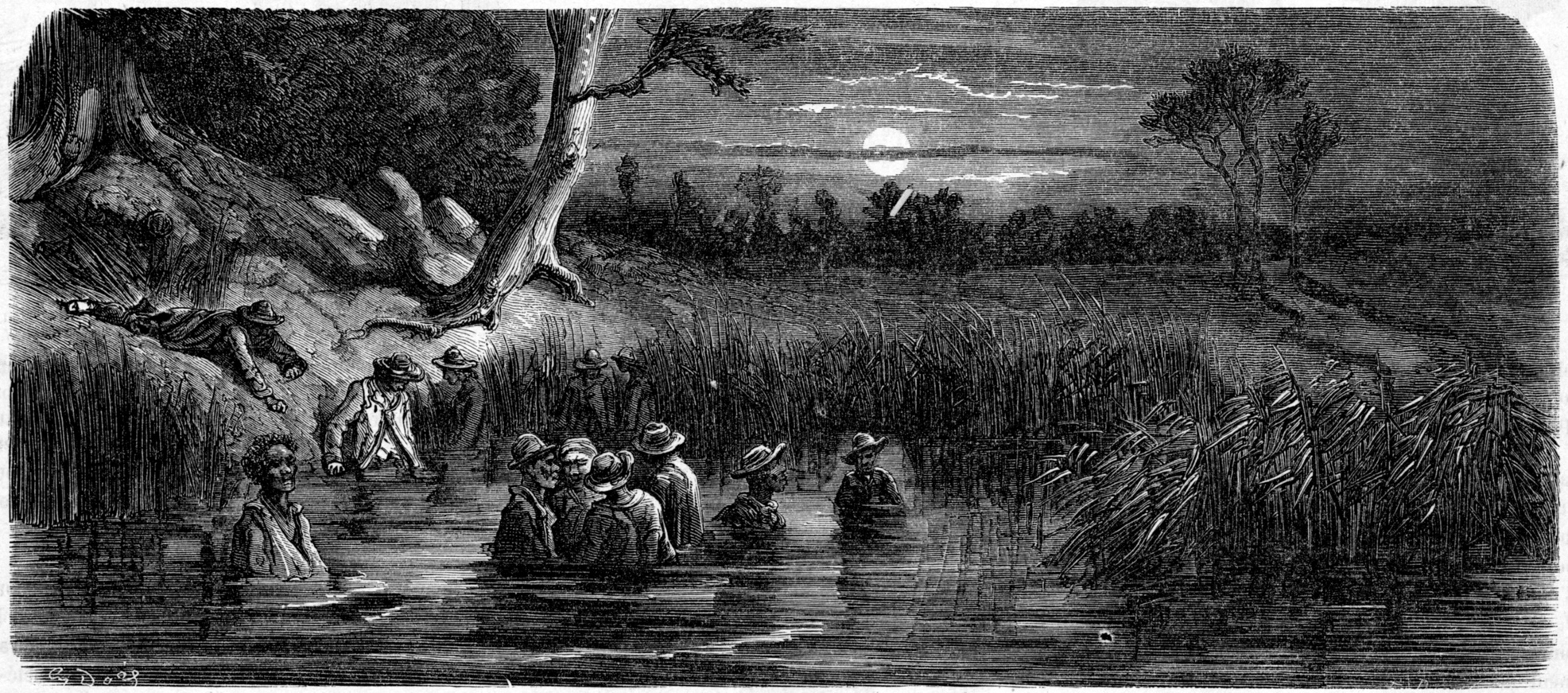

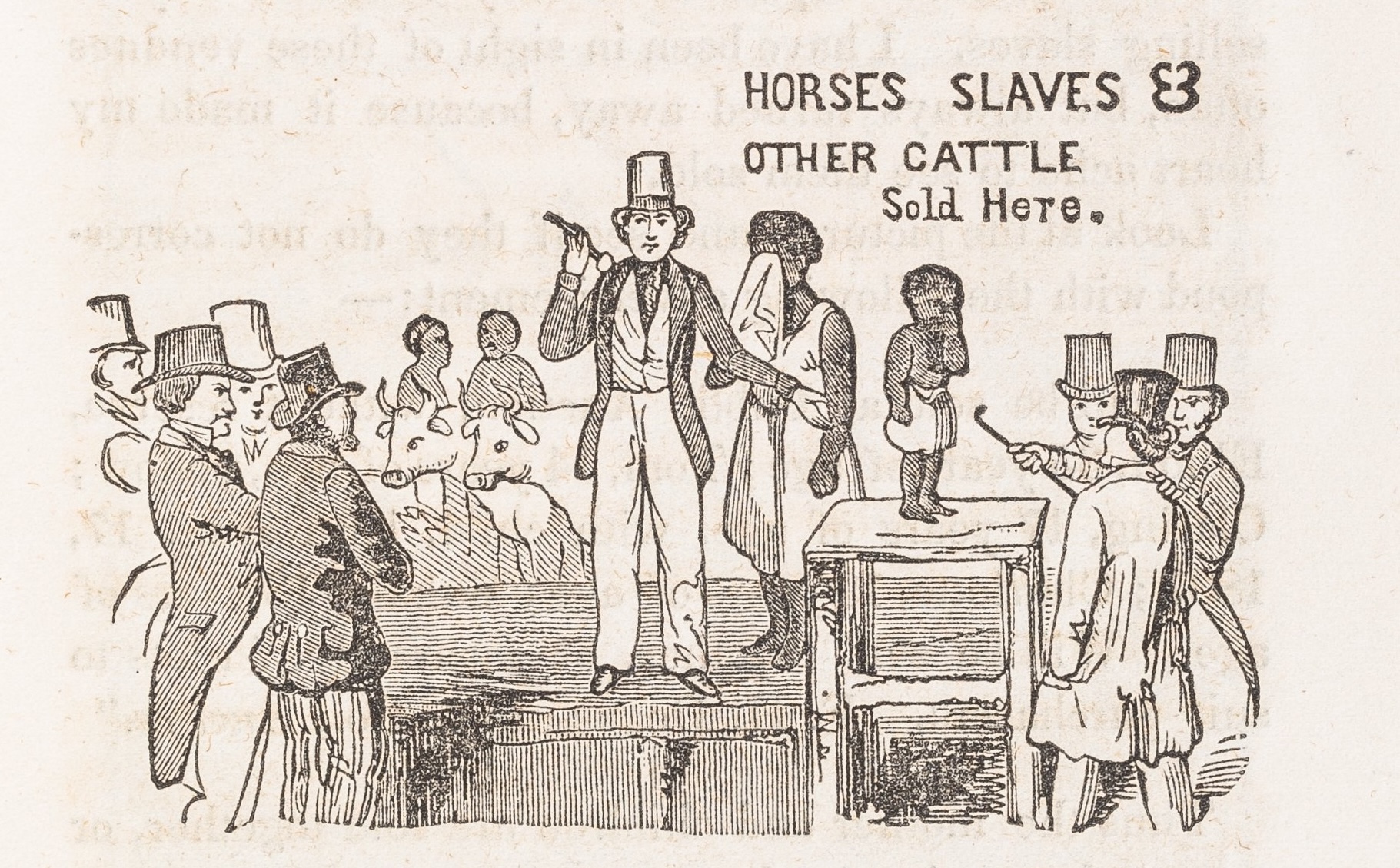

Specialization could have solved this problem, but in the market structure of the eighteenth and early nineteenth centuries, that would actually have increased the risk of failure. The demand for discrete products was divided into many isolated islands of customers separated by distance, borders, and all the attendant risks of transportation associated with seafaring before steam and roads before macadam, not to mention plundering armies and navies in times of war, as well as thieves during all periods. Even in the best of circumstances, crossing the Atlantic took several weeks. Market prices could fluctuate wildly in the meantime and a trader could end up with a net loss on what had first looked like a golden opportunity. Multiple investments in various goods was the only way to spread the risks. Errors of judgment were also more costly to traders who specialized. A few sales of inferior products at higher-quality prices, or of goods with latent defects, could result in a massive loss of customers who would know by word of mouth that the offending retailer was not to be trusted when it came to the goods in question. Since no trader could avoid occasional mistakes, highly specialized merchants ran a constant risk of seeing their customer base dry up without any alternative source of business to fall back on. This is not to say that no specialization took place, especially in the slave trade. But that may well be because even slave traders were never really able to see the commerce in human chattel as a regular business any more than they were able to see human beings as mere merchandize, to be mixed with other goods.

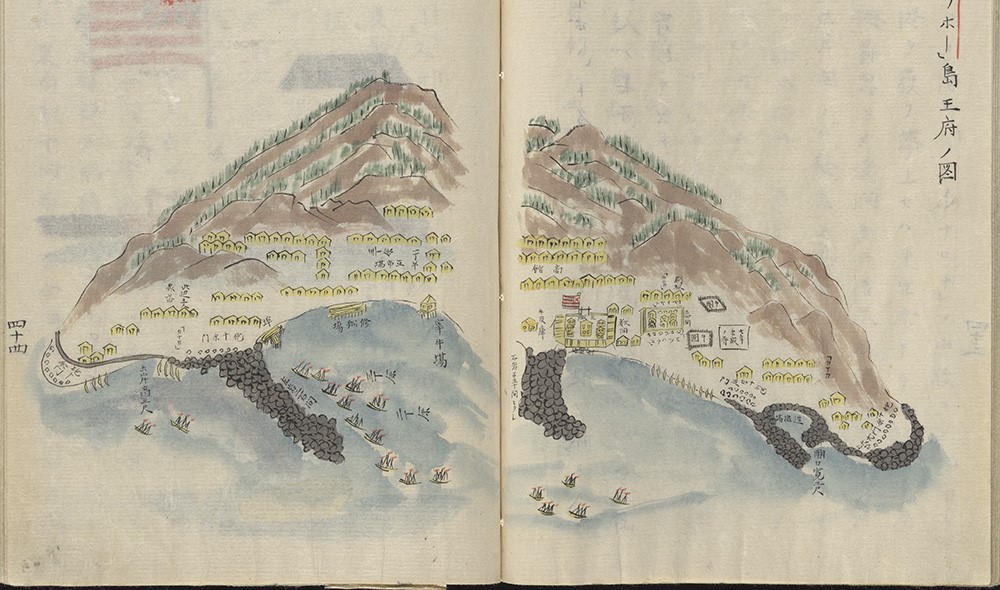

Whatever the trade, then, the key problem for the merchant was how to select the right goods which would be the basis of his or her reputation and credit. Any merchant would go far to safeguard a relationship with a reliable supplier of quality goods since this helped to escape the vagaries of markets, and provided up-to-date information on the state of these markets. A well-connected dealer in a certain type of cloth could form a general picture of its availability as well as the demand for it by learning from other regions and other traders and then estimating the possible evolution of the market. Thus, when Henry Lee wrote to a correspondent in 1810 that “Sugars remain @ $11.50 @ 13.50 they will rise here unless they fall in Havana, there are not many more that will be wanted from consumption [but] 20,000 Boxes will be wanted in February to make up the cargoes for the Baltic and Archangel,” he was using inside information about past movements and present situations culled from half a dozen ports spread over three continents, all to build a thumbnail description of an entire product market, complete with future prices.

Knowledge about a product included knowledge of the customers to whom it would be sold. Traders’ demands reflected customers’ demands, which again allowed a well-connected wholesaler to get an early peek at new trends and fashions. This kind of information was crucially important, since the often-invoked ultimate arbiter—the taste of customers—was only another name for the range of qualities from which one could choose, each choice attracting a slightly different subset of customers and commanding a varying set of prices. In many ways, a merchant’s identity was determined by the customer’s portfolio, as David Hancock nicely puts it. Keeping and enlarging that portfolio meant finding the right goods for the right people at the right price. This was necessarily a joint venture between suppliers and retailers. Both had to play their part if the customer was to be satisfied.

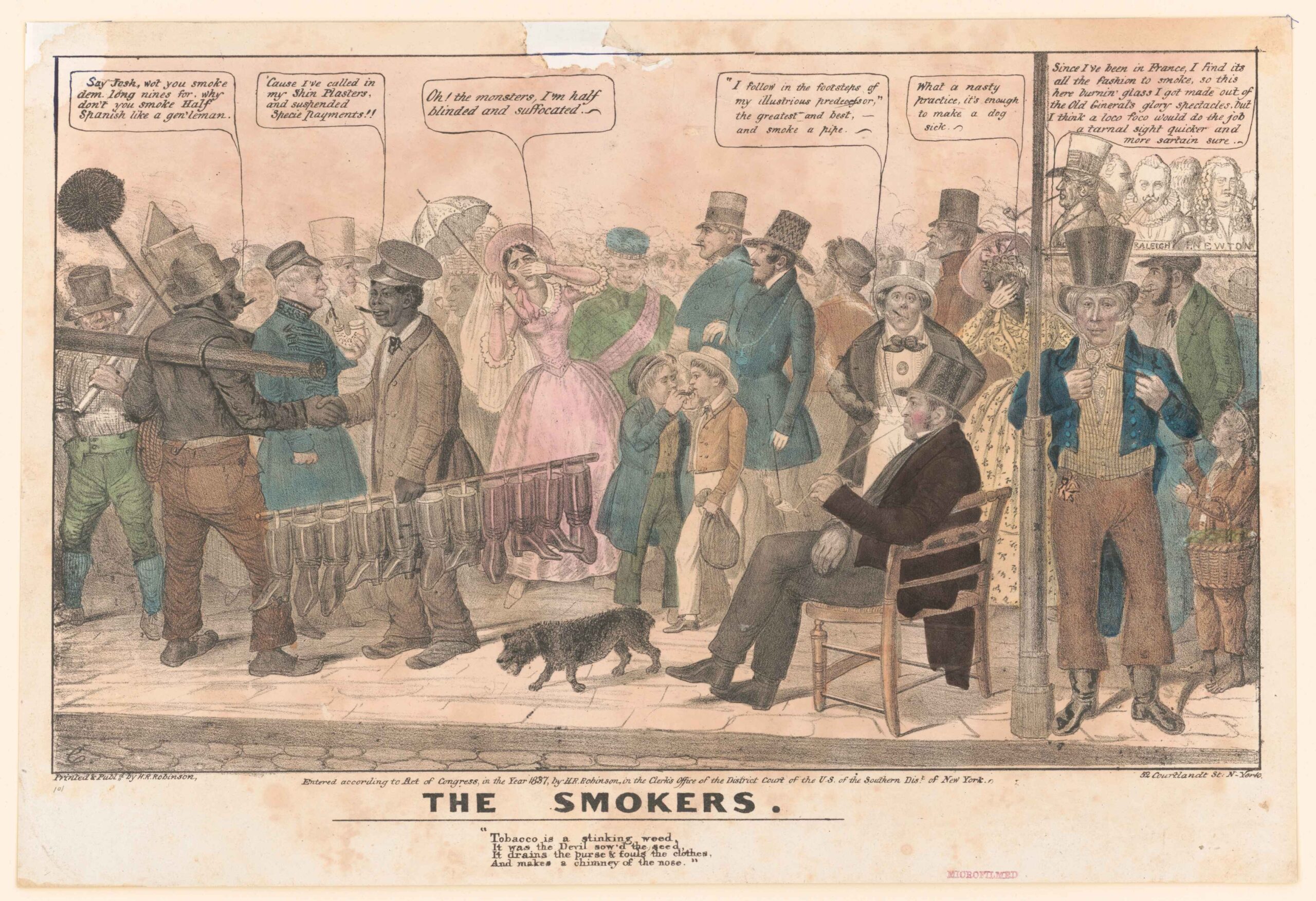

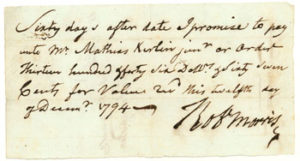

When it came to goods, the building of a reputable business was thus heavily dependent on cooperation and mutual trust between various traders. This was the case in regards to the other side of the balance sheet as well: money. Payments were no less dependent on reputation and mutual trust as were supplies since, in most cases, no money at all changed hands. What was given instead was some promise to pay, that is, credit. The systematic use of credit instruments was partly a matter of expediency since some areas of the world were chronically short of metal currencies. Cash-starved colonists in North America, for instance, could rarely get their hands on actual gold or silver. In 1754 even such a large Boston merchant as Thomas Hancock had to pay for four pair of “breeches” (one for his adopted nephew John, the future Revolutionary leader) with “4 po(d) of Tee, 1 Quire of Cartridge paper, 1 Doz(e) of women’s glazed Lamb Gloves” worth £2 6s. This assortment of goods was nonetheless listed by the tailor as “cash paid in full,” proof enough that “cash” in the eighteenth century could mean a variety of currencies, few of them actual cash as we know it. Traders would also swap fish, wood, or sundry other goods in order to balance their accounts with each other. And yet, most debt settlements involved neither cash or commodity money: what was swapped, rather, was credit itself, very often through complex, multiple transactions.

The basic principle was always the same: a trader transferred credit he had with another to a third to whom he was in debt. Some of these transactions gave rise to commercial paper, which played the role of both our paper money and bank credit. The modern letter of exchange, by which a drawer ordered a drawee to pay a certain sum to a third party (the payee), had to follow certain legal rules formalized in the Middle Ages. But by the end of the eighteenth century most paper debts existed in the form of promissory notes or IOUs, which were called “notes of hand” or “bills,” in which one trader promised to pay a given sum, with interest, on a given date, often to a certain person. Both formal letters and informal notes circulated by endorsement and so constituted a quasi-currency. The notes of the largest traders, which were as good as cash, could travel all over Europe and the Americas. Exiled Boston loyalist John Amory could thus pay his way in Brussels in 1781 with the proceeds of a “note of hand” from a Parisian trader which was originally used to pay off John’s brother Thomas, in Boston. The latter sent the note to a London house with which John had an account, and the Londoners drafted a new order of their own to their correspondent in Brussels, who in turn credited John with the sum thus transferred. The original French note was resold to some other London house, or sent to Paris to be cashed. The whole circuit had taken place in the midst of the war between France and England. Indeed, credit systems among traders were so vital that they proved impervious to national loyalties and political conflict.

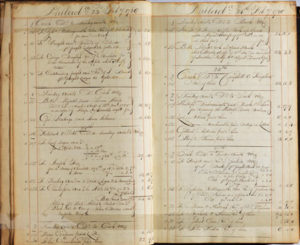

In Amory’s case, paper actually changed hands, the French note being supplemented with a standard bill of exchange on a Brussels house for the last leg of his journey. But credit operations could, and often did, involve no physical transaction at all. Every time a customer opened an account with a trader, book credit was generated because accounts were seldom closed. The customer would owe money, or actually be owed money, as in the case of a supplier having an account with a retailer, but in both cases a certain amount of money was loaned by one party to the other, at no interest. Commercial paper usually bore interest. In other words, every trader functioned as a small bank extending free loans to customers. In the year 1808, Princeton grocer Josiah Worth loaned a total of more than $500 to more than twenty different local customers, that sum representing close to 10 percent of the total value of his goods on hand. The further back in time one goes (or the farther away from those areas, such as large European cities, where metal currency was plentiful), the smaller was the number of cash transactions. In 1753, Boston grocer Joseph Green sold £25 worth of British goods in one month, £20 of that on book credit.

Josiah Worth had a very small local operation in what was a village of a few hundred inhabitants. Joseph Green’s Boston suffered from a dire shortage of cash. But even the largest traders in the most vibrant commercial centers of Europe were as dependent as their poorer brethren on the other side of the Atlantic on credit transactions. The house of Gradis, in Bordeaux, was one of the largest French merchant houses in the country’s wealthiest port prior to the Revolution. Almost 60 percent of all the transactions registered in the account books of the Gradis partnership during one month in 1754 involved no cash, even though these large négociants were bound to use more cash than did most small dealers. Even more strikingly, half of the 600,000 livre tournois (worth approximately $5 million at current prices) which changed hands in these operations did so by compensating accounts, that is, without utilizing either cash or commercial paper. Assets from Nantes or Saint-Domingue were transferred to traders in Quebec or Lisbon by moving them from one of the Gradis’ accounts to another in the back room of some small Bordeaux shop. Traders large and small were thus entirely dependent on their credit networks, just as they were dependent on their supplier networks.

All transactions thus entailed credit, both in a financial as well as a more general sense. For to give credit meant to trust—to trust that the goods were satisfactory, that the book account would eventually be settled, that a promissory note would be “honored,” or paid when presented. Whom to trust, when to trust, and for how much to trust—the answers depended on a variety of issues, not least of which was the social status of the debtor. “Credit” to noble patrons in France or England was very often an outright gift, which, once advertised, would attract other, less illustrious customers intent on shopping where grandees such as the Duke of Rohan or Lady Waldegrave shopped. British potter Josiah Wedgwood built his fortune upon such snobbish associations, combined with clever advertisement, selling his earthenware as “the Queen’s ware” from 1762 on. At the other end of the social scale, local retailers needed to attract enough less privileged people to their store to sustain their business. Tight credit would not have served this purpose. Village grocers, careful not to antagonize their customers, could thus only hope for episodic payments as debts often extended over months or years. And then there were all sorts of personal issues that could interfere, ranging from family ties to shared religious or political loyalties. Credit at the local level was very much a matter of balancing reputations, of practicing a Maussian give-and-take, and of ever-precarious equilibria being constantly renegotiated.

The same was true for larger traders. In practice, almost all credit was revolving credit. New credit was constantly extended. Notes of hand bore interest, the interest often being paid when the note was renewed. Book debts were a different matter since they were apparently free, allowed to stand for years, although some form of interest could, in fact, show up in the form of inflated prices, especially with impecunious noble customers. But not all open accounts were treated the same way in this respect. Accounts between partners or close business associates remained open year after year, just like the accounts of small customers, but price rises or interest charged on the debts of the former were extremely rare. Close associates had the right to demand immunity in this respect. In practice, interest charges varied wildly and a number of other considerations, ranging from family relations to personal association, could significantly alter the rate that was applied.

The thorniest issue in regards to credit had less to do with what interest rate to charge to whom than when to start saying no. Non-payment, or a bad credit record, was only one of several parameters to keep in mind, and a trader could well decide to bear a likely loss for various reasons. As with local grandees, relations with a prominent merchant could bring privileged access to local markets as well as to other traders. Thorough knowledge of a certain product was also worth bankrolling, which is why failed traders rarely found themselves unemployed—their knowledge could be usefully recycled. Boston merchant Henry Lee, who voiced his worries in February 1811, did indeed go bankrupt in March but then resurfaced five months later as the agent of a fellow trader on a ship en route to Calcutta. Lee had logged significant experience in the Calcutta market and could still be counted on in this respect, regardless of his bankrupt status. And so, knowledgeable correspondents could be worth much more than the book debt or the note of hand they owed, and pressing payment of these debts would have been a very bad move indeed.

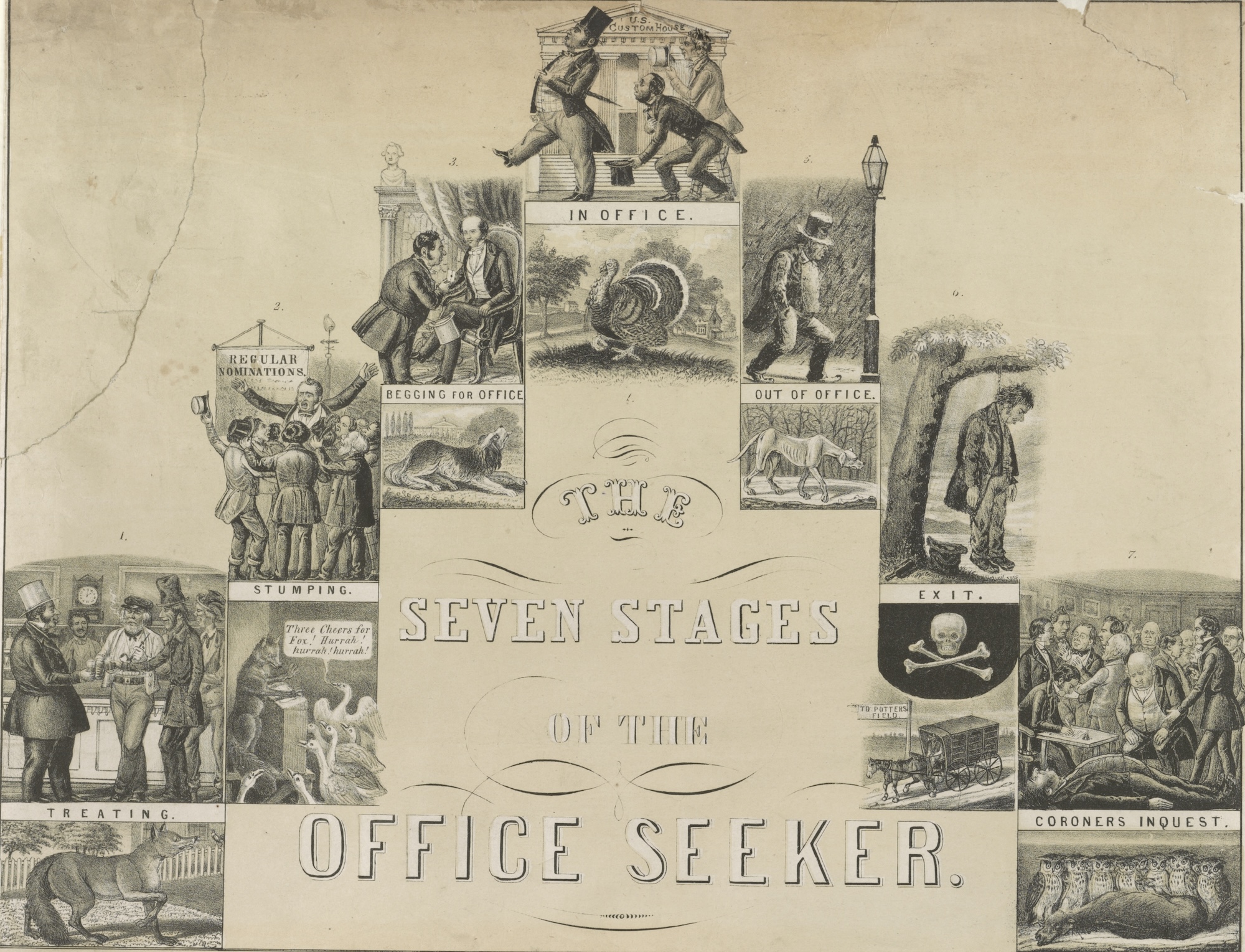

Except, of course, if the same correspondents were on the verge of bankruptcy, in which case it was best to try and recoup as much as possible and as fast as possible. The bankruptcy of a debtor usually meant the loss of most of the funds that had been loaned since legal proceedings were long, haphazard, and ultimately provided little compensation to creditors. Bruce Mann describes the many ways by which a bankrupt debtor in the Early Republic could delay judgment. He could, for instance, “keep close,” that is, stay home and keep out the sheriff, the deputies and the court orders they could not serve because they were forbidden from forcibly entering a debtor’s home. Consequently, creditors were rarely keen on pushing a debtor into bankruptcy, all the more so because that could also earn them a very bad reputation among other traders as being too hard-hearted and unforgiving. While bankruptcy proceedings were constantly brandished as a threat, most traders in practice tried to discreetly negotiate some kind of preferential treatment. That is why backroom negotiations continued even after bankruptcy, as Ewing’s example shows. Still, once bankruptcy was declared, it was essential to act fast since in common law most creditors were refunded on a first-come, first-served basis. And so, as with commodities, early and accurate information was crucial.

Information was also crucial because business failure constituted a potential threat to a wide circle of traders. This brings us back to the subject of cash. The whole credit system was built like an inverted pyramid, resting on a relatively narrow basis of hard cash. It was consequently most important to preserve that cash basis, thus according it a central economic role. Using no cash at all would raise questions about one’s solvency, so a certain amount of cash had to be provided in each transaction, if only for symbolic reasons. This led to a constant flow of creditors showing up on a trader’s doorstep and requesting at least partial cash payments, which they in turn needed to use in other deals. Determining the amounts of cash one should pay became another complex issue. Some cash was always kept “on hand,” as the saying went, though excessive caution (that is, keeping on hand a large amount of unused cash) meant lost opportunities as well as the risk of being cut off by fellow traders who would have no reason to “credit” a colleague who was so “unaccommodating,” that is, unwilling to extend loans to others. In any event, the sheer amount of credit involved in any trading business meant that even the largest houses could only pay off part of their debt at any one time.

On the other hand, failure to repay even a small note when asked to do so would bring an avalanche of panicky demands on the part of all one’s creditors, hence the absolute necessity of keeping a flow of hard currency moving through the system. And because all traders relied on an array of fellow traders to provide the necessary funds, each subgroup worked like a highly interconnected set of financial institutions of the kind we are familiar with today. If one failed, a domino effect would ensue. Failure would freeze needed funds and cripple all creditors, who lost a precious source of currency. If their dependency on the failed trader was considerable they would fail in turn. The bigger the failed business, the bigger its fallout. Robert Morris, the Philadelphia merchant who bankrolled the War of Independence, “can’t fail,” a contemporary, himself the son of a failed merchant, exclaimed in 1788. “If he does[,] ruin on Thousands” would result. The Lehman Brothers of his times did indeed fail in 1797, consequently ruining thousands.

Failure could obviously be brought on through excessive optimism or a lack of caution or foresight. But it could also be the result of sheer bad luck. Risks could not be addressed by insurance since the latter was costly and available only for some operations, such as shipping and transportation. Using pricing in order to compensate for the numerous unknowns remained an approximate affair at best in an environment of highly segmented, constantly fluctuating markets with highly imperfect information. Indeed, information again proved to be crucial since it helped one recognize which traders were unwisely expanding their operations and therefore constituted a risk. Certainly, Henry Lee’s buying spree in India in the last months of 1810 in the face of an increasing shortage of money should have warned off other traders, had they been aware of it.

But there was no protection against the sudden death of an important creditor. Testamentary executors would then have to insist on immediate repayment of debts which would have otherwise been left to mature much longer. And so, as with suppliers, the best protection against risk, and the best method for reducing uncertainty, was diversification, that is, having as many different debtors and creditors as possible. But even then the most cautious, clear-eyed, diversified trader could still be caught high and dry. British and U.S. bankruptcy law admitted as much, providing as they did relief for commercial but not for personal bankruptcies on the explicit grounds that the former were most often the result of unavoidable professional hazards while the latter were supposedly caused by excessive, overindulgent spending.

Ewing’s failure, by his own rueful admission, was not quite unavoidable. He had been “too sanguine,” too optimistic. Still, his story fits the general pattern of commercial bankruptcies before the advent of industrial capitalism in the nineteenth century. He had come to grief by allowing the delicate balance between the claims he had on others and those others had on him to go out of kilter. Maintaining this balance was no simple matter if one keeps in mind that monetary credits and debts were only part of the equation. No account could be evaluated in isolation, nor in strictly accounting terms. There was the larger flow of trade, the constant struggle to buy quality goods, to which were added downturns, wars, and sudden shifts in markets. One had to judge how one’s own combination of credit flows would fare, which investments would earn and which would lose, when it was time to contract or to expand. The basic accounting figures for each venture would not be enough because each account was bound up, as we have seen, with future ventures and with past profits. One also needed to factor in the intangible benefits of one’s debtor’s enhanced reputation, improved information, and better market access, as well as consider what had so far been gained in the relationship. The fact is, ingratitude had its risks as well since it could cause one to lose the respect, and thus the cooperation, of other traders, as Avner Greif pointed out long ago. There were also networking issues at play. A delinquent debtor could be protected from pressure if he was closely associated with other traders that one needed to do business with. On the whole, assessing credit situations meant parsing a constant flow of diverse information and trying to separate the true signals from unfounded rumor and hearsay.

Other, larger social forces were also at work. The need to rely on fellow traders at all times and for all aspects of business made it imperative for a trader to take part in the merchant community. In this respect, the scions of old, established merchant families enjoyed clear comparative advantage over upstarts and recent arrivals. They had bigger, older, and hence more compelling sets of claims and counterclaims, as well as more extended and hence more resilient networks of family, friends, allies, and acquaintances. James Ewing was well-connected up to a point, being the son of a notable Presbyterian minister in Philadelphia who had been rector of the College of Pennsylvania. His unfortunate investment in a distillery was made in partnership with members of the well-established Philadelphia firm of Robert Waln. Indeed, the day before Ewing wrote to Rhea, his main creditor in Philadelphia, one William Clark, had also sent a letter to Rhea agreeing to except furniture from the settlement. There was a definite whiff of class solidarity in Clark’s statement that “no human person would wish to deprive a worthy family from the articles necessary to their comfort, when it must be well known that misfortune alone have brought the head of that family to the present distress.” A farmer or craftsman in the same situation would not necessarily have enjoyed such benign treatment.

But Ewing did not come from merchant stock. His grandparents were farmers and he disappeared from the trading scene after 1811. Other bankrupt merchants from more established families might have done better. The fact that Ewing was forced to default might have been connected to his status as a relative outsider. Henry Lee’s failure gave rise to a telling anecdote concerning his brother-in-law Patrick Tracy Jackson, who later helped to establish the Massachusetts textile industry. In 1811 Jackson was a Boston merchant closely linked to the recently failed firm of Joseph and Henry Lee, the relation resting both on blood ties and on a common interest in the India trade. Quite reasonably, rumors began to circulate that Jackson himself was on the verge of defaulting. According to the New York gazetteer Freeman Hunt, of Merchants’ Magazine fame, Jackson “called upon some of his principal creditors, made a most lucid exposition of the state of his affairs, and showed that, if allowed to manage them in his own way, his means were abundantly sufficient; while, so great was the amount of his liabilities, that, under the charge of assignees [i.e. in bankruptcy proceedings], not only might all his hard earnings be swept away, but the creditors themselves be the sufferers.”

The question Jackson addressed was a standard one: given the uncertain outcome of legal proceedings, which could well bring no gain at all for the creditors, should the debt be put on hold? The interesting point here is that Jackson was technically bankrupt since his liabilities were much larger than his assets, to the point where he could not meet his obligations without a grace period from his creditors. In fact, he admitted as much. And yet, he was allowed to continue in business. Hunt explains this happy turn as follows: “So admirably had his accounts be kept, and so completely did he show himself to be master of his business, that the appeal was irresistible. He was allowed to go on unmolested.” Whatever the veracity of this story, it points to a deeper truth about merchant failure, namely, that it was always, first and foremost, a failure of trust on the part of fellow merchants. For a variety of possible reasons—ranging from his undeniable talents as an accountant and manager to more elusive issues of family and elite class solidarities—Jackson was able to keep the trust of his fellow traders, in spite of his obvious inability to repay his debts. To sustain one’s credit among others, then, included much more than regular payments or debt avoidance, which were impossible anyway given the circumstances. A whole social realm was bundled up in the credit networks of traders, which became most evident in times of crisis when bankruptcy loomed large on the horizon.

At once roilingly uncertain and happily insulated, the eighteenth-century world of trade and failure faded away during the industrial revolution. By the second third of the nineteenth century a series of new business tools was being developed that deeply revolutionized the management of risk. After several decades in which they functioned as glorified investor’s clubs closed to outsiders, banks turned into large lending institutions available to the general public and eventually backed by the state as a lender of last resort. Individual traders could increasingly rely on a secure source of credit outside of their own network of associates. The advent of the corporation also made a new breed of business ventures possible that were impervious to the hazards of the market, and even the deaths of their participants. Information was formalized and distributed by such credit-rating agencies as Dun and Bradstreet, reducing the need for rumor and gossip. Insurance could be purchased for anything and everything, its price dramatically reduced by sophisticated risk-measuring tools. And an increasing control of the production process ushered in an age of standardization and normalization, again with a heavy dose of institutional oversight from public or quasi-public organizations.

Increasingly able to rely on standardized goods and accurate information regarding the state of the markets and the solvency of both customers and suppliers, traders all over the world started to specialize, which further reduced risk and uncertainty. The good feelings of associates and an extended network of personal ties would still play a role among industrial capitalists but these no longer constituted their core assets. Eventually credit itself acquired a much narrower economic meaning: its broader connection to issues of trust, social status, kinship and class solidarity disappeared (only to be recovered by the recent revival of scholarship in the history of credit). Older merchant strategies began to look somewhat opaque and haphazard in retrospect because the rules that constrained trade and the logic generated by these rules were no longer widely understood. Meanwhile, merchant princes were being displaced by bankers and industrialists, and local grocers and shopkeepers found themselves on the losing end of the retailing revolution. Trade, which had been a way of life, was reduced to an ancillary role as the focus shifted to production costs and product quality. In this new incarnation, sales and marketing—a narrative of technical standards and the scientific study of focus groups—replaced personal credit networks as the main source of information for making strategic choices. A faint resonance of the expansionist nature, manic activity, and essential instability of merchant life in its golden age remained alive in the popular imagination, however. In Arthur Miller’s play Death of a Salesman, which also chronicles the death of an era, Willy Lohman’s reliance on “a shoeshine and a smile” was no less than a latter-day, debased echo of the cultivation of personal networks which for centuries served as the main protection for traders against commercial failure.

Further reading

Merchant groups and their operations in the eighteenth century have been extensively studied, most recently in David Hancock’s Oceans of Wine: Madeira and the Emergence of American Trade and Taste (New Haven, 2009); see also his Citizens of the World: London Merchants and the Integration of the British Atlantic Community, 1735-1785 (Cambridge, 1995), as well as Cathy Matson’s study of New York traders, Merchants and Empire: Trading in Colonial New York (Baltimore, 1998). Other regional studies, older but still useful, include Thomas Doerflinger, A Vigorous Spirit of Enterprise: Merchants and Economic Development in Revolutionary Philadelphia (New York, 1986) as well as Bernard Bailyn, The New England Merchant in the Seventeenth Century (Cambridge, 1955) and Conrad Edick Wright and Katheryn P. Viens eds., Entrepreneurs: The Boston Business Community, 1700-1850 (Boston, 1997). One should note that there is also a large array of recent works in French for readers proficient in this, most notably Pierre Jeannin’s brilliant collections of articles, Marchands du Nord (Paris, 1996) andMarchands d’Europe (Paris, 2002), and Silvia Marzagali’s Les boulevards de la fraude (Villeneuve d’Ascq, 1999).

The minutiae of credit relationships remain little studied, even among accounting historians: William Baxter’s The House of Hancock (Cambridge, 1945) is still one of the most detailed works available. As Basil Yamey pointed out in a recent cautionary article in Accounting, Business and Financial History (“The ‘particular gain or loss upon each article we deal in:’ an aspect of mercantile accounting, 1300-1800,” ABFH10-1, 2000), merchant accounting strategies are still far from clear. Another key source, merchant correspondence, can also be accessed through older editing ventures such as Kenneth Wiggins Porter’s The Jacksons and the Lees (Cambridge, 1937, 2 vol.). On the whole, detailed quantitative analysis of accounts remains limited, even in studies directly concerned with such issues. Consider for instance Edwin J. Perkins, Financing the Anglo-American Trade: The House of Brown, 1800-1880 (Cambridge,1975), or the collection of essays edited by Peter A. Coclanis, The Atlantic Economy during the Seventeenth and Eighteenth Century: Organization, Operation, Practice, and Personnel (Columbia, 2005) ; also Sheryllynne Haggerty’s The British-Atlantic Trading Community, 160-1810: Men, Women, and the Distribution of Goods (Leiden, 2006), otherwise useful for her pioneering analysis of gender roles.

The institutional underpinnings of credit are better known thanks to Bruce Mann’s Republic of Debtors: Bankruptcy in the Age of American Independence (Cambridge, 2002). Theoretical discussions among sociologists, anthropologists and economists are also worth following, and range from Marcel Mauss’ 1924 essay, “The Gift” (Glencoe,1954) down to Avner Greif’sInstitutions and the Path to the Modern Economy: Lessons from Medieval Trade (Cambridge, 2008). Credit issues are also one of the most burning topics among economic historians in Europe, and especially in French historiography, both from a socio-cultural prospect (Laurence Fontaine, L’économie morale: pauvreté, crédit et confiance dans l’Europe préindustrielle, Paris, 2008) and from heterodox economic angles (Guillaume Daudin,Commerce et Prospérité: la France au XVIIIe siècle, Paris, 2005; also Jean-Yves Grenier, L’économie d’Ancien Régime: un monde de l’échange et de l’incertitude , Paris, 1996).

This article originally appeared in issue 10.3 (April, 2010).

Pierre Gervais, associate professor, Ecole des Hautes Etudes en Sciences Sociales/Université Paris VIII, France, is the author of Les Origines de la révolution industrielle aux Etats-Unis (2004), which was awarded the Willi Paul Adams prize of the Organization of American Historians in 2007. His most recent publication in English is “Neither Imperial, nor Atlantic: A Merchant Perspective on International Trade in the 18th Century,” History of European Ideas, 2008.