In 2010, I found myself living in a small Maine town, helping my spouse establish a bankruptcy law practice. This was not long after the beginning of the financial crisis, so bankruptcy law seemed a promising gig. It was also a few years after the passage of a bankruptcy reform bill in 2005, with new regulations that made it much harder to establish oneself as a so-called honest debtor eligible for a discharge of debts. That also made more work for lawyers. So, in breaks from writing my dissertation about eighteenth-century literature, I pasted paystub data into spreadsheets, tallied up living expenses and debt, and learned to think about bankruptcy as a shorthand for relief, rather than a code for failure.

On occasion I sat in courtrooms and watched the presiding trustee march through the rolls of petitioners, raising questions about the value of an RV or the ownership structure of a family cabin. At the end of each hearing the trustee would rattle off a half-hearted benediction, sending the petitioners out into the world for another try at making a living. The bankruptcy code is designed to provide debtors with a fresh start, he would say; I hope it works out that way for you. The phrase fresh start stuck out to me. It seemed so colloquial, so non-legalistic. It is, in fact, contained in the official glossary of bankruptcy terms provided by the state. It says:

Fresh Start—the characterization of a debtor’s status after bankruptcy, i.e. free of most debts. (Giving debtors a fresh start is one purpose of the Bankruptcy Code.)

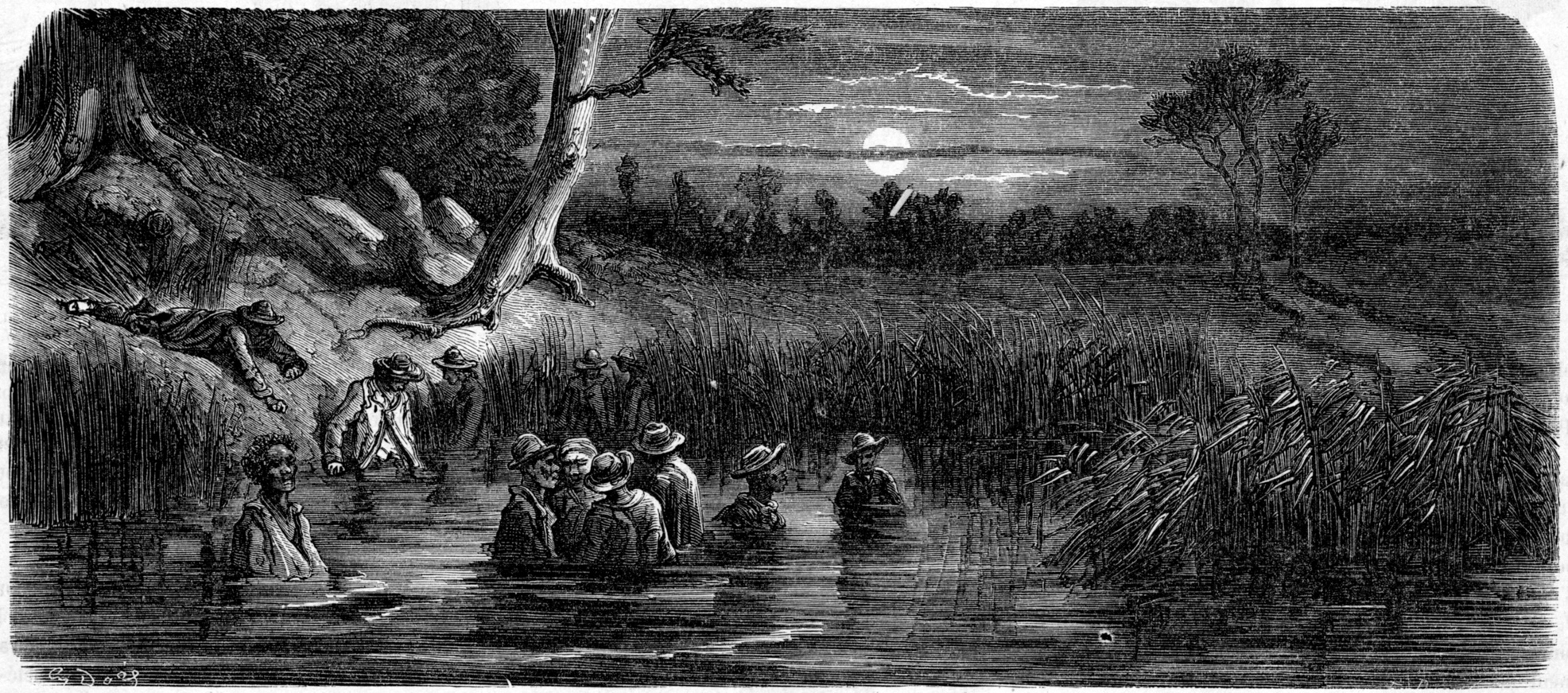

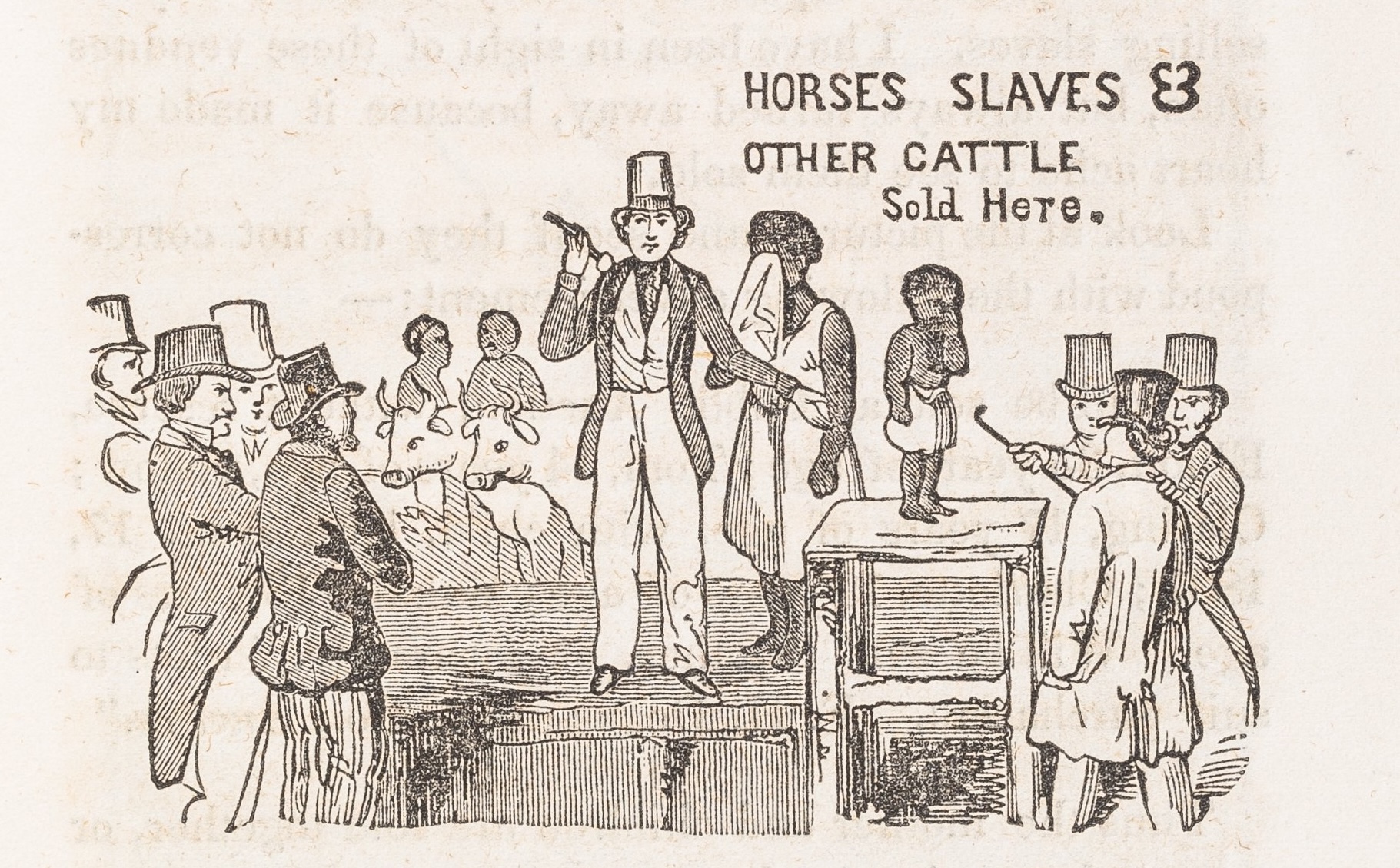

Beyond the oddness of the framing, I was struck by the concept of the fresh start. The idea of bankruptcy as redemption, as the rock-bottom that precedes a new rise, looked to me quite different from the stories of bankruptcy that appeared in eighteenth-century literature. There, bankruptcy often signals vice and corruption. A fictional bankrupt is often also a seducer, a gambler, and any number of other terrible things. When a person is broke, his story is over. If he wants a fresh start he is going to have to move away, to some hazy other-country with richer soils for self-reinvention. Often, that country is America. But what about those who were already here?

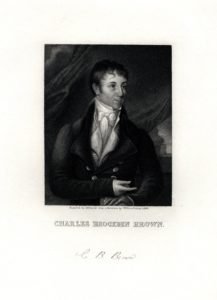

You don’t come across a lot of bankruptcy hearings in eighteenth-century novels. This is pretty easy to explain: they didn’t happen much. But they did happen, and I’m going to go into some depth about one early American novel that touches on the subject, in the process opening a window into the turbulent waters of debt, failure, and new beginnings. This novel is Arthur Mervyn, published in 1799 by Charles Brockden Brown. It’s a long, rambling novel that follows a young naif, Arthur, as he travels through turn-of-the-century America. The novel is most often remembered (when it is remembered) for its gothic descriptions of Philadelphia in the grip of the 1793 yellow fever epidemic. Critics also like to discuss its unreliable narrative; it’s impossible to follow the turns of the plot, and the veracity of the first-person account is constantly challenged by other characters. However, I take the side of a small but longstanding critical cadre that believes Arthur Mervyn is best read as a tale of financial transactions. Specifically, I read it as a novel about debt.

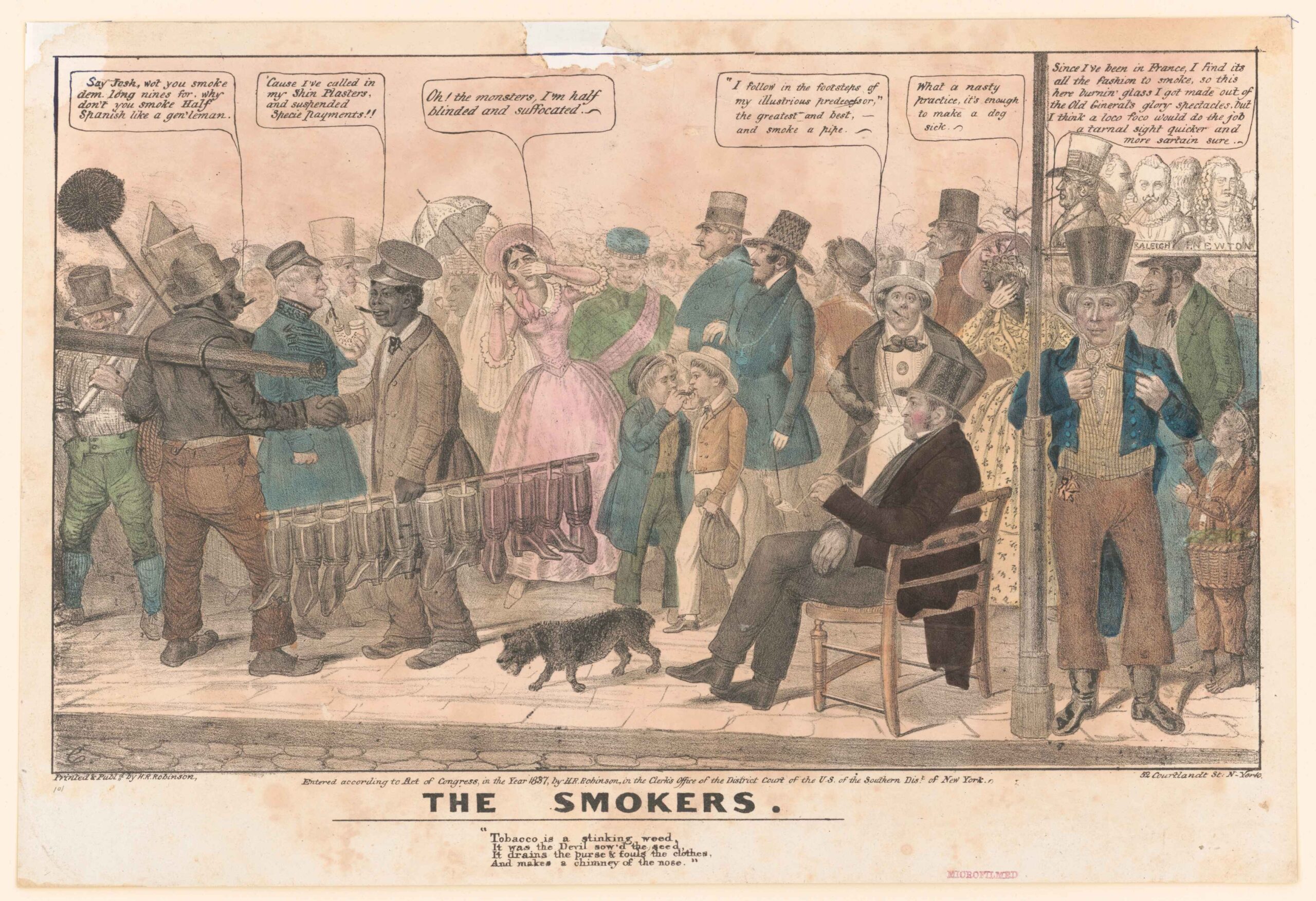

The growth of a mercantile Atlantic economy through the eighteenth century caused a sea change in concepts of credit and risk, one so momentous that we continue to sort through its effects today. Borrowing and lending became depersonalized; debt shifted from a moral hazard to a cost of doing business, and a business in itself. Both the radically unstable narrative of the eponymous hero and the raging career of Welbeck, the villain, can be understood as critiques of the unmoored economy of speculation, in which fortunes were won and lost in what seemed then, before nanotrading, like the blink of an eye.

Charles Brockden Brown came from a commercial family, and makes clear throughout Arthur Mervyn that he has a professional’s knowledge of financial transactions and the consequences they can carry. (His father was once imprisoned for debt.) The novel teems with reversals of fortune: sudden plunges from middle-class respectability caused by bad banknotes or fraudulent insurance arrangements, as well as by disease, seduction, ill-will, or bad luck. Precarity is the background hum behind the novel’s picaresque plot. Time and time again, Arthur Mervyn finds himself without a penny or a crumb to his name, starting fresh. Yet, while his progress shines a light on the instability of personal finances in early America, Arthur himself remains optimistic, seemingly untouched by failure.

Arthur goes bankrupt almost as soon as he leaves his rural home for Philadelphia. He starts with a little money, but is so naïve that he spends it all on two sorry meals. As he walks along, ruminating on his plight, he finds that he has already entered the city. And he realizes something else. “Suddenly I recollected that I had not paid the customary toll at the bridge; neither had I money wherewith to pay it.” He is stuck: “I had nothing to pay, and by returning I should only double my debt. Let it stand, said I, where it does. All that honour enjoins is to pay when I am able.”

Arthur’s progress, therefore, begins with insolvency. He considers himself in debt, promising himself he will pay when he can. He decides immediately that the answer to his problem is more debt, and sets out to find a farmer he knows who might lend him enough for a meal. In the process he leaves behind his bundle of clothes, and even his shoes, as if to underscore his total lack of worldly capital. For Arthur, however, indigence is opportunity. While he claims to be in search of honest work, he never does settle down to any task. Instead, he lets himself be swept along by the currents of the commercial city, until they carry him out of it. Before long he finds himself again at the bridge, and again penniless. Far from recalling his old debt, Arthur cheerfully doubles it. “With light steps and palpitating heart I turned my face towards the country. My necessitous condition I believed would justify me in passing without payment the Schuylkill bridge.” Bankrupt, Arthur is free to follow his destiny.

Let’s pause for a moment on the debt of the bridge. At the beginning of the novel, the rusticated Arthur believes that “honour enjoins” him to pay the toll later. A quarter of the way into the book, having begun an education in the commercial economy, he has acquired a new approach to debt: having nothing justifies nonpayment. In other words, bankruptcy undoes obligations, and provides opportunity.

Arthur’s constant optimism in the face of loss makes him exceptional, but he is far from singular in his bankrupt status; ruin seems an occupational hazard of being a character in this book. I’d like to focus on two of these insolvents. The first is Welbeck, the sensational, irredeemable villain, who drives much of the novel’s plot through his career as a swindler, seducer, and forger, as well as through his patronage of Mervyn. The other is Carlton, whom nobody remembers.

In a novel so overstuffed with plot and characters, the mild-mannered Carlton fails to draw much attention. Carlton is a bankrupt, but he is not a gambler or a drinker, nor does he attempt to seduce heiresses under false pretenses of prosperity. He’s an honest man who happens to have both a poor head for business and an importunate creditor.

Carlton enters the narrative when Arthur’s friend receives a mysterious note requesting him to come without delay “to the debtors’ apartments in Prune Street,” the infamous debtors’ prison. The gothic atmosphere of the prison reminds readers of the scenes of yellow fever that began the book. Prune Street is “filled with pale faces and withered forms,” the air a “noxious element” that makes it hard to breathe. Yet Arthur’s friend, named Stevens, is unsympathetic: “The marks of negligence and poverty were visible in all; but few betrayed, in their features or gestures, any symptoms of concern on account of their condition. Ferocious gaiety, or stupid indifference, seemed to sit on every brow.”

This is a fitting place for a villain, in other words. Thus when Stevens finds that the prison contains a dying Welbeck, a narrative loop seems closed: debtors’ prison is not the gallows, but is a suitable end to a rake’s progress. This morality tale, however, is disrupted by the figure of Carlton. Stevens finds him “Seated on a bench, silent and aloof from the crowd, his eyes fixed on the floor, and his face half concealed by his hand.” Unlike the thoughtless mob, Carlton is “governed by an exquisite sensibility to disgrace” and anguished by the thought of what will happen to his dependent sisters. But, Stevens tells us, “fortitude was not among my friend’s qualities,” and he seems likely to share Welbeck’s fate of dying in debtors’ prison.

What great mistake or tragic misunderstanding brought this seemingly innocent person to this place, we wonder? As is typical in this novel, the story is slow to unwind. We learn that he “lives by binding fast the bargains others made”—I take this to mean that he is a commercial lawyer. Brown himself, it bears noting, was intended for the law by his family. We might assume that he knows whereof he speaks when he writes that Carlton’s “impatient temper and delicate frame unfitted him for the trade.” Unlike Brown, who chose to write instead, Carlton had gone ahead with the profession, and “pursued it with no less reluctance than diligence, devoting to the task three nights in the week, and the whole of each day,” even to the risk of his health. Hardworking and responsible, Carlton is nevertheless “embarrassed with debts which he was unable to discharge.” We learn later that there is just one debt, contracted by Carlton’s father, who had himself been imprisoned for it. To free his father from prison and save his health, Carlton had co-signed the debt, and had steadily worked to pay it off. Finally, however, he had fallen short, with $400 left to pay.

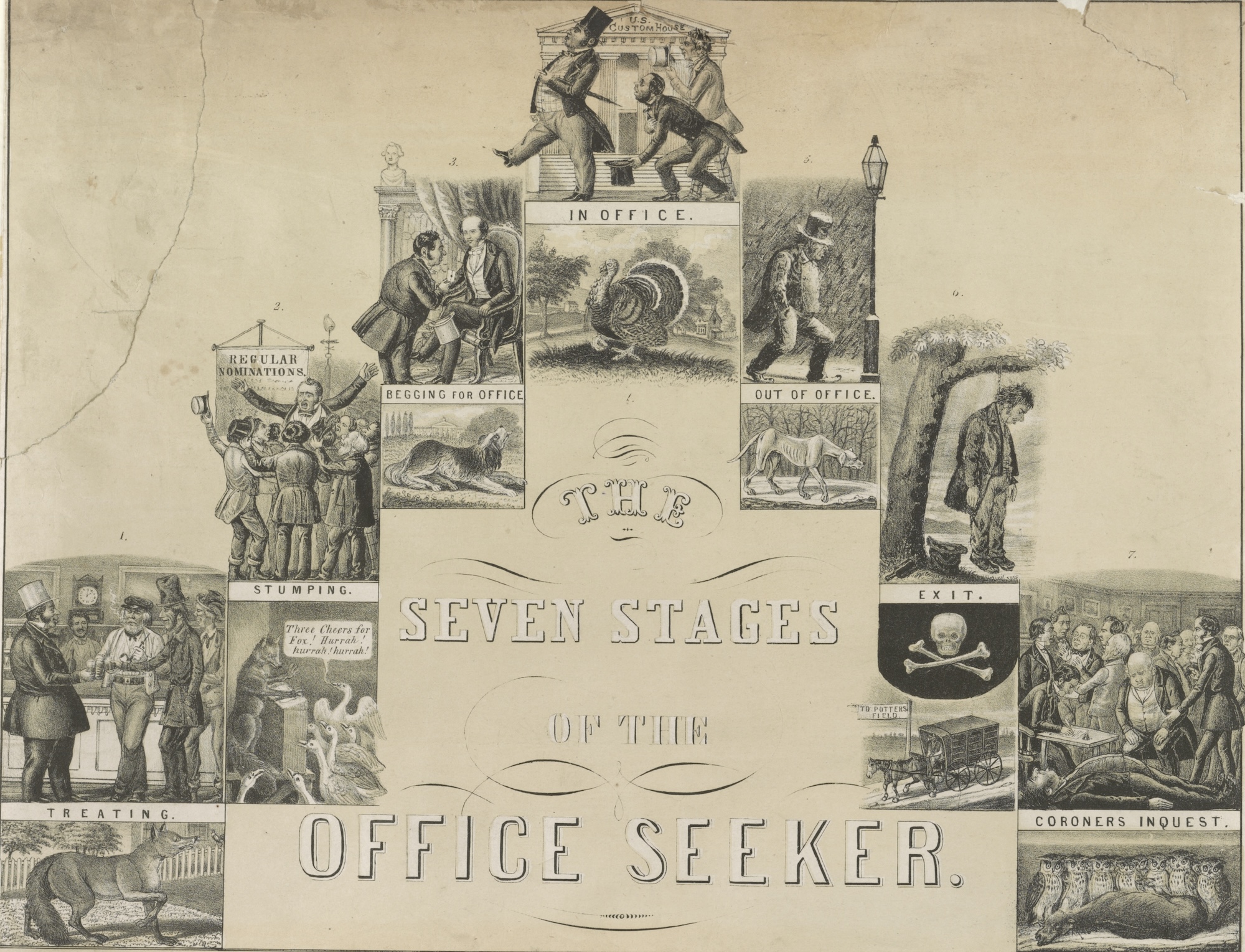

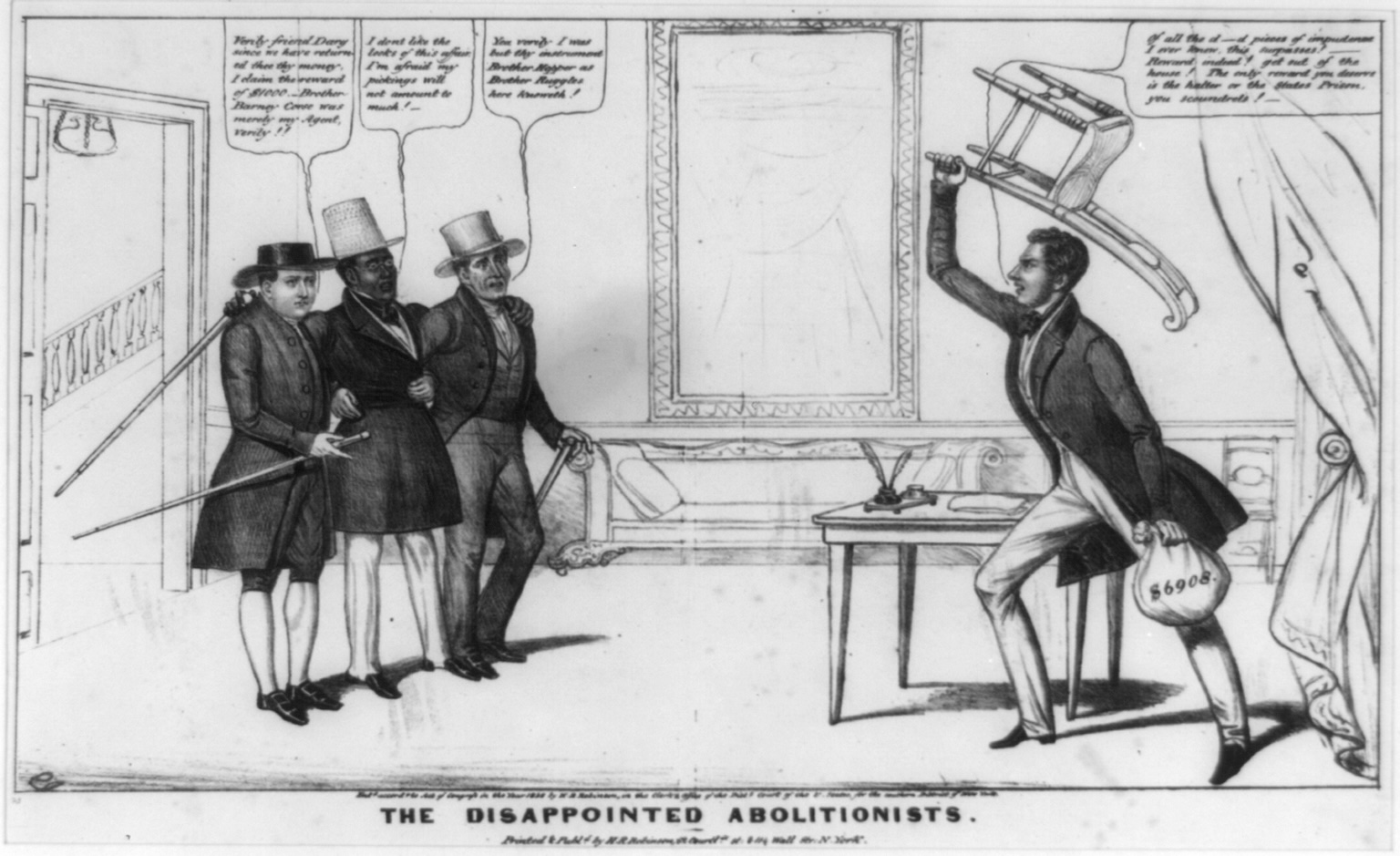

Stevens gets Carlton a private room in the debtors’ prison, which, with great narrative convenience, is already occupied by Welbeck. Side by side, they are the two faces of bankruptcy: the swindler and the unfortunate. If Welbeck, who seduces and lies and forges because he refuses to do honest work, represents the reckless speculator, poor forgotten Carlton is his milquetoast foil, the insolvent. If Welbeck shows the spectacular potential and dangers of mercantilism, Carlton raises questions about how society handles the collateral damage of capitalism. Does it leave him to perish in the prison, or does it give him another try?

This is the question that the earliest forms of bankruptcy law tried to answer. Debts should be paid, it was generally agreed, but a growing movement suggested that when payment was impossible, it was cruel and counterproductive to punish the debtor. “Is the state of the creditor such as to make the loss of four hundred dollars of more importance to him than the loss of liberty to your brother?” Arthur asks Carlton’s sister, incredulously. He continues more pragmatically: “Your brother cannot pay the debt while in prison; whereas, if at liberty, he might slowly and finally discharge it. If his [that is, the creditor’s] humanity would not yield, his avarice might be brought to acquiesce.” This particular creditor, however, is motivated by a sense of vengeance, and would rather see Carlton expire in prison than recover his money. In a world of ruthless lenders, it won’t do to rely on individuals for a sense of proportion in dealing with debt. We will have to look to the law to maintain humanity—and to keep individuals properly productive within the capitalist system.

It is indeed through law that Carlton’s situation is resolved. After he has marinated in the Prune Street prison for another quarter of the novel (though only a few days, according to its murky accounting of time), Stevens returns to his friend, whom “with much difficulty, he persuaded to take advantage of the laws in favor of insolvent debtors.” In other words, he petitions for a discharge of debts under a bankruptcy law. This proved successful: “by rendering up every species of property, except his clothes and the implements of his trade, he obtained a full discharge. In conjunction with his sister, he once more assumed the pen, and, being no longer burdened with debts he was unable to discharge, he resumed, together with his pen, his cheerfulness. Their mutual industry was sufficient for their decent and moderate subsistence.” The inhumane creditor is overridden by law, and a useful citizen returned to productive activity.

While Brown was writing Arthur Mervyn, what he calls the “laws in favor of insolvent debtors” existed in a shifting patchwork of state ordinances. Very few citizens would have had access to the kind of discharge Carlton received. The first federal bankruptcy act was passed in 1800, just after the publication of Arthur Mervyn. Given the extensive political debate around the 1800 law, the question of bankruptcy would have been in the air when Brown was writing the book. Legislators discussed the same problems suggested by the novel: How could the law protect insolvents like Carlton, while leaving the villainous and the irresponsible to their fates? Who, in other words, deserves a slate wiped clean, a second chance?

The question has proved difficult, to this day. The 1800 law lasted only three years, and no federal legislation had any staying power until the end of the nineteenth century. Even after another century of refinements, the Manichean quality of bankruptcy appeared again in the title of the 2005 revision to the law: the Bankruptcy Abuse Prevention and Consumer Protection Act. Creditors (specifically, credit card companies) had come to feel that bankruptcy relief was obtained too easily, and with too little shame. Most commentators agree that “consumer protection” is much less a focus of the law than creditor protection, but the title does reflect the continuing sense that a commercial society needs some way to offer relief from overwhelming debt. Elizabeth Warren, who strenuously opposed the act, argued that, “If Congress is determined to sort the good debtors from the bad, then it is both morally and economically imperative that they distinguish those who have worked hard and played by the rules from those who have shirked their responsibilities.”

The 2016 election (like the publication of Arthur Mervyn) proved one of the rare moments when debates around bankruptcy emerged from legislative and legal chambers into popular culture, with self-styled “king of debt” Donald Trump bragging about his companies’ multiple bankruptcies as demonstrations of business savvy while a Hillary Clinton ad titled “Who Got Hurt?” presented, over murky scenes of Atlantic City, “How Donald Trump made millions while bankrupting his businesses, laying off his workers, and stiffing his contractors.” In the terms of this article, Trump is a Welbeck—a swindler whose careless investments wreak havoc on individual lives and the national economy, protected from Welbeck’s fate by his “brilliant” use of bankruptcy law.

But Arthur Mervyn is neither a Carlton nor a Welbeck, neither a good debtor nor a bad one. As often as he is penniless, he is lucky; as often as he is lucky, he is foolish; as often as he loses credibility, he talks his way back to credit. At the novel’s end he finally achieves financial stability by marrying well—indeed, by abandoning his first love to be the second husband of a wealthy European. As Arthur prepares to depart for the Old World, he leaves us with the sense that under American capitalism, speculation and diligence alike are mugs’ games.

Perhaps we are more than ever in need of the idea of Arthur Mervyn, who is such a shameless bankrupt, who can turn inability to pay into a backward form of currency, a constant stream of fresh starts. Arthur is a free radical in the system of credit and debt, punishment and forgiveness.

Reading Arthur Mervyn as a book about debt and relief, we are reminded that it might be possible to be penniless and free, to take insolvency as opportunity.

Further Reading

The text of the novel referenced here is Charles Brockden Brown, Arthur Mervyn, or Memoirs of the Year 1793 (Kent, Ohio, 1980), first published by H. Maxwell, Philadelphia, 1799. For a thorough and excellent discussion of debates around bankruptcy law in the eighteenth and nineteenth centuries, see Bruce Mann, Republic of Debtors: Bankruptcy in the Age of American Independence (Cambridge, Mass., 2009). Mann’s wife, Senator Elizabeth Warren, is equally lucid and erudite on the legal and social aspects of bankruptcy. Her books on the topic include As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America (Frederick, Md., 1999) and The Fragile Middle Class: Americans in Debt (New Haven, 2001), both coauthored with Teresa Sullivan and Jay Westbrook, and The Two-Income Trap: Why Middle-Class Parents Are Going Broke (New York, 2003), with Amelia Tyagi.

This article originally appeared in issue 18.1 (Winter, 2018).

Katherine Gaudet is associate director of the Honors Program and affiliate faculty in Humanities at the University of New Hampshire. Her scholarly focus is the cultural and social history of reading practices, which she sees as part of a larger project of linking humanities scholarship with public discourse. She is also a freelance editor and writer in southern Maine, where she lives with a charming bankruptcy lawyer and their two children.