I was recently invited to appear on television and provide the morning news audience with a historical perspective on the most recent global crisis to visit the industrial economy. The interview did not go very well. The show’s anchors kept pressing me to name names, to finger those villains responsible for past crises and the earlier misfortunes of millions. Who were the Madoffs of yesteryear, they wanted to know. Rockefeller? Carnegie? Jay Gould? Shylock?

Fortunately, I have a weak memory for names. And so, I tried to explain that assigning blame to this or that personality was liable to distract us from the actual sources of crisis, which are imbedded in the very structure of the economy. Even such “usual suspects” as underconsumption and overproduction, technology gaps, erratic price movements and soaring (or plummeting) interest rates, coupled with speculative frenzies and the abandonment of the monetary standards of old cannot explain the stubborn recurrence of crisis. Disorder, I declared, was essential to the normal workings of the system, the “price” we pay for capitalism’s breathtaking ability to reorganize itself in ever-more profitable incarnations of market-sponsored exchange.

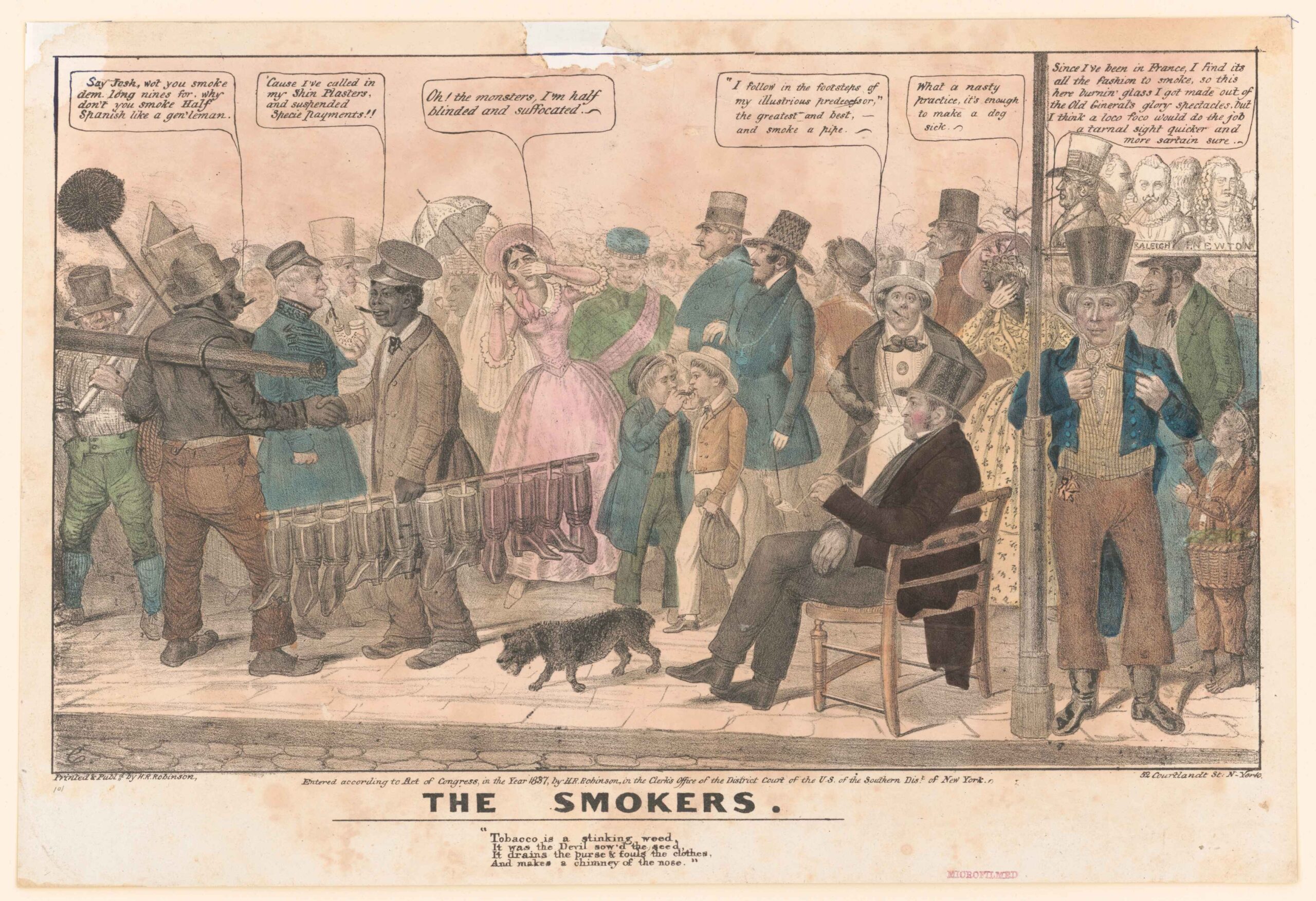

“It was the best of times, it was the worst of times,” Dickens wrote in a different context, but one that nevertheless provides us with an apposite slogan for modern economic life. That economy has been systematically built on borrowed money. It is fair to say, in fact, that the creation of credit is one of capitalism’s great production projects. But in contrast to other manufacturing efforts, credit can be conjured out of nothing, for it rests solely on the promise to pay sometime in the future. It is, as a consequence, a force that feeds upon itself, expanding without tangible limits, and so serving as a most dynamic engine of growth and enrichment. That is why conflicts over the production of credit—over control of the money supply—have accompanied the whole political history of America. But the system is no less vulnerable to economic than to political complications. Failure to pay one’s debts, for instance, or sudden shifts in the cost of credit—which soon becomes a commodity traded in its own right (representing “the value of things without the things themselves,” as Georg Simmel observed in his Philosophy of Money)—or the incessant movement of investment capital from one market to another in search of enhanced earnings can effectively destroy what the financial system was originally designed to create.

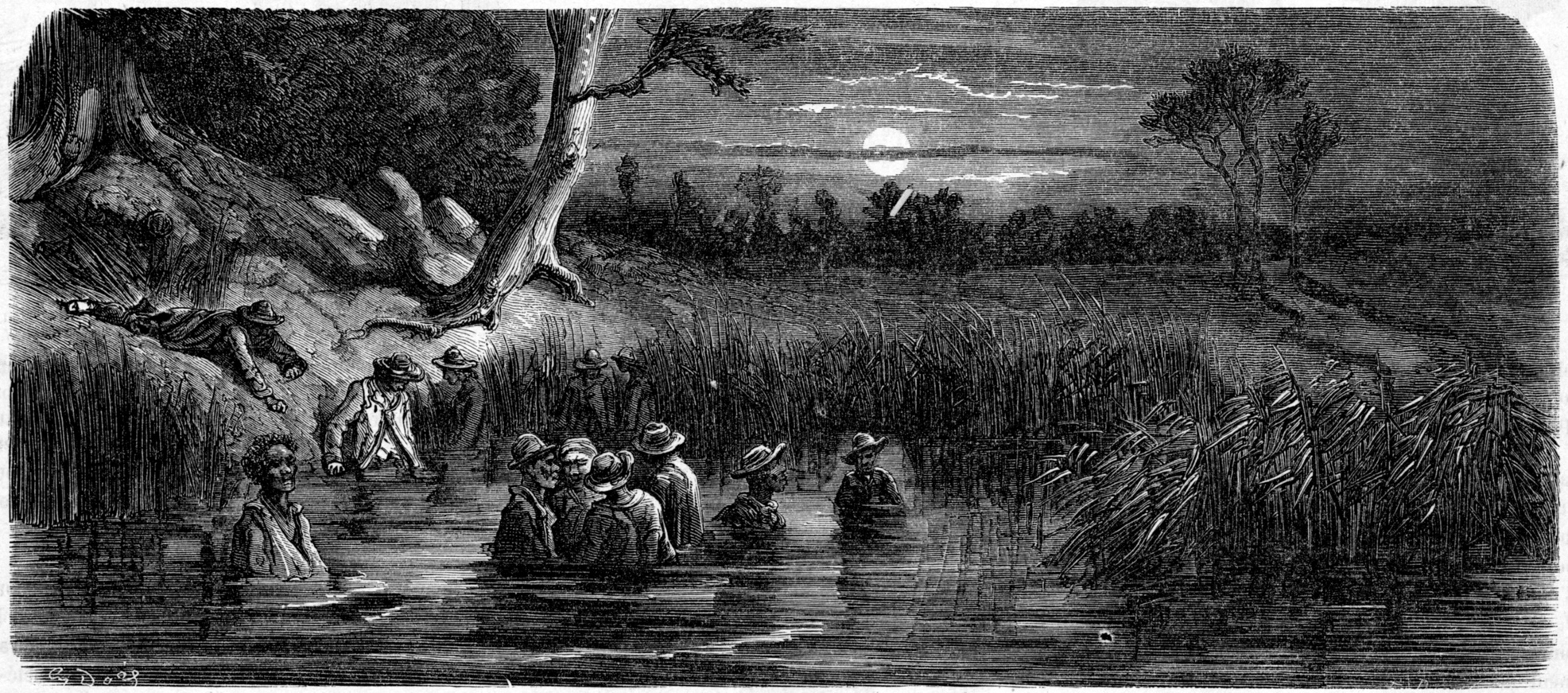

This is what brought Henry George to observe in Progress and Poverty (1879) that “the phenomena we class together and speak of as industrial depression are but intensifications of phenomena which always accompany material progress.” As such, the escalating competition, narrowing profits, and declining wages that portend crisis also constitute a “wonderful moment” for accumulating, innovating, and expanding the economy, according to the sociologist Giovanni Arrighi, who also argued that this pattern was already evident in early modern Europe. Nevertheless, industrial revolution altered the meaning of such moments. The social emergency that followed the economic downturns of 1819, 1829, 1837, 1847, and 1857 “was a new thing,” Charles Beard explained, signaling a changed relationship between culture and the material world. The modern experience of want could not be compared to the chronic shortages that had long characterized agrarian life precisely because it now occurred under the aegis of economic growth and physical abundance. More significantly, problems in liquidity, shortages in supply, or a decline in investment were no longer just the concern of merchant circles. They affected whole populations.

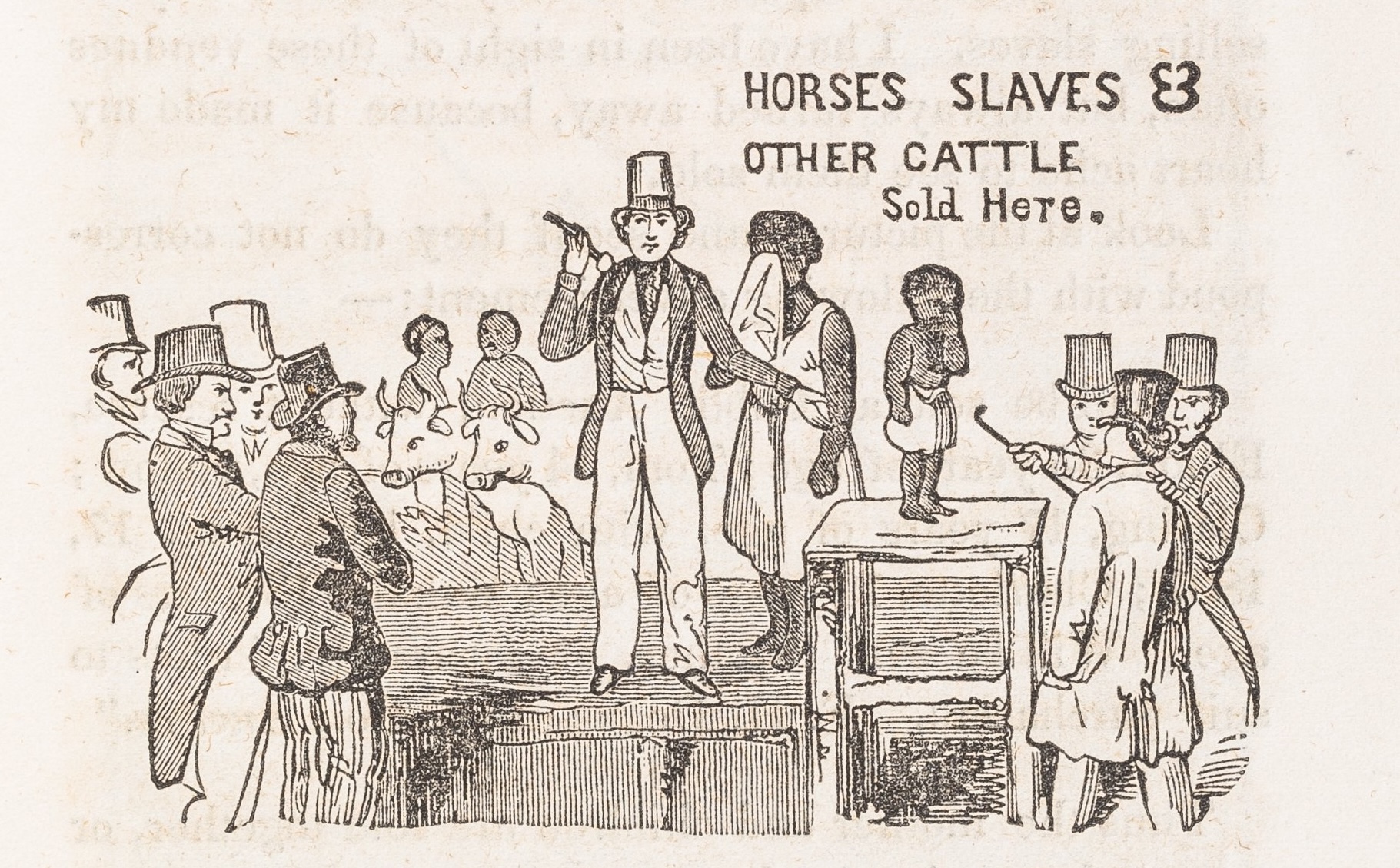

The resulting hard times are a highly discriminatory event, which found notorious expression at the pawnshop. This was where credit was supplied to a growing population of free men and women who otherwise had few assets with which to collateralize a loan. They consequently traded in the very stuff of their existence: their bed sheets, utensils, clothing, and jewelry. The pawnshop emerged as a unique kind of banking institution in the new economy, and a sordid site of industrial poverty. In fact, as Peter Stallybrass argued in an essay on “Marx’s Coat,” the indigent classes understand better than anyone else the “double life” of commodities by which the basic objects of everyday use keep mutating into the basic objects of exchange. The life of the poor, in other words, is saturated with market logic, a logic experienced as the perpetual loss of one’s possessions to the anonymous forces of greater purchasing power.

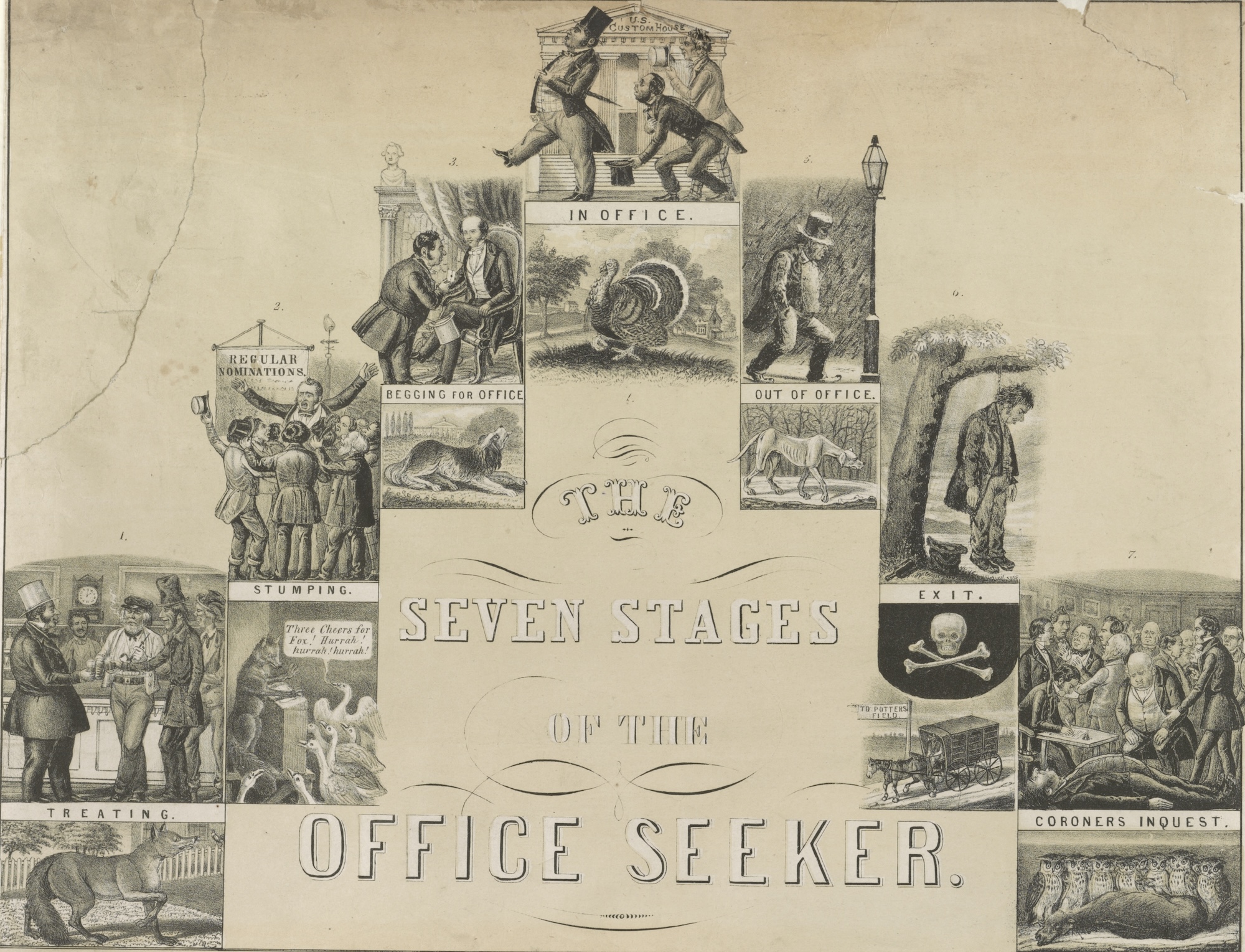

The “everlasting uncertainty and agitation” at the core of this system, Marx himself never tired of exclaiming, was not unknown to the propertied classes either. The “embarrassments and failures of sudden poverty falling on the opulent” was no less apparent to observers of nineteenth-century America than were the “thousands left destitute of employment, and perhaps of bread.” A glimpse of what this might mean in practical terms is provided by the diary entry of a failed businessman summing up the last five years of dashed ambition:

1852, July—for the first time in its great reality I am embarked in business, […] a few short months and destruction defines the position of my affairs—and (April 1853) sorrow commences—dread of offended creditors—hopes dashed to earth—the offer of compromise—the sympathy of friends—the hunger of creditors—all pass swiftly through my mind. Then the assignment—and the unburdening of a load of care—I look upon my children and bless them and their mother and depart, to find in Western lands what they could never give—a home and soon—the return … 1854, May 1—again in the field—a clerk—and in the old business in which I was reared—Flour—with a good honest quaker … here I find a stopping place until 1857 March 1st … May 1/57 John J. Marvin my brother enters into a limited partnership with our father and I am employed by him—a sorry year.

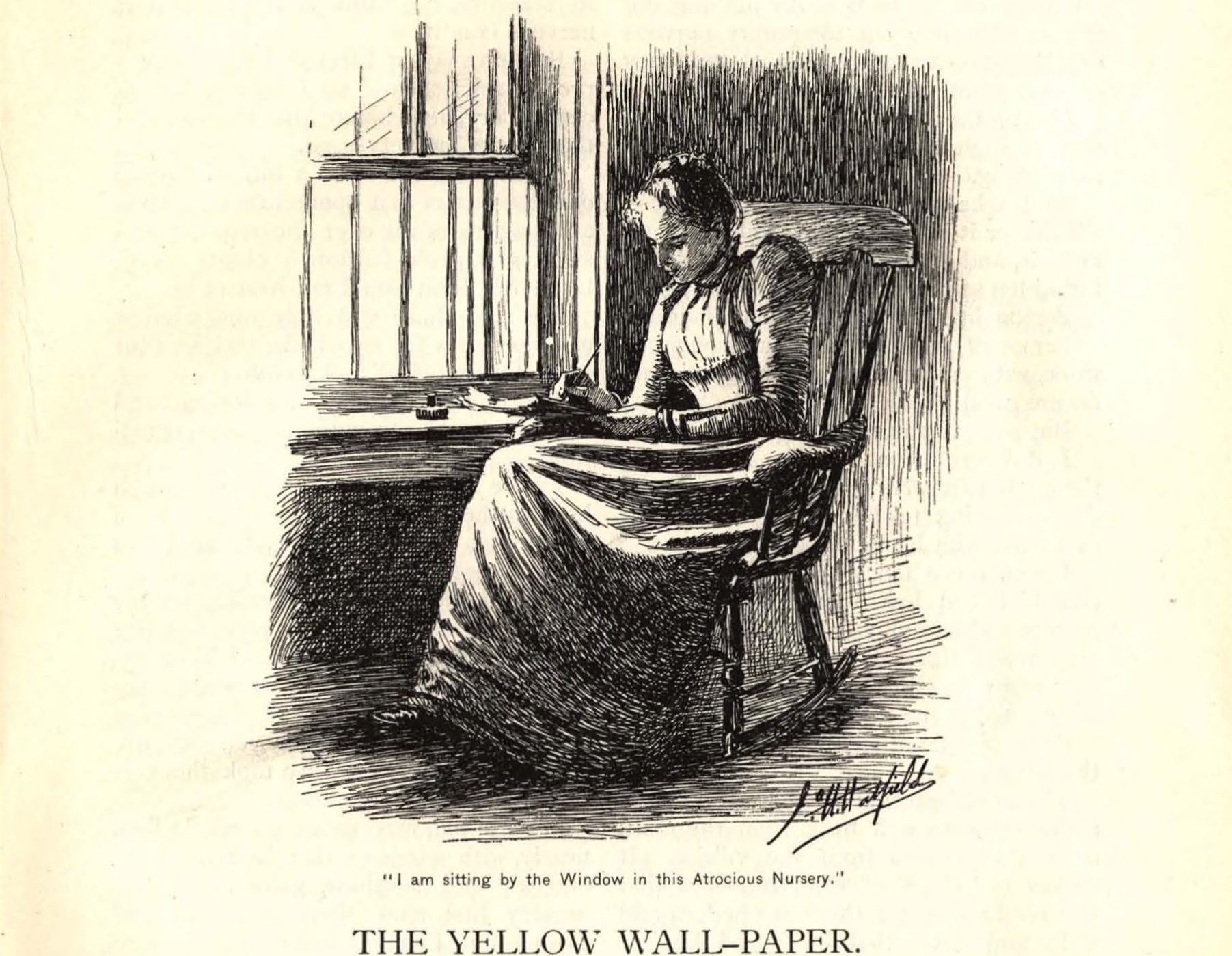

The risk economy proves to be the least protective of all built environments. It offers no safeguards from its incessant agitations and uncertainties, not even to those who stand to gain the most from it since their gains are, of course, derived from those same agitations. This is why the bourgeoisie began to accouter their lives with personal bric-a-brac and family heirlooms, that which the poor were ever having to pawn, and why the pawnbroker himself emerged as a favorite object of polite revulsion who symbolized the degradation of the market (while subconsciously suggesting that the market itself might be the actual source of degradation). The capitalist classes, in fact, have their own version of the double life of things. It is manifest in the opposing meanings they assign to value, which simultaneously represents the price of something as adjudicated by the marketplace as well as that which is “priceless” or, in other words, immune to such adjudication. This duality effectively marks the boundary between rich and poor, between their respective ability or inability to keep their possessions—and themselves—safe from capitalism. Incorporation laws constituted the state-sponsored acme of such protection, as well as capital’s unconditional victory in the class war. It was a most unmagnanimous victory: many years would pass before government organized public welfare assistance for those who needed the most protection.

Defense from the market was such an urgent priority because the system kept crashing, like a “sudden and swift … typhoon,” a “whirlwind that wrecked and scattered the earthly fortunes and hopes of thousands,” subsequently leaving “the spinal nerve of all the great businesses of the world … paralyzed.” That was how things appeared in New York after the “sorry year” of 1857, as merchants, bankers, brokers, and “all the clerks they could spare for the hour” gathered at “change” every day at noon, not to do business but to pray. Could their supplications redeem the past sins of over-trading? Frankly, their contrition had a distinct air of opportunism about it. Or, as Baudelaire, no friend of the new ruling classes, remarked of such displays of bourgeois rectitude, “for the merchant, even honesty is a financial speculation.” And, indeed, the spiritual impoverishment of the propertied classes is the central theme of Dickens’s Hard Times (1853), a work dedicated to Thomas Carlyle, England’s leading agnostic regarding the new liberal religion of progress. Hard Times presents us with a gallery of industrial-age rogues, including Thomas Gradgrind, a devout disciple of “hard facts” for whom system and statistics were at once means and end, and Josiah Bounderby, the hard-hearted arrivisté who has invested all his personal capital in promoting his own self-made myth. Both were truly indigent, Dickens shows us, in ways that no economist could measure, but which bring to mind Tocqueville’s well-known description of Americans as “restless in the midst of abundance,” citizens driven by “distress, fear, and regret” in searching out the shortest route to prosperity and, once finding it, continuing to search. Speculative mania thus proves to be a personal as much as a social condition, and so panic and depression became psychological and not just economic categories for modern times.

But isn’t “acquisitiveness” a part of our very nature, Max Weber famously asked, and proceeded to answer in the affirmative. “It is and has been found among waiters, doctors, coachmen, artists, tarts, venal officials, soldiers, brigands, crusaders, frequenters of gambling dens, [and] beggars … in all ages and in all countries of the world.” Greed, Weber went on to argue in convincing fashion, has nothing to do with capitalism. If anything, the opposite might be the case: the industrial economy represented an unprecedented effort to rein in, or at least systematize, this most irrational and impulsive of human traits. But that is precisely what was so radical and subversive about the new market order, for it showed that rationality encouraged chaos. Despite all the images of typhoons, whirlwinds, and paralysis—and, more recently, tsunamis and toxic loans—capitalist crisis is clearly no natural disaster. Panics, crashes, depressions, sell-offs, bankruptcies, and lay-offs are insistently social events and industry’s astounding success in liberating humanity from the stinginess of nature only underlines the fact that indigence must also be of industrial origin. Society produces poverty in the same way—and at the same time—that it produces wealth.

And so, “Hard Times” emerge as a form of schizophrenia, diagnostic shorthand for an economy that is always in crisis, and subsequently never in crisis, whose life-granting profits are at once a paralyzing toxin. This is our double life of things, for better and for worse.

This article originally appeared in issue 10.3 (April, 2010).

Michael Zakim is the author of Ready-Made Democracy (2003), a political history of men’s dress, and of a forthcoming study of the business clerk tentatively entitled “Accounting for Capitalism.” He teaches history at Tel Aviv University.