Commercial correspondence rarely qualifies as an exciting read, as I learned while going through the correspondence of an eighteenth-century flour merchant from Philadelphia, Levi Hollingsworth. His letters are kept at the Historical Society of Pennsylvania, and I was using them as part of a larger, quantitative project on commercial profit in the early modern era. I was working from digital copies acquired by my Paris research unit, and my primary task was to compile all the information the letters contained on the suppliers and customers listed in an account book for 1786. I read each letter carefully, looking for names. This was not always easy: Hollingsworth sold flour on commission on behalf of a number of countryside farmers, millers, and storekeepers from eastern Pennsylvania or northern Delaware, who also bought exotic products from him, such as molasses, rum, or tobacco. Some letters were written in barely legible English, sometimes mixed with words in Dutch or German. Even in more legible correspondence, abbreviations were ubiquitous, and a lot of sentences were too allusive to determine who the person mentioned actually was.

The contents were also rather repetitive. Rural customers and suppliers usually mentioned goods sent and received, and apologized for delayed payment, with the requisite reference to the lack of metallic currency—but next month, surely, things would look up. Merchants sent similar information, but their payments were more timely as a rule, and there were added elements: details of complex transactions including personal IOU’s (“bills” or “notes of hand”) endorsed, accepted, or discounted, considerations on the “dearness of money,” i.e. the level of interest rates (always too high), and information on the state of the market in which they operated—this last, a gesture of goodwill toward their correspondent. Hollingsworth’s agent downriver from Philadelphia along the Delaware, Solomon Maxwell, reported news of cargo sent, of Jamaican captains buying foodstuffs, and helped link his principal to the network of local economic actors supplying him with the flour he would resell, for a fee—usually the customary 2.5 percent.

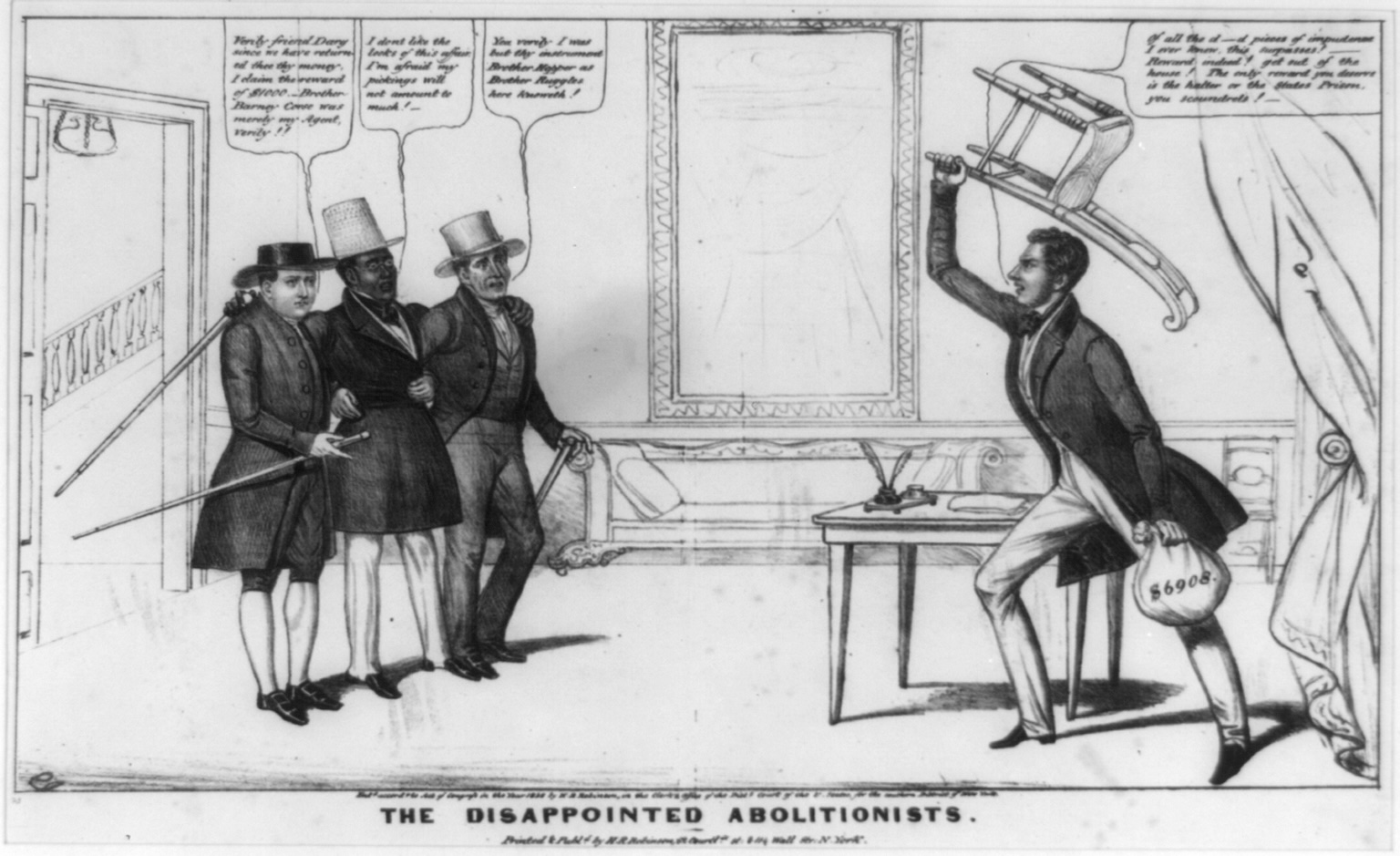

Philadelphia seen from the Delaware, 1778, “An East Perspective View of the City of Philadelphia, in the Province of Pensylvania in North America; taken from the Jersey Shore,” engraved from a drawing, printed for and sold by Carington Bowles (London, 1778). Courtesy of the American Antiquarian Society, Worcester, Massachusetts.

I quickly determined what Maxwell’s role was, and would have neglected the rest of his letters, with their humdrum news given in between the repetitive formulas of “Dear Sir” and “Your obedt servant,” had I not been on the lookout for any information I could find on any other people the correspondence would mention. There was a Mr. Potts, for instance, appearing in a letter from Maxwell dated December 22, 1786, and written in Port Penn, a landing below Wilmington, on the west bank of the Delaware river. Hollingsworth’s emissary wrote that “W.M.&Swanwick’s Mr. Potts is here & says T Canby has sold them 500 bbs @ 40/- & he expects remainder at that price but I shall engage all near this place early tomorrow & they must call on us for remandr.”

Translated into today’s English, this meant that a Mr. Potts, working for the firm Willing, Morris & Swanwick, with whom Hollingsworth also had dealings (and which belonged in part to Robert Morris of Revolutionary War fame), had bought 500 barrels (“bbs”) of flour, since the letter spoke of nothing else, from one Thomas Canby, to whom Hollingsworth occasionally sold tobacco and rum. The Canby family owned a mill in Wilmington, Delaware, and Thomas Canby (not to be confused with a homonymous earlier member of the Colonial Assembly of Pennsylvania who may have been his grandfather) may have run a store next to it. The price Potts paid was 40 shillings a barrel, that is, two (Pennsylvania) pounds, an amount which fit with similar sales recorded in Holligsworth’s account books the month before.

It turned out that Potts did not appear anywhere in Hollingsworth’s accounts, and in and of itself the particular transaction between he and Canby that the letter reported was unremarkable. But the sentence was striking in another respect. Was Maxwell really explaining that he would buy off the entire supply in the area, so that the unfortunate Potts would have to come to him to get more flour, and presumably be forced to pay a higher price? Could we assume that this lowly agent of a midsize flour dealer on the lower Delaware was behaving like Jay Gould a hundred years later? Apparently, yes. A few minutes later, I stumbled upon a second letter from Maxwell, this time sent on December 27, five days later, from Christiana Bridge, a key transportation hub on the road to Maryland, inland to the northwest of Port Penn and a few miles southwest of Wilmington. Maxwell wrote that “Mr Potts is down for W.M.&Swanwick can’t get their load as yet & in consequence of Mr Emblen coming & applying to R. Tuckness & others to load him before I saw him thought best to take in sundry Millers at Back Creek & Bohemia & Keep what was in Shallops.”

There was only one possible interpretation of these two sentences, as far as I could see: Maxwell was running a very efficient, very ruthless market-cornering operation. He was tracking closely not only Potts, but anybody willing to give Potts a hand—Emblen, who appears elsewhere in the correspondence as a Hollingsworth ally, had unwittingly stepped in on the wrong side of Maxwell’s speculation, offering to help the newcomer, whereupon our monopolist made sure to take off the market not only his own flour held on sloops along the Delaware, but also whatever flour held by neighboring millers would have been obtainable through the would-be Good Samaritan, who was probably also told to stop interfering.

So the meaning of the original sentence was indeed that of a large-scale, successful market manipulation, freezing out an interloper by refusing to sell. This, in turn, had major implications for the structure and functioning of this market. Both letters could be written only in a universe in which a whole population of farmers, storekeepers, and millers was networked efficiently enough to be turned into a market-controlling, unified whole across an area of maybe twenty or thirty square miles around Wilmington, at least for a few days, by one individual. In other words, each and every local flour provider in the region had accepted to act in concert with Maxwell, as a member of a disciplined group.

This was an amazing feat of coordination. Large firms such as the various European East India companies did achieve at least partial control of the markets in high-value, exotic products—tea comes to mind; but their monopoly was legally sanctioned. And by studying large colonial merchants in France, I had myself found out that they were able to create similar informal monopolies on niche markets in colonial products at the level of large Atlantic ports, as with sugar from the West Indies in Bordeaux. But flour was not a rare commodity, and the flour markets of the early republic were very open, with many actors both on the buying and the selling side. How could monopoly control possibly be achieved in such markets? There was no mention of coercion, and no basis in what I knew of Delaware in 1786 to imagine jackbooted agents of a flour dealer going door to door to enforce the will of their boss. So what economic sociologist Avner Greif has called “weak ties”—informal personal relationships between actors based on socially accepted behavioral standards—must have been enough to enforce the unity Maxwell’s plan required.

I knew that Hollingsworth had personal relationships with many people in the area, whether through business dealings or family ties. He was an agent for dozens of farmers and millers around Wilmington—his “flour book” for the year 1784-86, in which he listed all the people whose flour he sold on commission, contained hundreds of accounts. Anyone relying on him to access the flour markets in Philadelphia or on the Delaware would enter a continuous, long-term cooperative process, extending over years. In many cases, the letters I had read also revealed the routine exchange of small services and favors, letters and small parcels passed on, common acquaintances taken care of. Credit was also an issue; Hollingsworth often allowed his customers to overdraft their accounts, acting as a bank making small loans. When he drew up his balance sheet in 1788, our Philadelphia merchant listed no fewer than 389 names of people owing him money on their account. And there was also the fact that he was a very good agent, as proved by his success at winning over such a large clientele: one’s flour would be in good hands with him, and would be sold at a good price.

Being frozen out of Hollingsworth’s network thus meant losing access to a range of services, to easy credit, and potentially losing money by having to use a less savvy agent. And there were other, more local considerations. Hollingsworth’s family owned large holdings in both Delaware and Maryland around neighboring Head of Elk (today’s Elktown), and breaking with him could lead to a tarnished local reputation and loss of standing. Overall, it would have been both financially and socially irrational to cross a powerful and influential figure such as Hollingsworth just to help a complete unknown such as Potts. This is why, if the Philadelphia merchant was willing to draw on the goodwill he had gained over the years in order to block Potts’ entry into the local flour market, local storekeepers and millers would certainly oblige. Indeed, Maxwell did not seem to find the whole operation exceptional or difficult, and mentioned it only in passing.

The consequence of all this was also that these “market” operations did not take place on what we would call an actual “free market.” Maxwell’s letters proved that he had succeeded in building what economists call barriers to entry, preventing outsiders from coming in and becoming competing market actors. And these barriers were impressively strong; Robert Morris was one of the most powerful men in the United States in 1786, and yet his power evaporated around Wilmington, a mere forty miles south of his residence. One key element was the self-reinforcing network of mutual cooperation that Maxwell’s letters implied, which prevented people like Potts from entering the local market. Another element was information. Potts does not seem to have been even aware of who his opponent was. Indeed, it is hard to imagine a scenario in which he might discover Maxwell’s shenanigans, short of sheer luck, such as sitting in a tavern next to some drunk who would brag that he had refused to sell flour to an interloper on orders from Mr. Hollingsworth. Maxwell, on the other hand, could apparently follow Potts’s every move on an almost hourly basis. Insider information was a key to market manipulation, then as now.

Wilmington was not the end of the story, either. The fact that Hollingsworth held a dominant position as a flour buyer also meant that he could try to turn it into a dominant position as a flour seller. With such a stranglehold on flour movements toward Philadelphia between the Delaware and the Chesapeake, he must have had a huge comparative advantage within Philadelphia itself, if only because he benefitted from a steady supply from secure and nearby sources. If the area under his control is any indication, it may well have turned out that only a handful of operators in the Quaker city and along the lower Delaware effectively controlled most of the flour supply there. They could easily strike illicit agreements, just as the sugar importers in Bordeaux were doing, in order to freeze out newcomers on the endpoint market as well. And there were other possible comparative advantages, not implied by the letter, such as the ease with which large operators could afford to engage in dumping wars, or the superior knowledge of the product and better ability to guarantee quality which came with being a long-established, strongly positioned dealer.

In the end, this one short sentence I caught almost by accident turned out to be very significant in the research program I was helping implement. Once I had unpacked all its meanings and implications, I could use it as proof of the existence of a self-reinforcing system of market control and manipulation by a circle of insiders, a technique I had already come to suspect to be generalized and constitutive of the early modern political economy. If such an environment as the flour markets in the lower Delaware valley in the 1780s could leave open the possibility of monopolistic control and market manipulation through insider information and informal price-fixing agreements, then any market at the time could be similarly controlled. The fact that the letter’s reference to such monopoly control was so casual also spoke to the breadth and depth of the economic power locally wielded by merchants. All in all, the sentence helped validate our project by confirming that the free, open, transparent market of the economists is not necessarily a fitting model for early modern market mechanisms.

But the main lesson I would take away from this experience was one of method, not of content. In most cases reported here in Tales from the Vault, the process of historical discovery entailed piecing together numerous minute or novel bits of evidence to rebuild a lost picture. The preceding story is different in one respect: the picture I found myself facing was captured in thumbnail form in a lone sentence, which was all the evidence I could find in the batch of letters I ended up reading. Other smoking guns may be buried deep elsewhere, in letters from or to Hollingsworth dating from other years, but I never got around to them. How can I argue then that one sentence could be enough to reach the broad conclusions I present above?

Of course, these conclusions fit our knowledge of merchant practice at the time. But I would go further: the evidence contained in the sentence, however minute, is still hard to gainsay. I have never been able to come up with any other plausible narrative which would explain away its contents—though readers are more than welcome to propose their own interpretation, and prove my lack of imagination by the same token; I promise full acknowledgement in the paper I would have to publish to recant my earlier erronous ways. In the meantime, though, I will stick to the idea that this group of 17 words offered a window onto a whole economic universe, and also that as historians we should be more willing to engage in “microreadings,” focused on drawing large amounts of information from a few highly significant words. This is what Carlo Ginzburg called the “scholarly apprehension of singularity,” crossed with what Natalie Zemon Davis taught us long ago about the necessity of close, anthropological readings sensitive to historical differences, but applied here to a single sentence in a single text. For one single sentence can tell us a lot sometimes, maybe even enough for a whole story, once we are prepared to dig deep into its many implicit meanings.

Further Reading

For Levi Hollingsworth and the Willing, Morris & Swanwick firm of Philadelphia see the archival presentations here and here.

On merchant practice and merchant networks, beyond the seminal article of Avner Greif, “Contract Enforceability and Economic Institutions in Early Trade: The Maghribi Traders’ Coalition,” American Economic Review 83:3 (June 1993): 525–548, classic descriptions are provided by Thomas Doerflinger, A Vigorous Spirit of Enterprise: Merchants and Economic Development in Revolutionary Philadelphia (Chapel Hill, 1986); David Hancock, Oceans of Wine: Madeira and the Emergence of American Trade and Taste (New Haven, 2009); Cathy D. Matson, Merchants and Empire: Trading in Colonial New York (Baltimore, 1998); and Francesca Trivellato, The Familiarity of Strangers: The Sephardic Diaspora, Livorno and Cross-Cultural Trade in the Early Modern Period (New Haven, 2009).

For recent research on merchant practice, including monopoly and market manipulation, see Manuel Covo, “I, François B.: Merchant, Protestant and Refugee—a Tale of Failure in the Atlantic World,” French History 25:1 (January 2011): 69– 88; Pierre Gervais, “Neither imperial, nor Atlantic: a merchant perspective on international trade in the eighteenth century,” History of European Ideas 34:4 (December 2008): 465–473; Pierre Gervais, “Crédit et filières marchandes au XVIIIe siècle,” Annales ESC 67:4 (October-December 2012): 1011-1048 (a translated English version is also available); and Silvia Marzagalli, “Establishing Transatlantic Trade Networks in Time of War: Bordeaux and the United States, 1793-1815,” Business History Review 79:4 (Winter 2005): 811-844.

Lastly, the idea of micro-readings is not new, nor does it come from history. One of the first theoretical expositions of it came from Jean-Pierre Richard, Microlectures (Paris, 1979). A historian’s version can be found in Carlo Ginzburg, John Tedeschi and Anne C. Tedeschi, “Microhistory: Two or Three Things That I Know about It,” Critical Inquiry 20:1 (October 1993): 10-35.

This article originally appeared in issue 16.2 (Winter, 2016).

Pierre Gervais is professor of American history and civilization at Sorbonne-Nouvelle University in Paris. A graduate of ENS Ulm, École des hautes études en sciences sociales and Princeton University, he studied the Industrial Revolution at first; his 2004 book, Les origines de la révolution industrielle aux États-Unis, received the Willi Paul Adams prize for best foreign book from the OAH in 2006. He turned then to the merchant economy, as head of the research project MARPROF, which led him to the Hollingsworth fund. The results of this project were published in Pierre Gervais, Lemarchand Yannick et Margairaz Dominique (dirs.), Merchants and Profit in the Age of Commerce, 1680–1830 (2014).