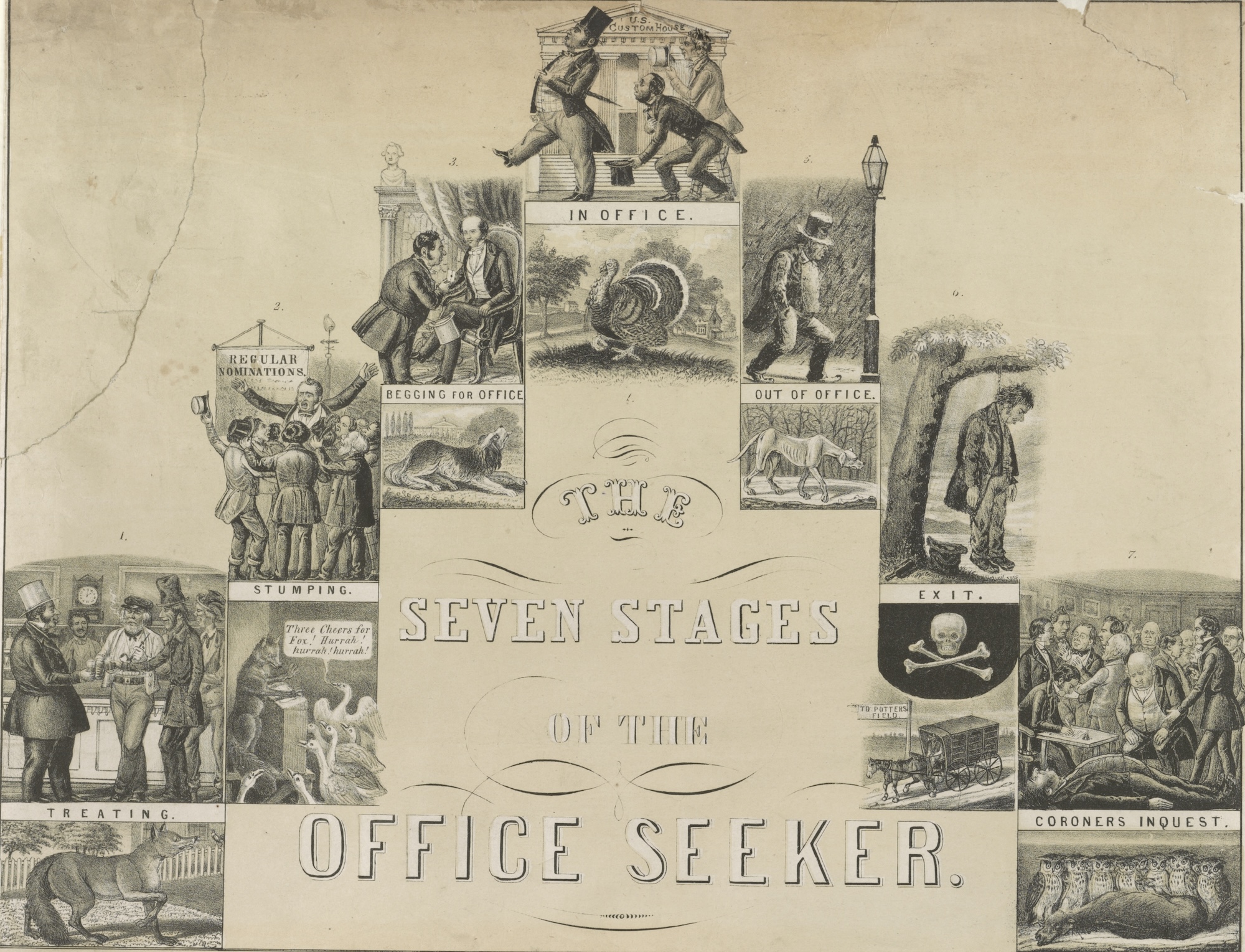

A mid-nineteenth-century prelude

The introduction of the Canada-U.S. Free Trade Agreement in 1989 has ushered in an era of much closer economic relations in North America. Could this relationship soon extend to the creation of a monetary union? The birth of the euro in 1999 has generated new interest in this question. Although few expect the U.S. government to embrace a new supranational North American currency any time soon, a number of analysts have speculated that Canada might create a monetary union by simply adopting the U.S. dollar in the coming years.

Would Canadians really ever agree to transform their monetary system in such a dramatic way? Little attention has so far been paid in the contemporary debate to an interesting historical precedent. At the time of the last comprehensive free-trade agreement between the two countries during the 1850s and 1860s, Canadian politicians did indeed embrace a new “dollarized” monetary system that was modeled on that of the United States. What lessons can be learned from this neglected episode in North American monetary history?

The First Era of North American Free Trade and Monetary Reform

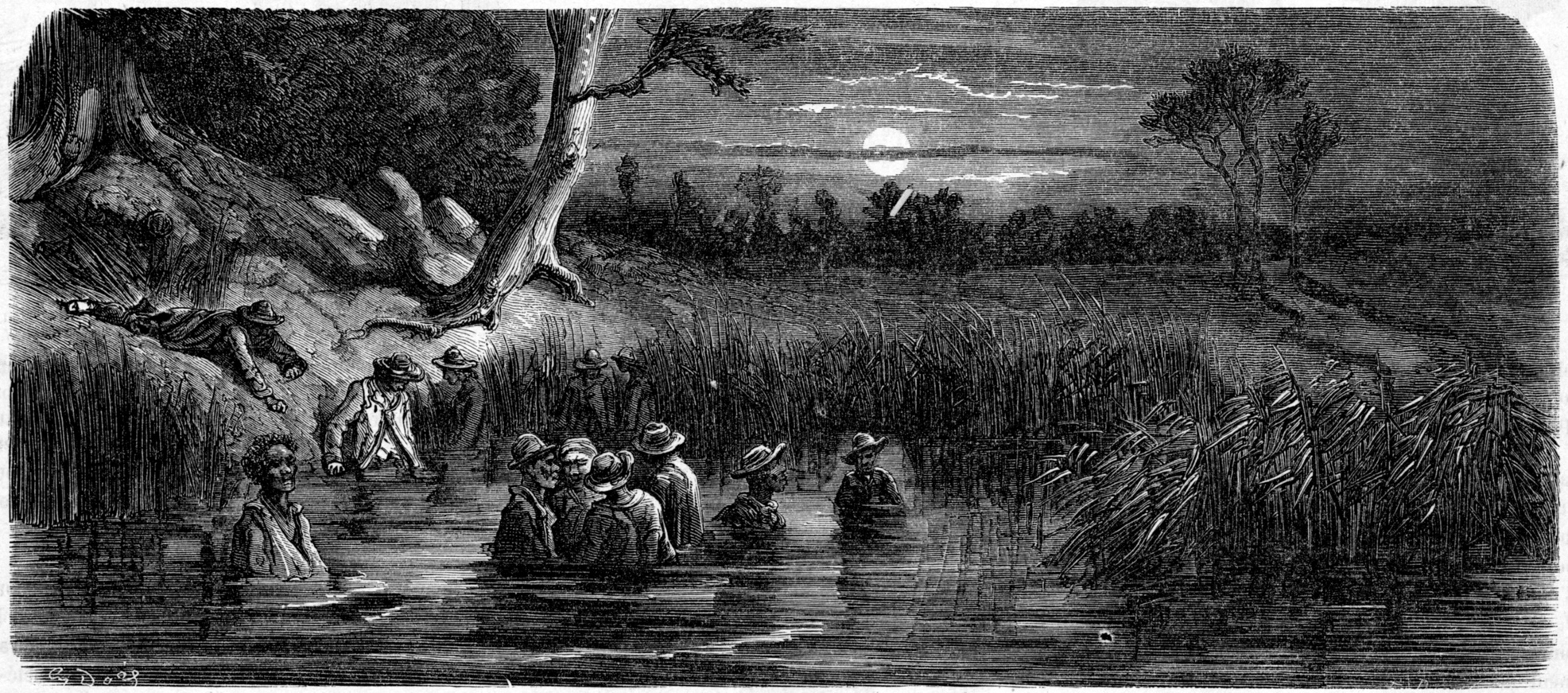

The idea of an integrated free-trade zone between the United States and Canada was first born in the wake of Britain’s decisions to abolish its Corn Laws in 1846 and reduce timber preferences throughout the 1840s. These moves sent economic shockwaves through the Canadian colonies by ending their protected export market in Britain. Many Canadian businesses quickly turned to the United States as their best alternative market, and cross-border trade expanded rapidly. Indeed, at one point, many prominent Montreal merchants even called for annexation with the United States. To forestall annexationist sentiments and to facilitate trade with the United States, the Canadian authorities successfully pressed for a free-trade deal with the United States, the Reciprocity Treaty of 1854-66.

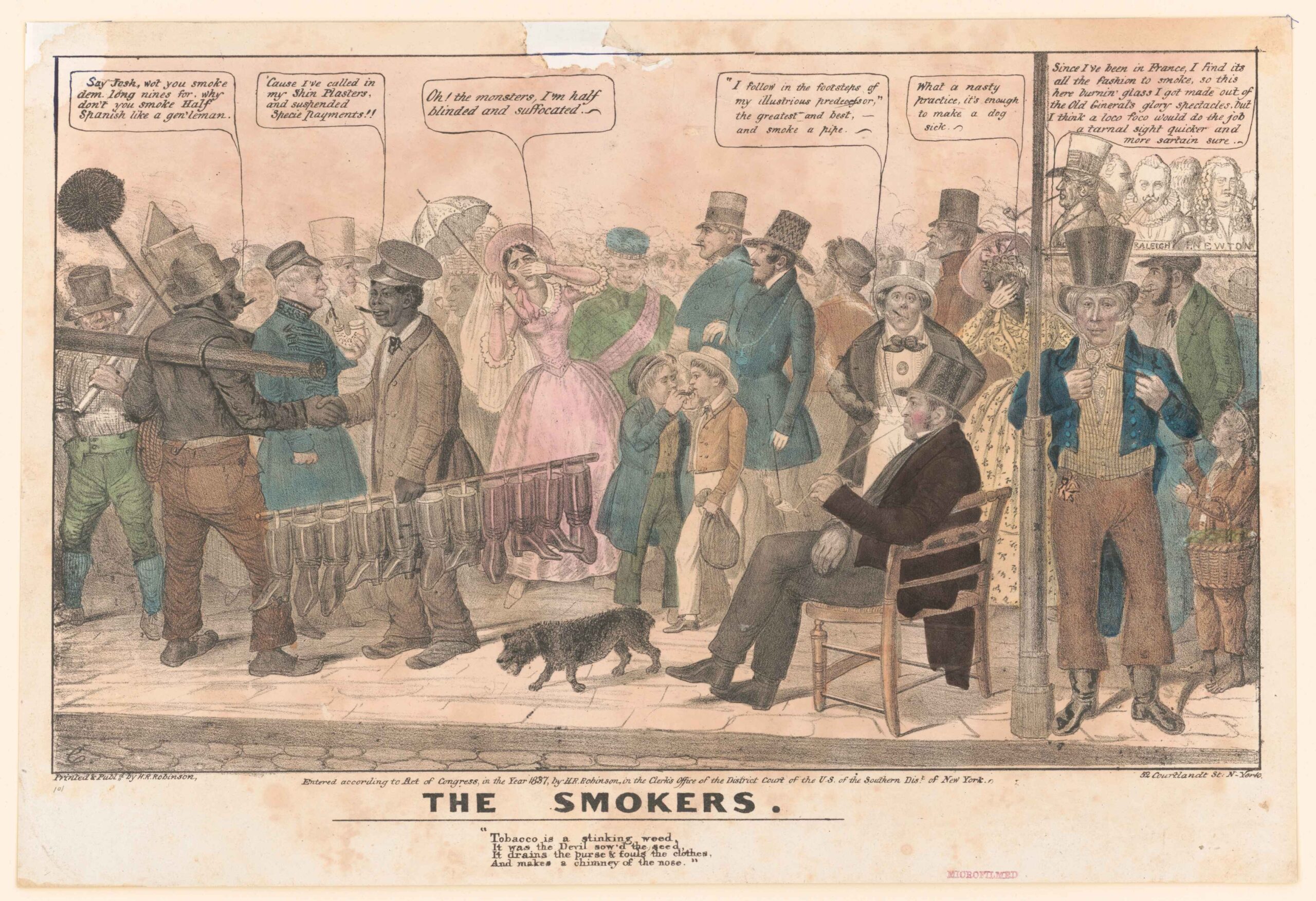

Then as now, intensifying North American economic integration prompted new interest in the idea of closer monetary ties between Canada and the United States. At the time, the bulk of the money supply in the Canadian colonies consisted of a motley collection of foreign coins whose value was rated according to the local sterling standards using the familiar terms of pounds, shillings, and pence. Each colony valued foreign coins slightly differently than the others, and in all cases, the official exchange rate between the two dominant coins in circulation—British and U.S. coins—contrasted with that existing in the United States at the time. The contrast was particularly large in the colony whose trade was growing most rapidly with the United States: the Province of Canada (which had been formed by merging Upper and Lower Canada in 1841). The British pound was rated at US$4 in the province, whereas its value was US$4.86⅔ within the United States. This difference in monetary standards, as well as that between the decimal-based dollar system and the sterling system, was a source of frustration to merchants involved in the growing cross-border commerce. These differences increased the costs merchants incurred in exchanging money, making cross-border price comparisons, and conducting basic accounting operations.

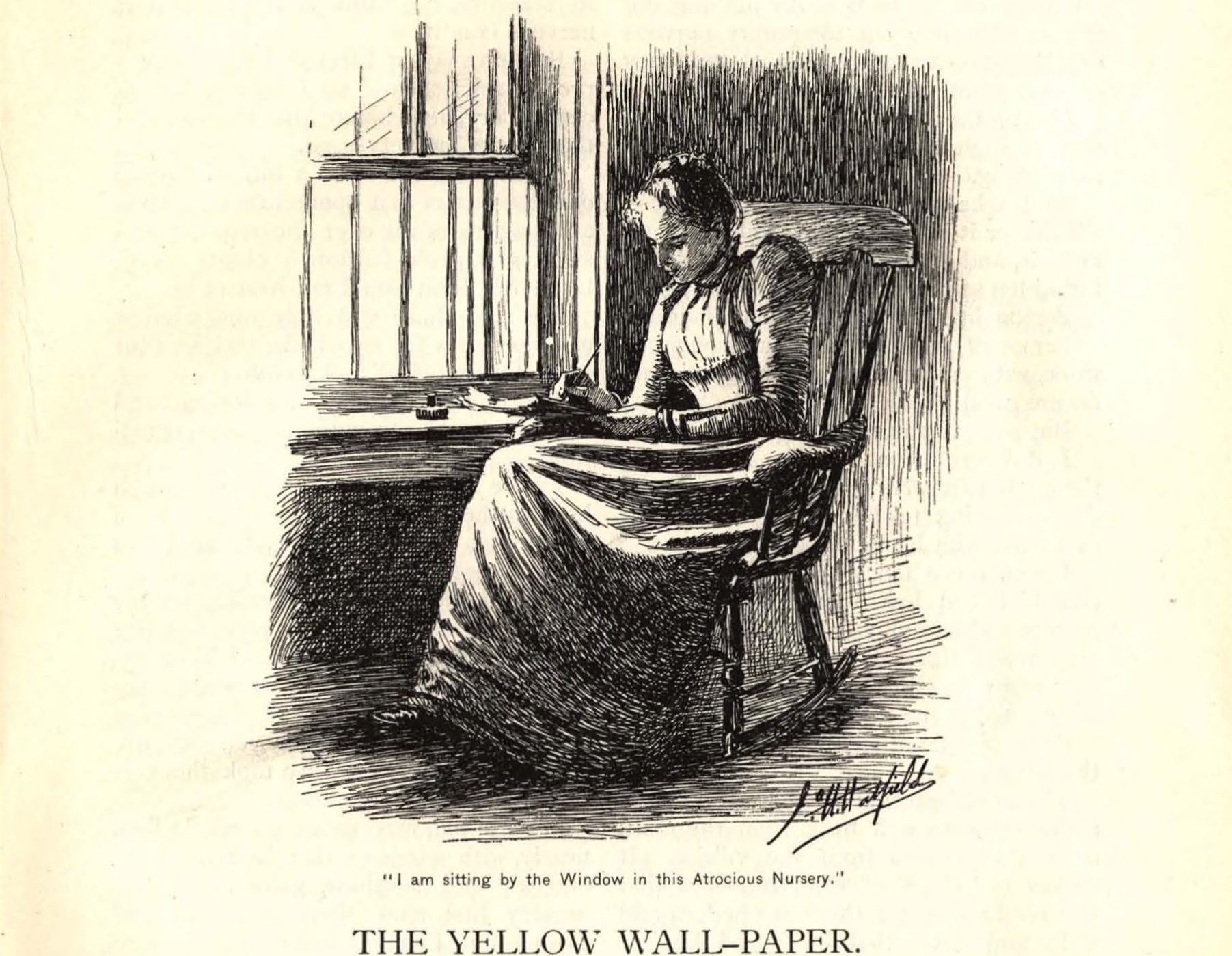

In the early 1850s, politicians in the Province of Canada made clear their determination to reform their monetary system. Particularly keen was Francis Hincks who held the post of inspector general from 1848-51 and that of prime minister from 1851-54. He had been a strong supporter of the political reforms that created the first elected Legislative Assembly in 1841, and he believed strongly that the province should be allowed to address its monetary problems without British interference. To this end, he proposed in 1850 that Canada issue its own silver and gold coins for the first time.

These coins, he argued, would be a source of pride to Canadians and allow the government to provide a more homogeneous and well-managed coinage by ending the colony’s reliance on foreign coins. But an equally important goal of the initiative was to facilitate trade with the United States. As early as 1841, when he had overseen the creation of a unified monetary standard for the new Province of Canada, Hincks had called for the adoption of a decimal-based dollar standard in order to simplify and foster cross-border trade. British authorities had opposed his idea then on the grounds that it would strengthen the colony’s ties to the United States and encourage annexationist sentiments. They had insisted instead on the introduction of the local sterling standard whose value was not determined by a U.S. dollar standard.

By 1850, Hincks was much more intent on implementing his proposal to reform the Canadian monetary system along U.S. lines. Though a leading opponent of the annexation movement, he still believed strongly in the need to expand trade with the United States, and he was closely involved in the early negotiations that led to the Reciprocity Treaty. In this era of rapidly expanding U.S.-Canada commerce, he found much more domestic support for his initiative to introduce a dollar-based monetary system. While under half of local businesses polled in the early 1840s had supported this option, a full 100 percent of those surveyed a decade later backed the idea.

British Resistance and the Birth of the Canadian Dollar

To minimize British resistance, Hincks initially proposed in 1850 that the province retain a sterling standard but simply alter its value to emulate that of the United States (i.e., to make one pound equal US $4.86⅔). But the British government would not accept this proposal and suggested instead the adoption of the British sterling standard and British coin (at least until a common coin for the colonies could be agreed upon). British authorities argued that this reform would ensure that the colony’s monetary system facilitated “the adjustment of Trade with the Mother Country.” They also objected that Hincks’s proposed coin issue would infringe on the royal prerogative.

When the British government disallowed Hincks’s act (despite its approval by the provincial legislature and local governor-general), Hincks submitted a new bill. In it, he accepted that Queen’s approval would be necessary for any coin issue by the province and even suggested that a separate coinage was not absolutely necessary. “That was more a matter of national pride than anything else,” he argued. While conceding this point, he became more provocative in arguing that a U.S.-style decimal-based dollar standard was now necessary for the province. His reasoning was as follows: “With the people of the United States . . . Canadians are brought into constant daily intercourse. They travel on the same Steamers and Railroad Cars—lodge at one another’s Hotels and carry on a most extensive Commercial intercourse with each other. To have an entirely different Currency . . . would be an intolerable inconvenience.”

Hincks’s new proposal was greeted enthusiastically in the province. One member of Parliament even “congratulated the House on the fact that people can now talk of dollars and cents without imputations of disloyalty.” Recognizing the political mood, the British government now backed down and agreed that the province could not only issue its own gold and silver coin (subject to the Queen’s approval) but even introduce the standard of value that Hincks suggested. In return, the British authorities asked Hincks to consider naming the new standard the pound and the new coins royals, half-crowns, and shillings. Discussing this request, one contemporary writer suggested that the British “may have considered it [the proposal for a dollar-based standard] to have too Americanizing a tendency, and been afraid that it might prove ‘the insertion of the thin end of the wedge.’”

Showing some flexibility, Hincks suggested that coin names were “of little consequence,” and he proposed the issuance of coins named royals, shillings, and marks, which would be based on a decimal accounting system (there would be one hundred marks in a royal and ten marks in a shilling). But other politicians in the provincial legislature were much less inclined to compromise on this point. Arguing that dollars and cents were “universally understood,” they favored a dollar-based system. So too did many outside the legislature. As Canadian monetary historian Adam Shortt has put it, “the very general opinion of the press was fairly expressed by the Toronto Leader in the statement, that in a country like Canada, situated on the borders of the United States and with more than one-half of its trade carried on with that country, it is necessary to adopt the system in force there.”

Responding to these sentiments, the legislature passed an act in 1853 that allowed for the issue of silver coin and legalized the use of a dollar standard. Although the government initially allowed the use of either the dollar-based standard or the old sterling-based one, the former quickly prevailed. By 1855, one government document reported, “[the adoption of the dollar standard] has taken place already in many parts of Canada; merchants keep their books, railway boards transact their business, hotel-keepers and traders make out their bills, in dollars and cents; bankers place their dollar on their notes as a regulating unit; the reciprocity treaty will greatly increase our trade with the United States, and our people are daily becoming more familiar with the decimal system in use there. The County Council of Lambton has recently ordered that dollars and cents shall be adopted as the system for keeping the county accounts, levying rates, etc.” The provincial government finally declared the dollar standard to be the exclusive standard of the province in 1857, and it issued the first silver coins denominated in this standard the next year.

The Province of Canada was not the only colony to introduce a decimal-based dollar standard in this period. New Brunswick adopted an identical one on an optional basis in 1852 and soon made it compulsory in 1860 when the colony first issued its own coins. Nova Scotia also embraced a decimal-based dollar standard in 1860, although it chose to value the dollar standard in a slightly different way to facilitate its maritime trade with the British West Indies. After Nova Scotia joined New Brunswick and the Province of Canada to form the new federation of Canada in 1867, Hincks (who had reappeared as finance minister in 1869) took the lead in eliminating that province’s distinctive valuation system, arguing once again that it was “necessary to assimilate the Currency with that of the United States.” Before they too joined Canada, the colonies of British Columbia, Manitoba, and Prince Edward Island (PEI) had also already chosen to embrace decimal-based dollar standards in 1865, 1870, and 1871, respectively, with values identical or very close to that of the United States.

Back to the Future?

The fact that Canada, still to this day, bases its monetary system on a decimal-based “dollar” standard (although one whose value is no longer identical to that of the United States) is thus a product of the last era of North American free trade. As we have seen, the Canadian dollar’s birth was the product of a desire to deepen North American economic integration in the mid-nineteenth century through the adoption of a monetary system based on the U.S. model. As we find ourselves in a new era of North American free trade, will history repeat itself? Will the desire for closer monetary ties this time around encourage Canadian policymakers to go one step further and fully embrace the U.S. dollar?

Some contemporary developments are indeed reminiscent of the mid-nineteenth-century period. A number of prominent Canadian business leaders and policy analysts have highlighted how the adoption of the U.S. dollar would help to facilitate cross-border economic transactions by reducing currency-related transaction costs. They also argue that the case for monetary union is strengthened by the fact that economic integration is encouraging some unofficial “dollarization” within Canada. Similar arguments were made by Hincks and others in the mid-nineteenth century.

At the same time, it is clear that contemporary Canadian supporters of North American monetary integration are encountering fiercer opposition than did their nineteenth-century counterparts. In the mid-nineteenth century, few policymakers took seriously the idea that a floating exchange rate could be used to bolster monetary autonomy by helping to insulate the national monetary system from external influences and constraints. They also did not consider that governments might use exchange-rate movements to encourage or discourage exports and imports in ways that fostered adjustments to balance of payments disequilibria. Both of these lines of thought would have been anathema to the gold-standard orthodoxy of the time. Since the 1930s, however, Canadian policymakers have been strongly wedded to a floating exchange rate for precisely these reasons. Indeed, so strong has this commitment been that they have been willing to accept a fixed exchange rate for only two brief periods: 1939-50 and 1962-70. In this context, the case for dollarization encounters stronger opposition on economic grounds.

Proposals to adopt the U.S. dollar also provoke significant nationalist opposition in Canada today. Here, the contrast with the mid-nineteenth-century period is stark. In that earlier era, the project of dollarization was in fact supported by a kind of nascent nationalism in the Canadian colonies. This was because it was associated with demands for self-government and the rejection of an inadequate colonially imposed monetary order. Today, instead of creating a national currency for the first time, Canadians are being asked to give up their national currency. And to make matters worse, they are being asked to adopt a currency issued by the country that has emerged since the nineteenth century as the dominant power in North America. No wonder then that dollarization now appears to many Canadians as a kind of quasi-colonial idea that could undermine their country’s sovereignty and identity.

Further Reading:

The sources for quotations in this article can be found in Eric Helleiner, Towards North American Monetary Union? (Montreal, 2006). For additional readings, see Adam Shortt, History of Canadian Currency and Banking, 1600-1880 (Toronto, 1986) and D.C. Masters, “The Establishment of the Decimal Currency in Canada,” Canadian Historical Review 33 (2) (1952): 129-47.

This article originally appeared in issue 6.3 (April, 2006).

Eric Helleiner is CIGI Chair in International Governance and associate professor in the Department of Political Science, University of Waterloo, Canada. He is author of Towards North American Monetary Union? (Montreal, 2006), The Making of National Money (Ithaca, N.Y., 2003), and States and the Reemergence of Global Finance (Ithaca, N.Y., 1994) as well as coeditor of Economic Nationalism in a Globalizing World (Ithaca, N.Y., 2005) and Nation-States and Money: The Past, Present and Future of National Currencies (New York, 1999). He is currently coeditor of the book series Cornell Studies in Money and the journal Review of International Political Economy.