The Jeffersonian tradition and American philanthropy

“The earth belongs in usufruct to the living; . . . [and] the dead have neither powers nor rights over it,” proclaimed Thomas Jefferson in 1789. Jefferson’s claim is a radical one: the wealth and power of past generations should not determine present and future ones. To maintain democratic equality across generations, Jefferson argued, private fortunes must be broken up by eliminating primogeniture and entails or what we today call trusts and foundations. Otherwise a few individuals or institutions would over time amass sufficient wealth to lord it over ordinary citizens.

Warren Buffett’s recent decision to donate the bulk of his fortune, a whopping $30.7 billion, to the Gates Foundation (already the largest foundation in the world) asks us once again to consider Jefferson’s claims. The press has lauded both Gates’s and Buffett’s philanthropy. But Jefferson is spokesman for a rival American tradition that is wary of foundations’ potential to unduly influence democratic public life.

Given the combined wealth of Gates and Buffett, one can be confident that the Gates Foundation, governed by a small board of trustees, will have significant public influence. For those of us who support Gates’s current goal of alleviating global poverty and improving American education, this is good. Yet its private control should give us pause. What if the Gates Foundation’s trustees supported either ends or practices that we as a people find unethical or impolitic? Should such a powerful institution trump the public will?

Americans confronted these questions soon after the Revolution during the Dartmouth College controversy of 1816. While in monarchical England, incorporation had long been accepted as a legal privilege granted by the monarch to those who served the realm, following independence many Americans worried that corporations would enable the few to exercise monopolistic privileges not available to the many. In time, many Americans feared, corporations and trusts would become immortal private fiefdoms, the basis for a new aristocracy. Corporations, they concluded, must be made subordinate to the public will.

When New Hampshire put Jeffersonians in power, Governor William Plumer therefore sought to extend the people’s control over Dartmouth College, a corporate entity that had been controlled by rival Federalists. Jeffersonians worried that Federalists would use Dartmouth to inculcate the wrong ideals in the next generation.

As Plumer put it, a powerful institution governed with little public oversight is “against the spirit and genius of a free government.” Jefferson agreed. Protecting institutions from the government makes sense in a monarchy but “is most absurd” in a republic, he told Plumer. Wealthy institutions beyond government control would mean that “the earth belongs to the dead and not the living.”

Federalists went to court to maintain control over Dartmouth. When the case reached the U.S. Supreme Court, Daniel Webster argued, “It will be dangerous, a most dangerous experiment to hold these institutions subject to the rise and fall of popular parties, and the fluctuations of political opinions.” If corporate charters could be altered whenever a new party rose to power, “colleges and halls will be deserted by better spirits, and become a theatre for the contention of politics.” In other words, corporations serve the common good because they are not subject to the voters’ whims. The court sided with Webster in its 1819 Dartmouth College ruling. The Constitution, the court declared, protects private institutions even when their activities are at odds with the goals of elected leaders.

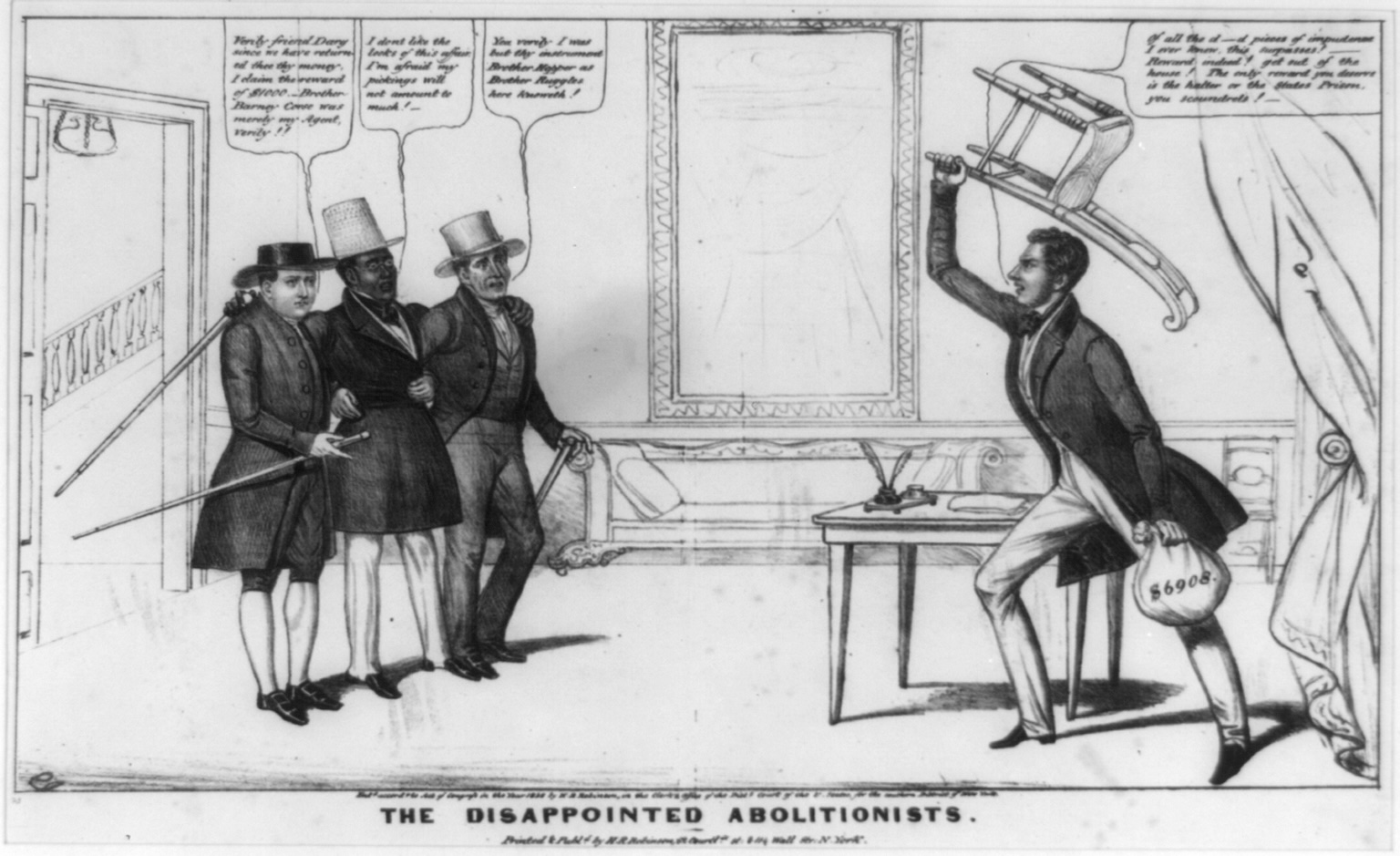

Jeffersonians lost the battle against Dartmouth, but they continued the war. Many southern states repealed the long-standing Elizabethan statute for charitable uses, effectively limiting the power of trusts and charities in the South. In the 1820s New York Democrats regulated the amount of property charitable trusts could hold, placed their activities under the supervision of the state regents, limited what testators could leave to charity, and prohibited bequests to unincorporated charities. All of these measures were meant to ensure that citizens had the ultimate say over what institutions could exist in New York.

In Massachusetts, Democratic governor Marcus Morton condemned endowed institutions in 1840 as “a kind of mortmain inconsistent with the spirit of our laws and the genius of our government.” He accused businessmen of using endowments “for the purpose of holding and managing property” rather than serving the public good. Morton’s accusation was fair. Massachusetts’s business elite routinely donated money to private institutions, including Harvard College, and then invested the funds themselves, often in the service of their own commercial interests.

Even as Democrats condemned powerful private institutions in the name of equality, the most prescient nineteenth-century observer of American democracy, Alexis de Tocqueville, applauded those institutions. Tocqueville argued in Democracy in America that private institutions preserve freedom by protecting minorities from the “tyranny of the majority.” The Democrats’ Whig opponents agreed. When Democrats criticized Harvard for failing to serve the common good, its president responded that colleges have a “duty to yield nothing to any temporary excitement, nothing to the desire of popularity, nothing to the mere hope of increasing the numbers in a seminary, nothing to any vain imagination of possessing more wisdom than the Author of the human mind.” Large endowments preserved freedom precisely because they insulated minorities from overzealous majorities.

The debate over the relationship between private institutions and popular democracy continued through the nineteenth century. When the New York State Supreme Court ruled in the late nineteenth century that state law prohibits testators from donating for undesignated purposes, overturning Governor Samuel J. Tilden’s decision to leave a large part of his estate to charity, state legislators repealed the limits imposed by their Jacksonian predecessors, paving the way for the new and much larger foundations established by Andrew Carnegie and John D. Rockefeller. Established at a time when some Americans were criticizing the inequalities generated by laissez-faire capitalism, Carnegie and Rockefeller’s activities raised anew concerns about the relationship between private money and public power.

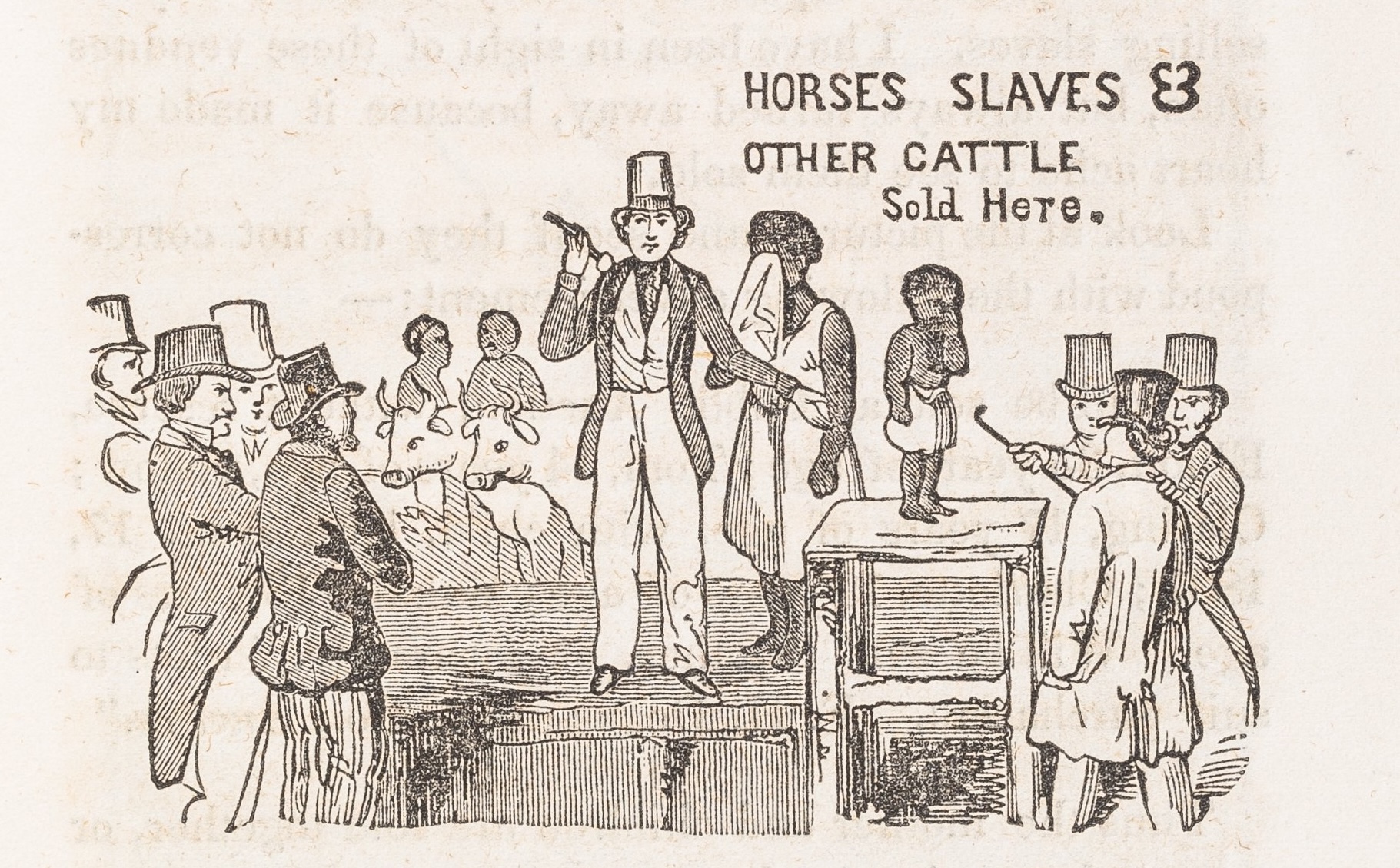

These concerns came to a head following Congress’s creation of the U.S. Commission on Industrial Relations in August 1912. Chaired by populist Democrat Frank Walsh, the commission’s charge was to investigate the sources of often bloody industrial strife that plagued the country. Dissenting from the majority of the commissioners, the populist Walsh argued that foundations help capitalists sustain their power “through the creation of enormous privately managed funds for indefinite purposes.” John D. Rockefeller’s money derived from “the exploitation of American workers” and rightly belongs “to the American people.” Foundations, Walsh concluded, allow rich families to insulate their wealth from taxes controlled by the people’s representatives. By limiting government’s intake they effectively enhance private power at public expense.

As critics condemned the ties between Gilded Age money and philanthropy, foundations addressed social and economic problems that the political system would not or chose not to address. Foundations even funded the salaries of government officials in experimental programs. To critics, the close ties between foundations and government confirmed the dangers that Jefferson had foreseen. Even as many New Deal Democrats emerged from foundation-funded social science projects and private universities, the party worked to curb philanthropic power by prohibiting tax-exempt foundations from lobbying government.

Debates over the public influence of private foundations arose again during the McCarthy era when populist conservatives accused foundations of supporting communism. And even though Congress’s Cox Committee absolved foundations of wrongdoing, Republican representative Carroll Reece organized a new committee, warning Americans that “large foundations have a tremendous influence on the intellectual and educational life of our country.” Among the committee’s targets were Carnegie and Rockefeller funded foundations, the former for funding Gunnar Myrdal’s research on race and the latter for supporting Alfred Kinsley’s on human sexuality.

Reece’s report never attracted much attention, but in 1959, when Congress proposed liberalizing tax provisions for foundations, a minority criticized these policies for further shifting the tax burden from the rich to the middle class. Responding to such concerns, Texas congressman Wright Patman initiated a series of influential investigations on foundations.

By the time Congress took up the issue of foundations’ tax privileges as part of the Tax Reform Act of 1969, it was clear that the Democrat Patman had pulled some powerful members of his party into the anti-foundation camp. Senator Al Gore Sr., for example, proposed to limit all foundations to a forty-year lifespan. Gore’s proposal was supported in the Senate Finance Committee but defeated on the floor. Nonetheless, the Patman faction carried enough political weight to make the 1969 Tax Reform Act a serious blow to private philanthropy. The act limited tax benefits for donations to foundations, imposed a tax on foundations’ investments, and prohibited foundations from engaging in partisan political activity. The last clause reflects Americans’ ongoing Jeffersonian desire to separate private wealth from public power.

Across America today the scope and scale of private donations are growing—what Stanley N. Katz calls “the new philanthropic math.” Foundations have been responsible for much good. They encourage innovation, promote knowledge that may be unpopular, and protect minority viewpoints. But the Jeffersonian tradition reminds us that concentrated wealth often translates into political power. Nowhere is this more clear than in public universities. Jefferson considered the University of Virginia to be one of his crowning achievements because it was a public institution controlled by and serving the people. Today many public universities are becoming more reliant upon private donors and are, in turn, freeing themselves from dependence on state funds. With this financial shift has come a political shift, as these institutions are less and less beholden to state legislatures and government oversight boards. The scales seem to be tipping away from Jefferson and towards Tocqueville.

We need not question Gates’s or Buffett’s altruism to worry about the growing influence of private philanthropy in higher education and elsewhere. Instead we must constantly keep the scales balanced between Jefferson and Tocqueville in order to benefit from private philanthropy while limiting its dangers. If the new philanthropic math has enhanced foundations’ power to levels we find alarming, we can erect clearer legal parameters around their activities. But there is a better solution. Public institutions, especially in higher education, have turned to private donations to compensate for declining public spending. There is growing pressure for private money even at the K-12 level. Reasserting public control over our institutions may therefore require a renewed public commitment to supporting them. Private philanthropy relies on untaxed wealth, but we might tax more of it in order to gain control over how it is spent. By enhancing the common wealth, Americans can reinvigorate the public element of their public institutions. Doing so would ensure that citizens, not a few wealthy individuals or foundations, determine their future.

Further Reading:

For historical overviews of the development of American philanthropy see Peter Dobkin Hall, Inventing the Nonprofit Sector and Other Essays on Philanthropy, Voluntarism, and Nonprofit Organizations (Baltimore, 1992); Judith Sealander, Private Wealth and Public Life: Foundation Philanthropy and the Reshaping of American Social Policy from the Progressive Era to the New Deal(Baltimore, 1997); and David Hammack’s essay in Kenneth Prewitt, Mattei Dogan, Steven Heydemann, and Stefan Toepler, eds., The Legitimacy of Philanthropic Foundations: United States and European Perspectives (New York, 2006). Sealander not only documents the relationship between private money and the American government but evaluates where and how private spending made a political difference.

Discussions of the recent growth of private philanthropy and some of its benefits and dangers can be found in Joel Fleishman, The Foundation: A Great American Secret; How Private Wealth is Changing the World (New York, 2007); Stanley N. Katz, “The New Philanthropic Math,” The Chronicle [of Higher Education] Review53:22 (Feb. 2, 2007): B6; Leslie Lenkowsky, “The Wealth Explosion: Big Philanthropy,” The Wilson Quarterly (Winter 2007); and Kathleen McCarthy, “Anonymous Donor: A New Era of Wealthy Foundations Demands a New Era of Transparency,” Democracy: A Journal of Ideas (Winter 2007).

This article originally appeared in issue 7.4 (July, 2007).

Johann N. Neem is assistant professor of history at Western Washington University. He is completing his manuscript, “Creating a Nation of Joiners: Democracy and Civil Society in Early National Massachusetts.”