Experiencing the Many Panics of 1837

Common-place asks Jessica Lepler, author of the 2013 book The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis, about the historical literature on panics, the experience of the panic for ordinary Americans, and the experience of writing about one financial crisis in the midst of another.

The argument of The Many Panics of 1837 starts with the premise that historians have gotten the chronology wrong. What had they missed, and how does The Many Panics correct the problem?

Historians are especially attuned to the fact that time only moves in one direction. If time machines worked, our discipline would not. Faith in chronology allows us to interpret evidence and make arguments about change over time. We have to know when something happened in order to make arguments about why something happened.

With a year in its name, the timing of the Panic of 1837 sounds like it ought to be obvious. When I began my research, I discovered that both the chronology of the Panic of 1837 and what was meant by this name were inconsistent in the existing literature. In some books, the Panic of 1837 was an economic depression provoked by American politics that began in New York City on May 10, 1837, and lasted approximately seven years. In other books, the Panic of 1837 was a financial crisis that began in the banks of London, reached New York City after New Orleans, and lasted from late 1836 through mid-1837. Moreover, few of these accounts of a panic featured anyone who seemed remotely panicked. So in different accounts, the same event had different causes, started in different places at different times, varied in length by six years, and despite being called a panic lacked any account of actual people panicking. The secondary sources ignored these striking inconsistencies.

The Many Panics of 1837 identifies and corrects these “problem[s]” by documenting the actual experience of panic in New York, New Orleans, and London in 1837. It argues that panic was plural. Individuals panicked differently. Communities dealt with their own independent yet interrelated local crises. And, although the United States of America and Great Britain shared transnational trade, they did not share the same national political economies. Moreover, the singular Panic of 1837, the event that had been so inconsistently defined by the secondary sources, was invented during the many panics of 1837 as panicked people transferred blame from their own behavior to systems larger than any individual. Some blamed the American political system; others blamed the transnational financial system. Both of these stories were specifically crafted to erase the individual experience of panic from the history of the Panic of 1837. Thus, the people of 1837 told multiple competing accounts of a panic-less Panic of 1837. These stories, in turn, shaped the way later scholars understood the history of this event and the concept of the business cycle.

So, it turns out that historians’ inconsistent chronology had not actually been “wrong”; it was incomplete. The chronological inconsistencies are only a “problem” if we expect the Panic of 1837 to be a singular event. If we accept, as The Many Panics argues, that the panic was plural from the very beginning, we gain a window not only into many previously undocumented experiences of financial crisis but also into the writing of history.

In many ways, the story of the Panic of 1837 seems to have been as much about information imbalances — both because of time lags and secrecy — as it was about economics or policy. Yet the financiers in New York, New Orleans, and London all worked in an environment where the same was true in flush times. What went wrong in 1837 with respect to communication?

Previous histories of the Panic of 1837 have focused on the political or macroeconomic causes of this event. By recognizing the plurality of not only the experience of panic but also of the event itself, The Many Panics was liberated from the quest for a single cause. Instead of why, the book answers the question how. How did the financial system work? How did panic spread? How did people panic? How did many panics become one Panic of 1837? It turns out that the answers to all four of these interrelated questions are based on information and interpretation.

Sometimes historians use negative evidence to demonstrate the existence of something otherwise invisible in the sources. Social historians, especially scholars of sexuality, look to the passing of laws to prevent certain socially taboo behaviors to prove that those otherwise undocumented behaviors existed. Similarly, financial crises offer the historian a special opportunity to render visible the ordinarily hidden world of financial communication. Merchants and bankers did not spend their time documenting and describing the system that enabled enormous transatlantic trade to occur in the 1820s and 1830s; they were too busy running it. But when confidence faltered and credit markets crashed in the spring of 1837, these same people wrote texts in private letters and public newspapers hoping to figure out what went wrong. In doing so, they cast a visibility charm on the structures of financial communication. Suddenly, the historian could see how the system operated when everything went right. By studying communication during a financial crisis, The Many Panics enables us to understand how, in more ordinary times, the financial system relied upon information and interpretation.

The Panic of 1837 is a particularly good subject for studying the flow of financial information because it happened after the United States became the globe’s leading supplier of the key raw material of the industrial revolution (cotton) but before the invention of electricity-based communication technology. It was a far-reaching paper-based panic, and as such it produced voluminous evidence that would be nearly impossible to find for later panics. This evidence demonstrates that one reason why the experience of panic in 1837 was long and plural was because of extraordinary winds that kept vital transatlantic news at sea. Londoners were desperate for news from the United States, and Americans acted in ignorance of British policy changes. Within the United States, New Yorkers were closer than New Orleanians to both England and Washington, D.C.; they used this geographic advantage to save their city’s reputation. Another reason for the panic’s plurality was the imprecision of the language used to describe local events. Different interpreters came to different conclusions about similar phenomena. Intense partisanship and nationalism colored the news; correspondents manipulated news for their own profits. Even a merchant’s own well-maintained ledger could not evaluate all the circulating goods and paper it documented because prices were in a state of flux. Like the old joke, the news in the spring of 1837 was bad and there was not enough of it. The uncertainty proved overwhelming. Incomplete and inaccurate information precipitated and, to some extent, constituted panic.

The paper trail from 1837 enables the historian to see the problems of information imbalances and interpretation, but paper did not catch every communication that spread panic. The whispers that instigated financial crisis evaporated nearly instantaneously after they were spoken. Nevertheless, we can find their evidentiary ghosts: the gossip of bank tellers caught by investigative committees, the rumors spread over gin slings in smoky barrooms echoed in newspaper articles, and the vituperative fights of bank directors whose minute books recorded the existence but not the substance of debates. From these traces of oral communications long past in combination with the paper trail, we can imagine how panics spread from person to person and from place to place. The Many Panics figures out what went wrong in 1837 and in the process helps us understand the instrumental role of cultural factors in the financial system in both good and bad times.

The story you tell in The Many Panics largely focuses on the action in major political and economic centers, though you move away from a traditional structure that overemphasizes the role of political elites. Can you say a bit more about how the events of 1837 looked from the vantage point of ordinary Americans?

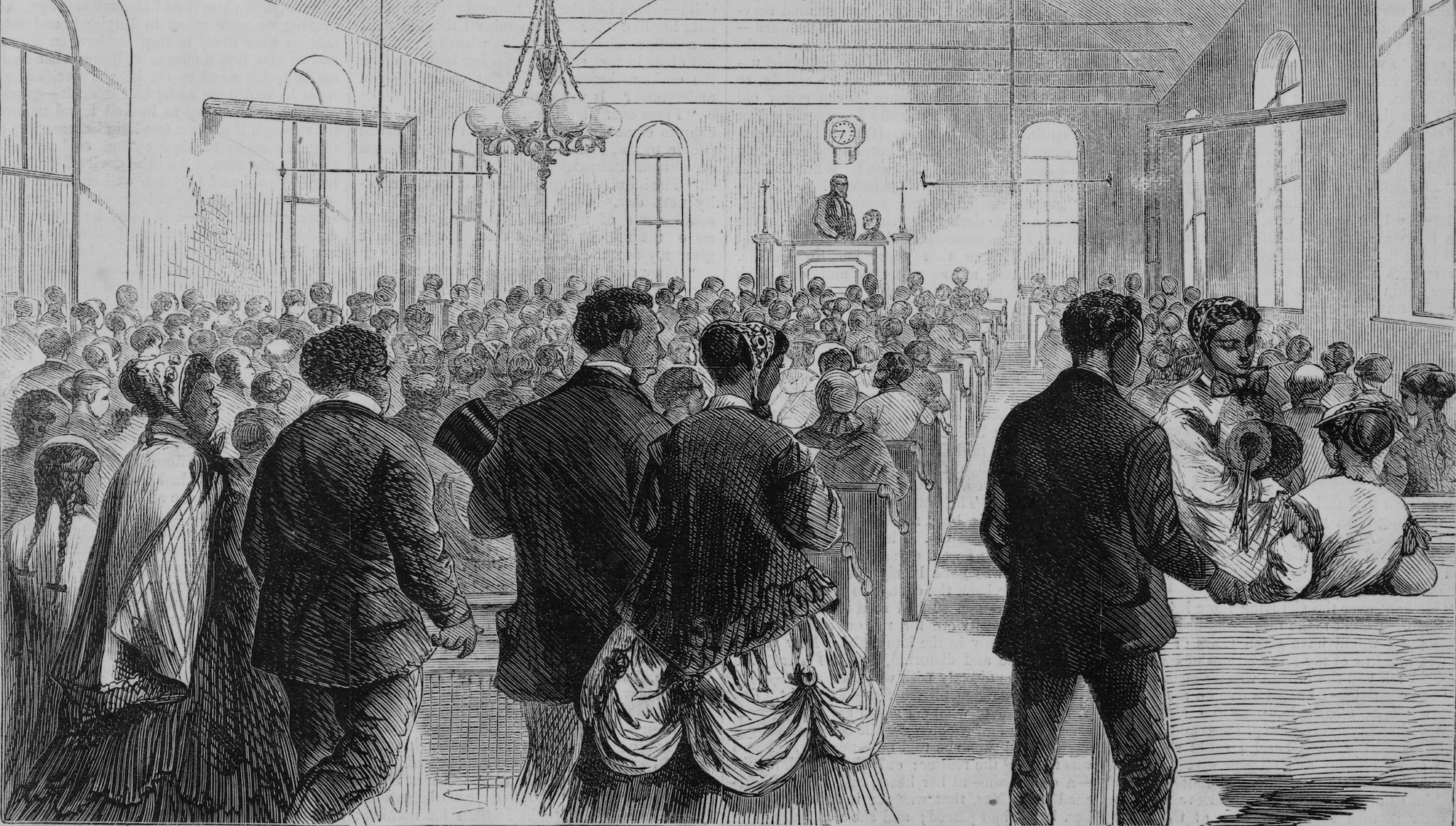

Although Andrew Jackson, Martin Van Buren, Nicholas Biddle, and the usual cast of Jacksonian and Victorian elites play a part in The Many Panics, the majority of the book is about less well-known characters: rioting workers, scheming speculators, anxious overseers, absconding debtors, failing British bankers, exhorting ministers, partisan editors, apologist textbook authors, repossessed slaves, doubt-ridden abolitionists, and even a very tired pigeon. Different people experienced panic differently, and perhaps even more importantly, one ordinary person’s panic could influence the panics of many other people.

Hannah Farnham Sawyer Lee provides a compelling example. While such classic writers of the American Renaissance as Poe, Hawthorne, and Melville struggled to find publishers and readers during the spring of 1837, Lee found a ready audience for her bestselling novel, Three Experiments of Living: Living Within the Means, Living Up To the Means, Living Beyond the Means. Lee’s book garnered praise from literary critics in a wide range of journals. Ralph Waldo Emerson noted in his diary that 20,000 copies of the novel had been sold in its first three months. With a novel that served as a “how to” manual on surviving or better yet avoiding financial catastrophe, Lee hit upon a recipe for profit amidst panic. Male imitators produced numerous spin-offs and were publicly accused of “sucking sustenance through their goose quills.” Lee triumphed as a panic profiteer because her message that individuals could control their financial destinies empowered her readers.

Thomas Fidoe Ormes had the opposite experience; the powerful messages he conveyed led to the spread of uncertainty and personal disaster. As a junior clerk at the Bank of England (BOE), Ormes knew that the information he and his colleagues in the Bill Office handled was incredibly valuable. By processing the paper financial instruments that enabled Anglo-American trade, the BOE’s clerks had their hands on the pulse of global trade. The clerks were forbidden from discussing the confidential details of their jobs, but as the credit crisis began, the potential failure of a large mercantile house proved too shocking for silence. A grizzled senior clerk, who had nearly gone blind in his service to the bank, whispered rumors that he had heard in a tavern to a nearly deaf colleague. Eventually, the rumors reached Ormes. On a trip to a toilet in a public portion of the BOE, Ormes (whom I call the leaky clerk) spread the office gossip “in confidence” to a stockbroker friend. Newspapers published the rumor; confidence in the credit system wavered. The BOE launched a full investigation of the leak, and despite the fact that some truth supported the rumors, punished all the clerks involved. No one paid a harsher penalty than Ormes, who suffered the dishonorable loss of the salaried job that had supported four generations of his family. His severe punishment reveals the power this ordinary man wielded in spreading panic.

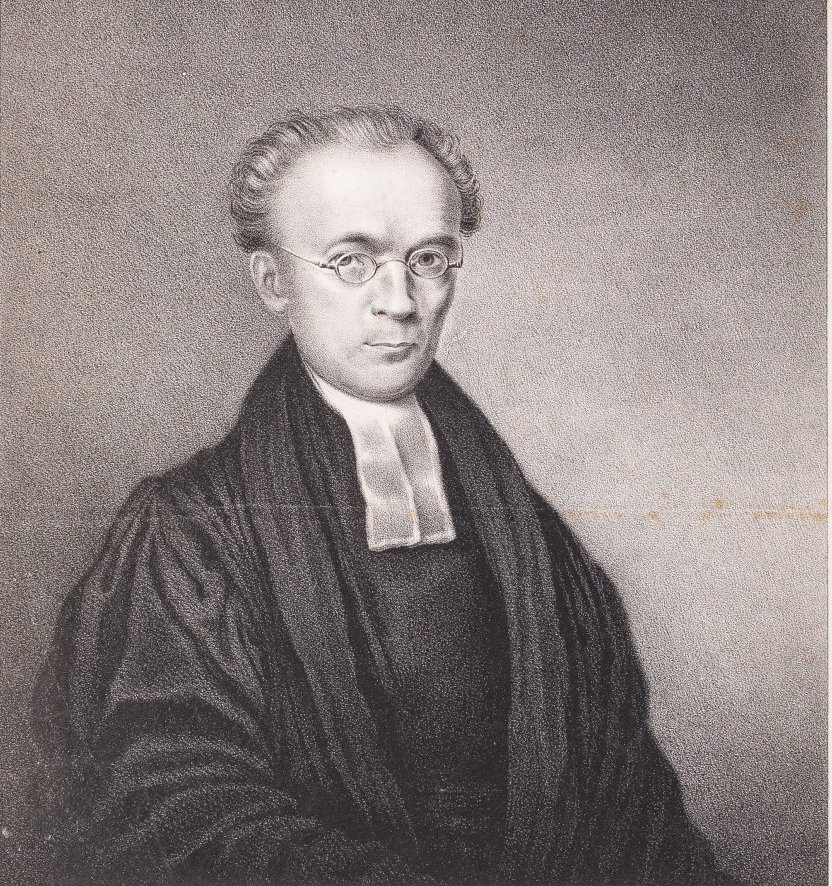

Other people felt entirely powerless in the face of panic. For Théodore Nicolet, a Swiss-born New Orleanian merchant, panic was overwhelming. Nicolet had amassed both prestige and a fortune by 1837. A man with nearly seventy shirts and sixty handkerchiefs of imported silks, he was an elegant bachelor who lived in a mahogany world. His bed, washstand, armoire, armchairs, shelves, safe, sofa, chairs, dining table, sideboards, desk, and even his commode were composed of the expensive wood. He served as a consul for his native nation and helped found the first Francophone Evangelical Church in New Orleans. But as the crisis began, he quickly descended into a mire of debt and fear. In the spring of 1837, he begged his creditors for time. His mortgaged slaves were repossessed. Rumors spread that he was insolvent. He decided to escape the calumny of financial dishonor. On the morning of May 3, 1837, the forty-six year old man walked to a friend’s house beyond the city limits and “blew his brains out.” The uncertainties of failure trumped Nicolet’s concerns about eternal damnation. People immediately blamed Nicolet’s death on the crisis. One New Orleanian newspaper editor asked, “When will this fatal madness end? Is there no honorable method of regulating a man’s affairs but by abandoning them?” Newspapers around the nation reprinted news of Nicolet’s death, prompting concerns about an epidemic of panic-induced suicides. For years after his death, Nicolet’s survivors struggled to sort out the financial fallout that he “abandon[ed].” Death might end one person’s panic, but it spread financial uncertainty.

Lee, Ormes, and Nicolet did not have the political or financial power of Jackson, Van Buren, or Biddle, but these ordinary people did have power in the midst of panic. These examples show that ordinary people should not just be interesting because they saw panic from a variety of vantage points; they should be historically essential, because by allaying and spreading panic, they contributed directly to the events of 1837.

For a historical monograph, The Many Panics of 1837 has a particularly strong resonance with the present, which you note in your conclusion. Did the contemporary recession of the last six years directly shape your argument? And how do you hope that people might use your arguments and research in discussing contemporary economic issues?

The central argument of The Many Panics was the product of historicizing the difference between the financial crisis in 2008 and that of 1837. In 2003, when I first began researching the Panic of 1837, I had no idea that I was living in the biggest boom of my lifetime. By the time I defended my dissertation in mid-2007, I could see the bust on the horizon. The housing market had reached its peak and subprime loans were starting to face serious scrutiny. As classes started during my first semester at the University of New Hampshire in the fall term of 2008, panic set in: credit markets threatened to freeze, financial institutions teetered on the edge of failure, and the stock market plunged. I felt like I was watching my dissertation unfold in real time and was terrified by the similarities. I knew that the aftermath of the panic in 1837 was years of hard times; I hoped that history would not repeat itself.

My hopes were founded on my historical training. As much as the Panic of 2008 seemed similar to the Panic of 1837, I knew that much was different between panic in the mid-nineteenth century and panic in the twenty-first century. Jacksonian Americans and Victorian Britons lived under systems of political economy that would seem foreign today. While twenty-first century Americans were worried about the effects of the crisis on the value of the dollar, nineteenth-century Americans dealt in thousands of different denominations of state-chartered bank notes. There was no EU, World Bank, FDIC, or Federal Reserve; panicked people could neither invest in mutual fund retirement accounts nor count on unemployment insurance. The nearly 200 years between the subject of my dissertation and my own life saw the development of innovations and institutions that were responses to intervening panics. Despite recent innovations that increased ordinary people’s involvement in and exposure to global financial markets, structural responses to past crises protected the present generation from many of the ravages of financial crisis faced in 1837.

As I allayed my own concerns by thinking historically, I began to rethink the assumptions I had made about what it meant to panic in 1837. While bad news played important and underappreciated roles in both crises, the content of that information, and even more importantly, how panicked people interpreted the news, changed dramatically. Nineteenth-century panicked people had not yet developed and adopted the ideas of “capitalism” or “the economy.” They could not possibly have looked for the same indicators as today’s market analysts. I realized that just as economic and financial institutions changed over time, the intellectual and cultural systems for making sense of financial crisis had changed too.

In my dissertation, I had traced the flow of panic; my book would have to figure out what it actually meant to panic in 1837. In January 2009, as I began a post-doctoral fellowship year at the American Antiquarian Society, I made the radical decision to isolate myself from the ideas that explained panic in the twenty-first century and to learn to see financial crisis through the intellectual context of 1837. Instead of my morning newspaper, I read thousands of print sources from 1837 to try to figure out the cultural tools with which my historical subjects would have interpreted bad news. Ultimately, I discovered that panicked people suffered not only from financial uncertainty (not knowing whether they would fail) but also from economic uncertainty (not knowing what caused their failure). The experience of panic changed the way panicked people understood their economic lives. And, even more relevant for our own times, these changes in economic thinking had ramifications that continue to affect the way we understand financial crises in the twenty-first century.

I hope that The Many Panics will revise our understanding of the Panic of 1837, but even more importantly, I hope that this case study of the role of culture in a financial crisis will teach us that there is never one simple story of panic. We get to shape the stories and thus the meanings of our panics.

Another major intervention of the present into your work was Hurricane Katrina, which devastated New Orleans, including its historical archives. From working in New Orleans during that period, how did that experience shape The Many Panics, and looking back almost ten years later, how are the archives you worked with recovering?

My summer 2005 research trip was a tour of early twenty-first century disasters. In New York City, I stayed with friends who lived near Battery Park, a few blocks from Ground Zero. After two months in New York, I arrived in London on the morning that the copycat Tube bombers were caught. And later that same summer, as I sat in a British Library reading room, I learned that the levees in New Orleans had been breached. Most of my worldly possessions, including all of my research for this book, were housed in that city in an apartment a few blocks from the Mississippi River. As I waited to be allowed to return home, I turned to writing as a source of relief. I immersed myself in the primary sources that I had gathered during the summer of 2005 and escaped into the Panic of 1837. When I finally made it back to New Orleans, I discovered that my apartment was in good shape, but the lowest levels of the Tulane University library had been flooded. The portion of the collection affected by the flood included the manuscript records of the Citizens’ Bank of Louisiana, the key New Orleanian bank in The Many Panics.

Able to transport only my most cherished belongings (which, of course, included my research), I moved out of New Orleans in the fall of 2005. As I was packing, I learned that I had won the inaugural Dianne Woest Fellowship from the Historic New Orleans Collection [THNOC]. When I returned as a fellow in the spring of 2006, the exquisite THNOC reading room, located in the French Quarter, was up and running with no perceivable damage. Although I could not access the Citizens’ Bank records, which had been freeze-dried and shipped to preservation specialists in Texas, I was able to continue my research in the bright and airy reading room of Tulane’s Special Collections. But as I drove to the campus of the University of New Orleans [UNO] near Lake Pontchatrain (an especially hard-hit area), the flood’s wrath was visible in the gutted and abandoned houses, dead lawns, and barely drivable roadways. The UNO library building, which houses the manuscript Louisiana Supreme Court papers, did not have running water, but it did preserve all of its collections. On that research trip, I did not revisit the City Archives at the New Orleans Public Library or the Notarial Archives, but I believe that these valuable collections survived as well. The city of New Orleans may have been devastated by Katrina and its aftermath, but its historical records, with a few unfortunate exceptions, were remarkably well preserved.

Over the years, I have occasionally checked up on the progress of the preservation of the Citizens’ Bank records. Some papers have returned but not all of the ink is legible. Nearly a decade later, as far as I know, the marbled minute books of the Citizens’ Bank of Louisiana that recorded the mortgages collateralized with enslaved human property, the narrow votes on regulating the city’s paper money supply, and the secret meetings designed to stave off panic remain frozen in time and in Texas.

This article originally appeared in issue 15.1 (Fall, 2014).

Jessica Lepler is an associate professor of history at the University of New Hampshire. Her book The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis (2013) was a co-winner of the 2013 James Broussard Best First Book Prize from the Society for Historians of the Early American Republic and a finalist for the 2013 Berkshire Conference Prize. She is currently working on a book project on the intersection between collections law and commercial expansionism in the early American republic.