Adam Smith never attached the invisible hand of the market to a fully formed body, but he and his fellow philosophers (along with some more recent historians) assumed that body was free, white, and male; financial interactions, they supposed, only happened between independent, self-interested actors. Ellen Hartigan-O’Connor’s convincing new book proves without a doubt that such a vision was pure fiction. Her analysis of women’s experiences in the marketplace completely dismantles any lingering ideas that the eighteenth-century economy was a place of pure liberal individualism. Rather, all economic transactions—from washing clothes to shopping with cash—were embedded in social networks that were created and sustained by women as much as men. By looking at the small port cities of Newport and Charleston at the end of the eighteenth century, Hartigan-O’Connor definitively demonstrates that women were fundamental to the expansion of capitalism through the period of the American Revolution.

The gendered nature of classical economic theory has obscured the workings of these port cities. The basic urban economic unit, for example, was not necessarily the patriarchal household marked by the obedience of women, children, servants, and slaves to its male head. Instead, it was a more flexible, changeable, and disparate unit that Hartigan-O’Connor cleverly dubs a “houseful.” In a houseful, authority was fragmented. Legally speaking, for example, a woman’s wages might belong to her husband, but she was the one who negotiated prices with borders and customers. A houseful was not simply a married man’s domain. Women moved between housefuls as renters, shop owners, servants, and family members. The idea of the houseful embodies the dynamic, energetic, and often unstable nature of an urban economy with women at its center.

Women were the linchpins for these urban transactions because they bore the responsibility for earning money as well as spending it. Their work not only bridged the distance between production and consumption but between home and work, unpaid and paid labor, and even on occasion the local and the international. In port cities like Newport and Charlestown, women’s chances to exploit their few resources and marketable skills were correspondingly greater than in the countryside. Enslaved women in particular found ways to earn discretionary income through skilled labor such as washing. Paying close attention to work also exposes some of the more intriguing differences between Charleston and Newport. While Newport hewed to a traditional ideal of “covering” married women’s financial activities under the name and responsibility of her husband, Charleston did not. Instead, officials there believed that it was beneficial for both the state and for individuals to allow even married women to trade on their own accounts. These different approaches to women’s property reveal the variety of strategies women needed in order to succeed—and the ones available to them. Although the larger economic world of the Atlantic basin provides a backdrop for these port economies, Hartigan-O’Connor’s careful attention to place gives local environments the greater explanatory power.

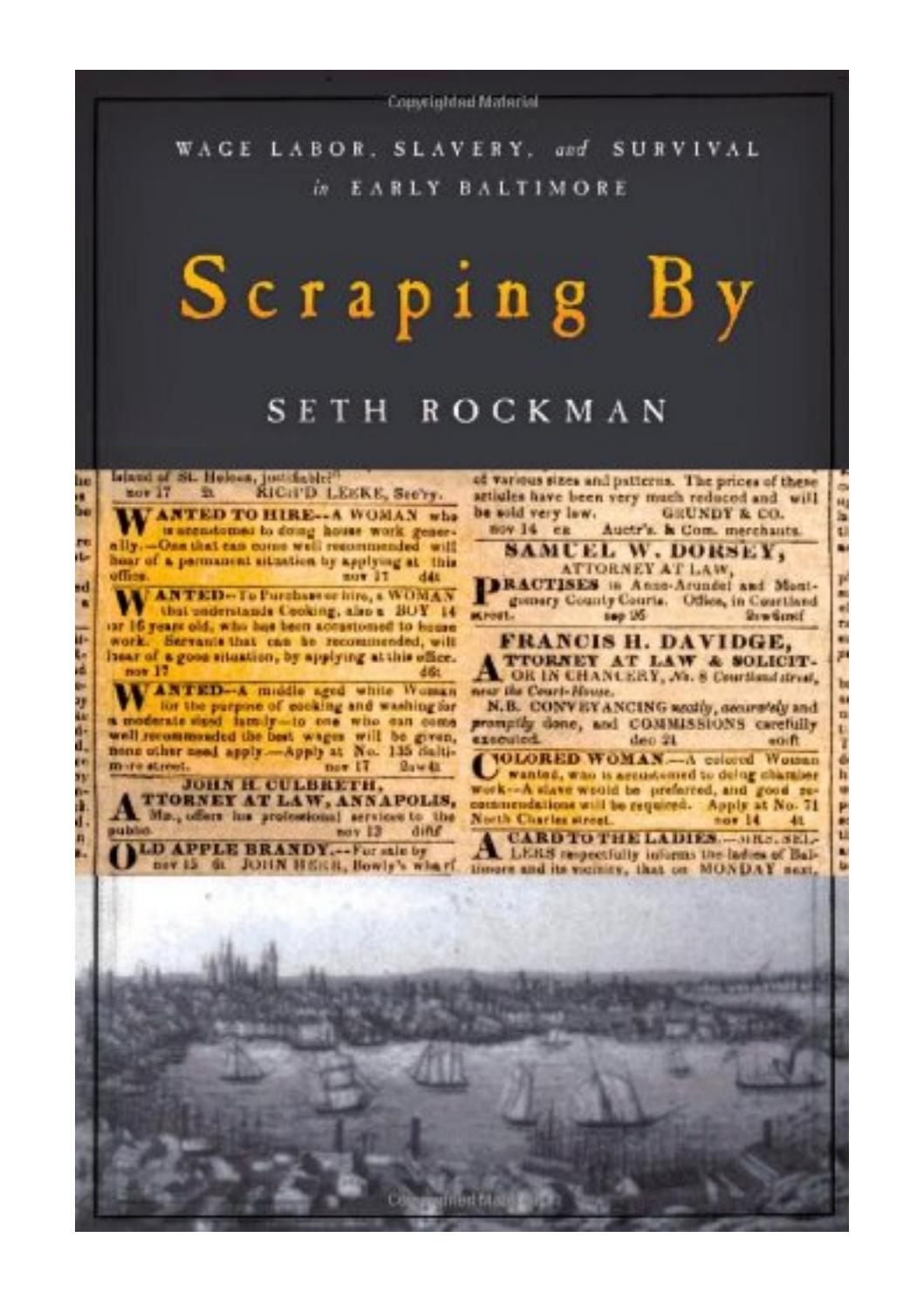

In the company of other historians, Hartigan-O’Connor compellingly demonstrates that the expansion of formal and litigated credit in the consumer market at the end of the eighteenth century did not push women out of financial activities. Instead, the demand for credit pulled women still further into complex economic relationships. Whether they received credit in their own names or through third parties, women continued to participate in the market economy throughout the upheavals of the revolutionary era. Because credit remained a hybrid economic instrument, drawing on both personal ties and impersonal exchanges, women’s legal limitations were no more significant than their social networks when it came to racking up debt. Indeed, debt was as likely to create useful market relationships as it was to create pernicious economic and legal dependence. Hartigan-O’Connor’s meticulous reconstruction of family credit networks also reveals the lived experience of the marketplace in all its confusion of unpaid meal tabs and enslaved proxy shoppers.

The accelerating shift from book credit to cash did not detach women from the personal associations that structured their relationship to the market. Likewise, the transition from pounds to dollars that accompanied American independence from Britain did not mark any watershed moment in women’s economic lives; as Hartigan-O’Connor shows, “The fact that social relationships always shaped the cultural significance of money was an important continuity in women’s lives from the colonial through the early national period” (102). While the social embeddedness of these urban market economies did not shift, women’s abilities to rationalize and quantify their social and labor interactions in monetary terms did. This was not necessarily much of a boon for women; because the American Revolution did not sweep away coverture, women’s work could become even more vulnerable to exploitation when it was translated into money. Yet (in contrast to Mary Beth Norton’s 1980 findings in Liberty’s Daughters), the extensive experience that women, both free and enslaved, had with money during this period did create in them a sense of competence about their ability to manage their financial affairs.

Prescriptive writers tried to deal with this paradox of women who understood money by emphasizing an imagined sexual division of labor: men owned money and women spent it. These writers were right that women shopped, but their casual dismissal of women’s purchasing practices as trivial or self-indulgent completely overlooked the vital commercial and cultural work inherent to buying goods in late eighteenth-century port cities. Like other commercial transactions, shopping was labor structured by social networks. Recent studies of consumption have tended to emphasize the liberating potential of consumer choice. Hartigan-O’Connor satisfyingly demolishes the gendered and presentist implications of this interpretation by fitting shopping back into its proper historical context. Her significant contribution is to show that many of women’s purchasing decisions were made long before they entered a store to select goods. Much more than simple consumer desire, it was women’s access to credit (such as third-party reimbursements and other financial intermediaries) that determined where they shopped and what they bought. Attitudes of sellers, including slaves, also had a significant effect on where and how women shopped. Although Hartigan-O’Connor is careful throughout the book to bring in the experiences of enslaved women alongside those of free ones, it is in her work on shopping that the relationship between slavery and economic networks emerges most creatively and persuasively. Enslaved women developed a sense of the consumer market similar to that of free women, since they too shopped for others. As people who were themselves commodities, their own experiences with shopping revealed the unequal power relationships that underpinned the seemingly impersonal consumption of goods. Although satirists attempted to package shopping as consumption, for the purpose of sustaining markets, it was as productive—and exploitative—an activity as the growing of any staple crop. Thus was “‘choice’—economic and cultural—for free white men and wealthy women produced by the shopping labors of the people who made up the web of any consumer’s network” (160).

The continuity from 1750 to 1820 of a socially embedded economy means that the American Revolution itself—despite the book’s subtitle—is essentially irrelevant to the central place that women held in urban economies. Endless debates over the corrupting nature of luxurious consumption had little impact on women’s economic importance. Newport and Charleston emerged from the upheavals of the Revolution with very different opportunities for women, but the essential collaborative network of family, friends, and housefuls remained the same.

The Ties That Buy is not the flashiest book about early America, but it is one of the soundest. Much like the tangle of relationships that created port economies, the threads of Hartigan-O’Connor’s argument emerge and disappear across chapters. Her deep and careful research into legal records, personal letters, account books, and newspapers reveals tantalizingly brief snippets about how the men in these marketplaces understood the gendered nature of financial activity. Were they just as smart and pragmatic as the women Hartigan-O’Connor has uncovered? Reflecting on this fine book, I am not sure whether it is much of a service to women to put them at the heart of the first capitalist expansion of the United States, but we can no longer doubt that they were there.

This article originally appeared in issue 9.4 (July, 2009).

Serena Zabin is associate professor of history at Carleton College. She recently published Dangerous Economies: Status and Commerce in Imperial New York (2009).